BCAS President CA Anand Bathiya’s Message for the Month of August 2024

Dear BCAS Family,

On July 6th, 2024, our Society completed 75 revolutions around the Sun. Our history chronicles the evolution from a small group of dedicated professionals gathering on Wednesdays to what is now the largest and oldest voluntary body of Chartered Accountants in India, with representation spanning over 350+ cities and towns nationwide. It is a fascinating phenomenon as to why, year-after-year, thousands of Chartered Accountants continue to revere our Society as a hub to fulfil their intellectual hunger and admire our Society as a pinnacle in enabling professional development.

The single most important reason for this incredible evolution and longevity of our Society over the last many decades has been the ‘constant urge and effort to stay relevant’. Being an observer of the inner functioning of our Society, I had the privilege to closely witness this continuous process of institutional self-reflection and the enduring drive towards ‘staying relevant’ to our community. This attribute of ‘staying relevant’ hinges on remaining conscious and alert to changing times and changing needs of our community.

It is of no surprise that with great honour, our Society wears the Sanskrit aphorism, “न भयं चास्ति जाग्रत:” (na bhayam chasti jagratah) as its esteemed emblem, signifying that those who remain conscious and alert, have no reason to fear.

Throughout the last decades, our profession has encountered numerous challenges, and our Society has been pivotal in augmenting our community’s ability to meet these challenges head-on and even transform them into opportunities. Our challenges today are much different, both in terms of their nature as well as their impact, and our Society’s role in the face of these challenges is of vital importance.

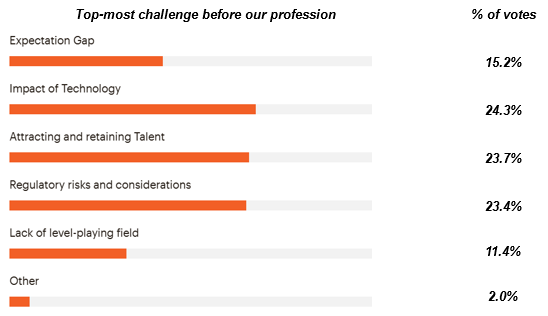

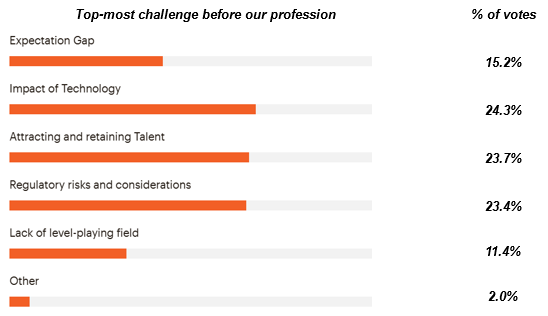

Last month, we carried out a Membership Survey with extensive participation from our community, gathering their valuable insights. A significant inquiry within the survey asked members: “What are the primary challenges you believe our Profession faces?”. The collected responses have been organized as follows:

While all of the above challenges deserve our undivided attention and dedicated efforts, the challenges related to technology, talent, and regulatory risks particularly distinguish themselves. Each of these will require concentrated efforts involving awareness, learning, upskilling, upgradation as well as advocacy.

Swamped with our July deadlines, September deadlines, October deadlines and deadlines after deadlines, we would need to introspect on these challenges and also our response to these challenges.

Within these challenges, exists the chance to excel and expand our professional pursuits, whether in our practice outfits or in our employment roles. Embracing contemporary technologies, enhancing our talent practices and managing risks will need to be the cornerstone of our efforts in the coming times.

Our Society remains committed to concentrating its efforts on tackling these contemporary challenges, aiding our community in enhancing its relevance.

Budget @ BCAS

Last month, the Indian Tax and finance community experienced a significant day with the presentation of the Union Budget for the fiscal year 2024-25. Speaking at the Public Lecture Meeting on Finance (No. 2) Bill, 2024, Shri CA. Pinakin Desai aptly summarised the budget as ‘On an overall basis, it is a satisfactory budget, with aberrations on both sides’. The Finance (No. 2) Bill, 2024,affecting more than 80 sections of the Income Tax Act of 1961 promises some impactful changes to the status quo.

While the drive towards simplification, streamlining, and standardisation is praiseworthy, specific measures such as the tax implications of share buybacks, the evaporation of indexation benefits, and the increased scope of TDS necessitate a more thorough impact evaluation.

The Society conducted two distinct Public Lecture Meetings on (i) Direct Tax Provisions under Finance (No. 2) Bill, 2024 by Shri CA. Pinakin Desai and (ii) Indirect Tax Provisions under Finance (No. 2) Bill, 2024 by Shri CA. Sunil Gabhawalla, both lectures were very well received and viewed in large numbers. The coveted and unbiased BCAS Budget Analysis is open for ordering and do order your copies soon.

Viksit Bharat

In the session before Union Budget Day, the Economic Division of India’s Department of Economic Affairs, Ministry of Finance, presented the Economic Survey 2023-24 at the Parliament. The Survey largely reflects the robust condition of the Indian economy but openly recognises the distinct challenge that India’s journey towards a developed nation by 2047 represents, compared to China’s ascent from 1980 to 2015. It points out 4 (four) challenges being de-globalization, geopolitical shifts, climate change and artificial intelligence as potential obstacles to maintaining high growth trajectory for India in the forthcoming years and decades.

Each of us holds a share in our progress towards Viksit Bharat, and being members of the intellectual community, it is our responsibility to express our opinions and set forth our views for its development. Our Society has begun a quest to capture the perspectives of varied stakeholders with distinct interests to further define the concept of Viksit Bharat. By organising multiple roundtable discussions as part of its outreach efforts, our Society aims to synthesise these insights into a research paper, which will then be shared with the decision-makers within the Government. Last month, two round tables were conducted, (i) with stalwart Chartered Accountants and (ii) with Chartered Accountancy students and management students, with more discussions being lined up towards this important initiative.

Our Society extends a hearty congratulations to the 20,446 Chartered Accountancy pass-outs and warmly welcomes them into our community. The future looks bright for India and our profession, and we wish them a satisfying and successful professional journey ahead.

Collaboration with BIA

Building upon our agenda to collaborate with peers, our Society has formalised a collaboration with the Bombay Industries Association. Both organisations have had a history of working together, and this formal collaboration outlines a unified strategy for future joint efforts.

In this special Industry:Profession partnership, both organisations, with 75 years of rich history, will combine their resources and capabilities to reinforce the economic structure of Mumbai, Maharashtra, and India. This includes collaborative learning opportunities, advocating for ease of business, offering policy suggestions, and engaging members from both groups.

In closing, I am profoundly thankful for the faith placed in me to serve as the 76th president of the Bombay Chartered Accountants’ Society. Sincere gratitude to CA. Chirag Doshi for his exemplary leadership during the important 75th year of the Society.

Best wishes for the festive season and 78th Independence Day!