INTRODUCTION

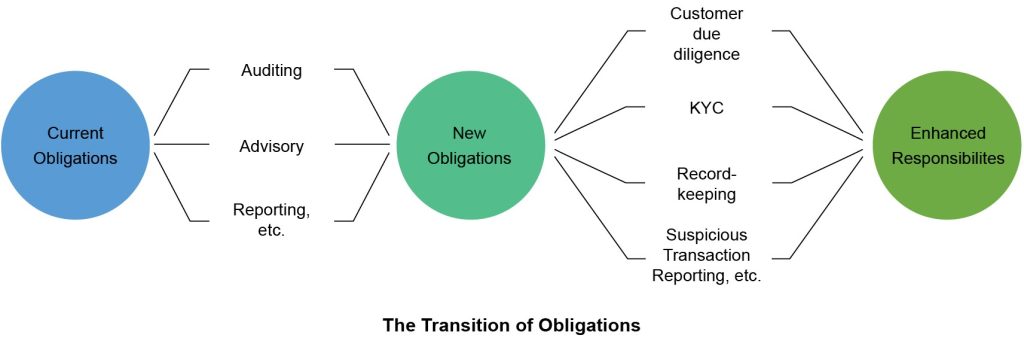

Notifications dated 3rd May, 2023 and 9th May, 2023 issued by the Ministry of Finance have the effect of making relevant persons ‘reporting entities’ as more particularly defined by Section 2(1)(sa)(vi) read with Section 2(1)(wa) of the Prevention of Money Laundering Act, 2002 (PMLA).

The 3rd May, 2023 Notification purports to cover within the definition of ‘reporting entities’ those ‘relevant persons’ who carry out ‘financial transactions’ on behalf of his / her client, in the course of one’s profession in relation to certain activities. If the certain activities listed in the Notification are carried out by the ‘relevant person’, then the professional would find himself/herself as a reporting entity under the PMLA. Explanation 1 in the Notification states that a ‘relevant person’ would include:

• an individual who obtained a certificate of practice under section 6 of the Chartered Accountants Act, 1949 (38 of 1949) and practicing individually or through a firm, in whatever manner it has been constituted;

• an individual who obtained a certificate of practice under section 6 of the Company Secretaries Act, 1980 (56 of 1980) and practicing individually or through a firm, in whatever manner it has been constituted;

• an individual who has obtained a certificate of practice under section 6 of the Cost and Works Accountants Act, 1959 (23 of 1959) and practicing individually or through a firm, in whatever manner it has been constituted.

On the other hand, the 9th May Notification purports to cover within the definition of ‘reporting entities’ those ‘persons’ who carry out certain activities in the course of business on behalf of or for another person as the case may be. This Notification does not seek to restrict the applicability of the Notification to a specific business or profession and therefore, can also act as a trigger for professionals to become reporting entities under the PMLA.

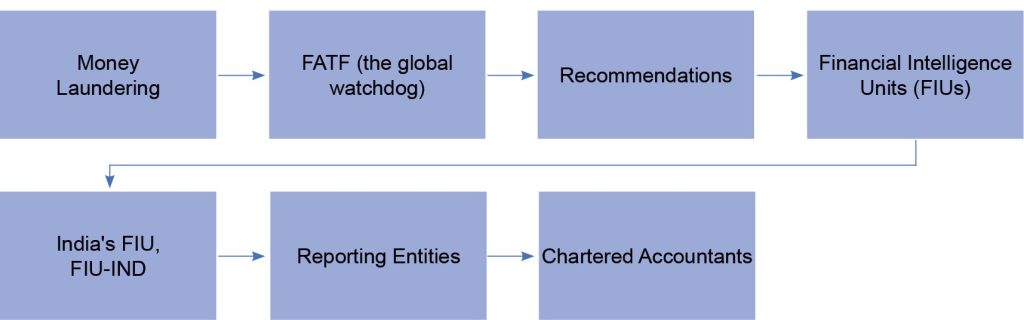

India is a member of the Financial Action Task Force (FATF). The FATF has a set of 40 recommendations that the member countries seek to implement in order to combat the menace of money laundering. Trying to comply with the FATF recommendations on money laundering is one of our country’s international commitments. In fact, the PMLA Act itself is a result of India’s international commitments. The preamble to the Act reads as follows:

“An Act to prevent money-laundering and to provide for confiscation of property derived from, or involved in, money-laundering and for matters connected therewith or incidental thereto.

WHEREAS the Political Declaration and Global Programme of Action, annexed to the resolution S-17/2 was adopted by the General Assembly of the United Nations at its seventeenth special session on the twenty-third day of February, 1990;

AND WHEREAS the Political Declaration adopted by the Special Session of the United Nations General Assembly held on 8th to 10th June, 1998 calls upon the Member States to adopt national money-laundering legislation and programme;

AND WHEREAS it is considered necessary to implement the aforesaid resolution and the Declaration.”

While much has already been discussed regarding these two notifications, there is still uncertainty around the phrase ‘on behalf of’ as used in them. Though perhaps we may have to wait for an authoritative judicial pronouncement on the exact interpretation to be given to this commonly used phrase, today we seek to lay down broad contours of what ‘on behalf of’ could mean with regard to these two notifications.

THE FATF FACTOR

The FATF recommendations also use the phrase ‘on behalf of’ quite often. In fact, the phrase ‘on behalf of’ when used in the Recommendations, seems to signify a fiduciary relationship and is broader than what is given in Indian law. Recommendation 23 (a) reads as follows:

Lawyers, notaries, other independent legal professionals and accountants should be required to report suspicious transactions when, on behalf of or for a client, they engage in a financial transaction in relation to the activities described in paragraph (d) of Recommendation 22. Countries are strongly encouraged to extend the reporting requirement to the rest of the professional activities of accountants, including auditing.

Recommendation 22 (d) in turn reads as follows:

Lawyers, notaries, other independent legal professionals and accountants – when they prepare for or carry out transactions for their client concerning the following activities:

• buying and selling of real estate;

• managing of client money, securities or other assets;

• management of bank, savings or securities accounts;

• organisation of contributions for the creation, operation or management of companies;

• creation, operation or management of legal persons or arrangements, and buying and selling of business entities.

The above two recommendations read together therefore are the genesis of the 3rd May, 2023 Circular. This is in line with the commitment that our country is showing to combat money laundering.

LAYING THE GROUNDWORK – USING ‘FOR ANOTHER PERSON’ TO HELP IN INTERPRETING ‘ON BEHALF OF’

In order to narrow down on the meaning of ‘on behalf of’, it would be perhaps instructive to hazard a guess as to what would constitute ‘for another person’. The 3rd May, 2023 notification does not include ‘for another person’. This language is used in the 9th May, 2023 Notification, the relevant portion of which reads –

“the following activities when carried out in the course of business on behalf of or for another person, as the case may be, as an activity for the purposes of said sub-clause”

Therefore, the Notification itself draws a distinction between ‘on behalf of another person’ and ‘for another person’ by making them alternative to each other through the use of the conjunction ‘or’. The list of activities covered in the 9th May notification is also instructive:

a) “acting as a formation agent of companies and limited liability partnerships;

b) acting as (or arranging for another person to act as) a director or secretary of a company, a partner of a firm or a similar position in relation to other companies and limited liability partnerships;

c) providing a registered office, business address or accommodation, correspondence or administrative address for a company or a limited liability partnership or a trust;

d) acting as (or arranging for another person to act as) a trustee of an express trust or performing the equivalent function for another type of trust; and

e) acting as (or arranging for another person to act as) a nominee shareholder for another person”.

Though the Explanation to the Notification provides for a list of exclusions, the only relevant part for our discussion would perhaps be restricted to Explanation ‘b’ which reads as follows:

“any activity that is carried out by an employee on behalf of his employer in the course of or in relation to his employment;”

The list of activities enumerated from ‘(a) to (e)’ above is telling. These activities do not need to be necessarily carried out in a representative capacity. They may also be carried out in a personal capacity for the benefit of someone else. A hypothesis can thus be drawn that ‘on behalf of another person’ would denote a person acting in a ‘representative capacity’ for another person, but ‘for another person’ would denote a person acting in a personal capacity for another person. Therefore, based on this premise, the 9th May, 2023 notification would make a professional a ‘reporting entity’, whether he carried out those activities in his individual capacity or in a representative capacity.

However, the absence of ‘for another person’ in the 3rd May, 2023 notification is telling. Firstly, the notification restricts itself to ‘financial transactions’, to be carried out specifically ‘on behalf of a client’, ‘in the course of the profession’ and in ‘relation to the following activities’–

1. “buying and selling of any immovable property;

2. managing of client money, securities or other assets;

3. management of bank, savings or securities accounts;

4. organisation of contributions for the creation, operation or management of companies;

5. creation, operation or management of companies, limited liability partnerships or trusts, and buying and selling of business entities.”

It may be of particular interest to note that the transactions covered in ‘1 to 5’ as enumerated above can possibly be conducted both ‘on behalf of a client’ as well as ‘for a client’. As the notification omits using the phrase ‘for the client’, the interpretation of ‘on behalf of a client’ gains a greater relevance. Significantly, distinguishing ‘on behalf of a client’ and ‘for a client’ also gains greater relevance as, while the former would make the professional a ‘reporting entity’, the latter would not.

DECIPHERING THE ENIGMA OF ‘ON BEHALF OF’

While embarking upon a journey to find the meaning of a phrase in law, the Black’s Law Dictionary has often served as a good starting point. The Black’s law dictionary, while defining ‘behalf’, includes the definition of ‘on behalf of’. The definition in the dictionary supports our hypothesis that ‘on behalf of’ would denote representative capacity. The dictionary states as follows:

behalf.[fr. Anglo-Saxon half “unit, side”] (14c) Side, part, advantage, or interest. • The phrase in behalf of traditionally means “in the interest, support, or defense of”; on behalf of means “in the name of, on the part of, as the agent or representative of.”

In fact, the Income-tax Act, 1961, also leads credence to this hypothesis of ‘on behalf of’ being used in a representative capacity. The phrase ‘on behalf of’ is used in the very definition of ‘Authorised Representative in Section 288(2) of the Act. It is reproduced below as follows:

Section 288 (2) For the purposes of this section, “authorised representative” means a person authorised by the assessee in writing to appear on his behalf, being—

(i) a person related to the assessee in any manner, or a person regularly employed by the assessee; or

(ii) any officer of a Scheduled Bank with which the assessee maintains a current account or has other regular dealings; or

(iii) any legal practitioner who is entitled to practise in any civil court in India; or

(iv) an accountant; or

(v) any person who has passed any accountancy examination recognised in this behalf by the Board; or

(vi) any person who has acquired such educational qualifications as the Board may prescribe for this purpose; or

(via) any person who, before the coming into force of this Act in the Union territory of Dadra and Nagar Haveli, Goa†, Daman and Diu, or Pondicherry, attended before an income-tax authority in the said territory on behalf of any assessee otherwise than in the capacity of an employee or relative of that assessee; or

(vii) any other person who, immediately before the commencement of this Act, was an income-tax practitioner within the meaning of clause (iv) of sub-section (2) of section 61 of the Indian Income-tax Act, 1922 (11 of 1922), and was actually practising as such;

[(viii) any other person as may be prescribed.]

Thus, the phrase ‘on behalf of’ in the Income-tax Act, 1961, is clearly in a representative capacity. It may be noted that for a professional to appear before the tax authorities, a ‘vakalatnama’ or a ‘power of attorney’ is required. This allows the person so authorised to appear ‘on behalf of a person’ before various authorities and make pleadings and submissions on their behalf. These pleadings and submissions are binding upon the person so represented. A cursory glance at umpteen Judgements of various courts will show that the Courts observe that Advocates have appeared ‘on behalf of’ a client. This introduces an additional point of distinction between ‘on behalf of’ and ‘for’. We may add this to our original hypothesis – For a transaction or activity to be carried out ‘on behalf of’ another person, there should be authorisation to that effect and the intention to be bound by the action of the person so authorised acting on one’s behalf.

In fact, inspiration can be drawn from the Judgment of the Constitution Bench of the Supreme Court in M. Siddiq (Ram Janmabhumi Temple-5 J.) vs. Suresh Das, (2020) 1 SCC 1. The Judgment, more famously known as the ‘Ayodhya Judgment’ or the ‘Ram Janmabhoomi Temple Judgment’ discussed the right of a ‘Shebait’ and the ‘next friend’ of the idol to institute a suit. The following extracts of the Judgment may prove to be instructive:

“Courts recognise a Hindu idol as the material embodiment of a testator’s pious purpose. Juristic personality can also be conferred on a Swayambhu deity which is a self-manifestation in nature. An idol is a juristic person in which title to the endowed property vests. The idol does not enjoy possession of the property in the same manner as do natural persons. The property vests in the idol only in an ideal sense. The idol must act through some human agency which will manage its properties, arrange for the performance of ceremonies associated with worship and take steps to protect the endowment, inter alia by bringing proceedings on behalf of the idol. The shebait is the human person who discharges this role..

..The dedicated property legally vests in the idol in an ideal sense and not in the shebait. A shebait does not bring an action for the recovery of the property in a personal capacity but on behalf of the idol for the protection of the idol’s dedicated property. Ordinarily, a deed of dedication will not contain a provision for the duties of the shebait. However, an express stipulation or even its absence does not mean that the property of the idol vests in the shebait. Though the property does not legally vest in the shebait, the shebait may have some interest in the usufruct generated from it. Appurtenant to the duties of a shebait, this interest is reflected in the nature of the office of a shebait..

..Ordinarily, the right to sue on behalf of the idol vests in the shebait. This does not however mean that the idol is deprived of its inherent and independent right to sue in its own name in certain situations. The property vests in the idol. A right to sue for the recovery of property is an inherent component of the rights that flow from the ownership of property. The shebait is merely the human actor through which the right to sue is exercised. As the immediate protector of the idols and the exclusive manager of its properties, a suit on behalf of the idol must be brought by the shebait alone. Where there exists a lawfully appointed shebait who is able and willing to take all actions necessary to protect the deity’s interests and to ensure its continued protection and providence, the right of the deity to sue cannot be separated from the right of the shebait to sue on behalf ofthe deity. In such situations, the idol’s right to sue stands merged with the right of the shebait to sue on behalf of the idol..

..A suit by a shebait on behalf of an idol binds the idol.For this reason, the question of who can sue on behalf of an idol is a question of substantive law. Vesting any stranger with the right to institute proceedings on behalf of the idol and bind it would leave the idol and its properties at the mercy of numerous individuals claiming to be “next friend”. Therefore, the interests of the idol are protected by restricting and scrutinising actions brought on behalf of the idol. For this reason, ordinarily, only a lawful shebait can sue on behalf of the idol. When a lawful shebait sues on behalf of the deity, the question whether the deity is a party to the proceedings is merely a matter of procedure. As long as the suit is filed in the capacity of a shebait, it is implicit that such a suit is on behalf of and for the benefit of the idol..”

Therefore, the shebait acts in a representative capacity on behalf of the idol in instituting a suit and by the virtue of being the shebait, has the authorisation by the virtue of appointment and consequently the authority to bind the idol through a suit. In short, as the Supreme Court observed, the shebait can file a suit on behalf of the idol.

In fact, the expression ‘on behalf of’ also finds use in the relationship of ‘agency’. A recent Judgment of the Supreme Court inRajasthan Art Emporium vs. Kuwait Airways & Onr. 2023 SCC OnLine SC 1461,examining Section 237 of the Indian Contract Act considered if the agent had the authority to act ‘on behalf of’ the Principal.

Section 237 of the Contract Act provides that:

“237. Liability of principal inducing belief that agent’s unauthorised acts were authorised – When an agent has, without authority, done acts or incurred obligations to third persons on behalf of his principal, the principal is bound by such acts or obligations if he has by his words or conduct induced such third persons to believe that such acts and obligations were within the scope of the agent’s authority.”

The Court observed that: “There is no gainsaying that onus to show that the act done by an agent was within the scope of his authority or ostensible authority held or exercised by him is on the person claiming against the principal. This, of course, can be shown by practice as well as by a written instrument. Thus, the question for consideration is whether on the evidence obtaining in the instant case, can it be said that Respondent 3 had an express or implied authority to act on behalf of Respondent 1 as their agent? If Respondent 3 had such an authority, then obviously Respondent 1 was bound by the commitment Respondent 3 had made to the appellant.”

This Judgment would also support our hypothesis that in order to act ‘on behalf of’ someone, the person must be authorised, and act in a representative capacity and such act must have the power to bind the person to the act committed.

In State of W.B. vs. O.P. Lodha (1997) 5 SCC 93 where an agent was selling goods both in his individual capacity and in his capacity as an agent, the Supreme Court observed: “In my judgement, the scheme of the Act leaves no room for doubt that an agent who sells goods on behalf of somebody else cannot escape the liability to pay sales tax on the sales made by him for and on behalf of others merely because, he was selling goods on behalf of others.”

The importance of the ‘on behalf of’ being in the course of business or profession to trigger the reporting obligations.

Therefore, a relationship akin to an agency would see an agent act ‘on behalf of the principal’. A perusal of the list of the activities and finance transactions covered by both the 3rd May as well as the 9th May, 2023 Notifications would seem to suggest that an agency relationship and the relationship of a constituted attorney / power of attorney holder for carrying out the listed activities / transactions would trigger the definition of reporting entity. After all, a constituted attorney also acts in a representative capacity, is specifically authorised and can bind the Donor (the person who grants the power of attorney) by his / her Acts.

For professionals, it is important to note that both Notifications carry an important safeguard. The activity / transactions must be carried out in the course of business / profession. If this safeguard did not exist, then personal transactions / activities of the nature listed in the notifications would also have been covered. After all, it is quite common for a parent / guardian / family member / spouse to act ‘on behalf of’ the minor child / ward / other members of the family or spouse. For example, for a minor to be admitted into a partnership, a parent / guardian needs to enter into the contract on the minor’s behalf.

In CIT vs. Shah Mohandas Sadhuram [1965] 57 ITR 415 (SC) the Supreme Court observed “Before we discuss these questions it is necessary to consider what are the incidents and true nature of “benefits of partnership” and what is a guardian of a minor competent to do on behalf of a minor to secure the full benefits of partnership to a minor. First it is clear from sub-section (2) of section 30 of the Partnership Act that a minor cannot be made liable for losses. Secondly, section 30, sub-section (4), enables a minor to sever his connection with the firm and if he does so, the amount of his share has to be determined by evaluation made, as far as possible, in accordance with the rules contained in section 48, which section visualises capital having been contributed by partners. There is no difficulty in holding that this severance may be effected on behalf of a minor by his guardian. Therefore, sub-section (4) contemplates that capital may have been contributed on behalf of a minor and that a guardian may on behalf of a minor sever his connection with the firm. If the guardian is entitled to sever the minor’s connection with the firm, he must also be held to be entitled to refuse to accept the benefits of partnership or agree to accept the benefits of partnership for a further period on terms which are in accordance with law. Subsection (5) proceeds on the basis that the minor may or may not know that he has been admitted to the benefits of partnership. This sub-section enables him to elect, on attaining majority, either to remain a partner or not to become a partner in the firm. Thus it contemplates that a guardian may have accepted the benefits of a partnershipon behalf ofa minor without his knowledge. If a guardian can accept benefits of partnership on behalf ofa minor, he must have the power to scrutinise the terms on which such benefits are received by the minor. He must also have the power to accept the conditions on which the benefits of partnership are being conferred. It appears to us that the guardian can do all that is necessary to effectuate the conferment and receipt of the benefits of partnership.”

In fact, ‘on behalf of’ is often used between a minor and a guardian. If we look at the Indian Trusts Act, 1882, it uses the phrase ‘on behalf of’, statutorily allows a trust to be created by or on behalf of a minor subject to the law contained in Section 7(b) of the Act. In the Definitions included in the FATF 40 recommendations, the phrase ‘on behalf of’ is also used in the definition of trustee to denote a family member which reads as follows:

Trustee: The terms trust and trustee should be understood as described in and consistent with Article 2 of the Hague Convention on the law applicable to trusts and their recognition. Trustees may be professional (e.g. depending on the jurisdiction, a lawyer or trust company) if they are paid to act as a trustee in the course of their business, or a non-professional who is not in the business of being a trustee (e.g. a person acting on behalf of the family).

Normally, this activity of the Guardian would have triggered the definition of ‘reporting entity’ qua the 9th May, 2023 Notification by acting as a partner of a firm on behalf of the minor or through the other activities / transactions listed in the notifications e.g. buying and selling of immovable property and management of bank, savings of securities account. The same activities can also be carried out for family members as well as major children through an express Power of Attorney etc. Therefore, the transaction / activity needing to be in the course of profession / business in addition to being carried out on behalf of another person or (in the case of the 9th May, 2023 Notification) for another person is an important safeguard to one’s privacy.

CONCLUSION

This discussion, rather than trying to be the last word on the interpretation of the phrase ‘on behalf of’, seeks to be a ‘starting point’. The phrase ‘on behalf of’ is generic and is often used in a broad sense. Whether an activity or a transaction is conducted on behalf ofanother person or not would be greatly influenced by fact. The image would change as one peers through the kaleidoscope of facts. In law, the interpretation given to this phrase will undoubtedly affect both, the professionals as well as the general public with regard to the reporting and compliance requirements imposed by Chapter IV of the PMLA.

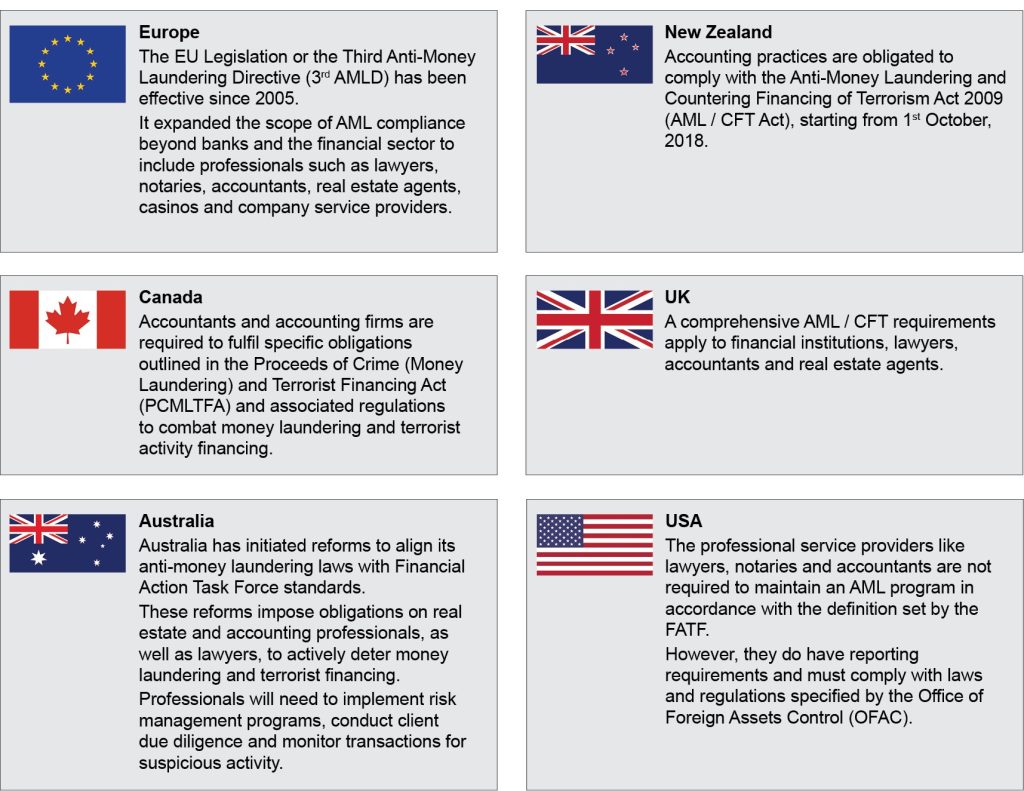

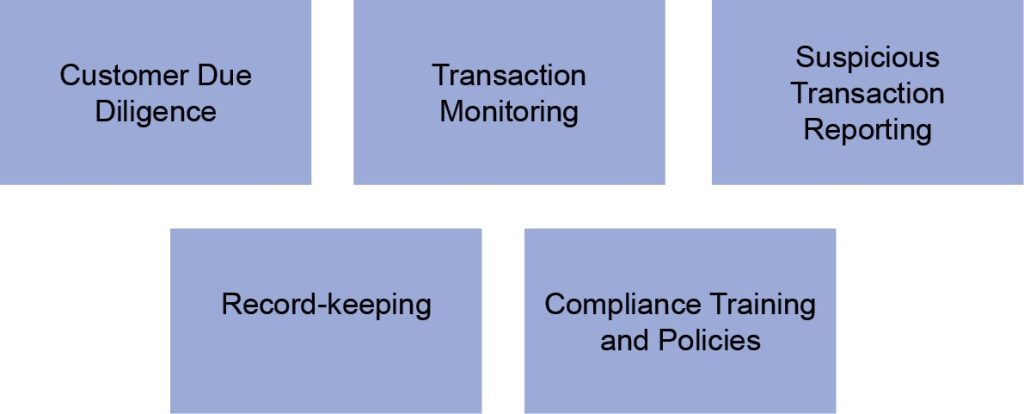

If one goes through the FATF recommendations which are available on the website, one would see that the scheme is putting the onus on Lawyers, Notaries, Independent Legal Professionals and Accountants to carry out KYC and report suspicious transactions as a part of the 40 recommendations. Therefore, putting the onus on professionals is not a decision that has been taken by the Government of India in an arbitrary manner or as a ‘vendetta’ but is a part of our international commitments to adhere to global practices. These obligations will be implemented in FATF member countries across the globe at some point in time, if not already implemented. The relationships that have been indicated for the purposes of reporting are mainly fiduciary in nature. Professionals can avoid being reporting entities by not rendering the services that have been listed in the Notifications. Most of these services are generally not a part of professional services rendered and are more ‘personal’ in nature and may be seen as being fiduciary relationships.

It is important to note that the penalty for not complying with Chapter IV of the PMLA is a monetary one under Section 13 and no prosecution is contemplated. The fine may be steep, as a separate fine may be levied (maximum of One lakh), but the fine shall be for each individual infraction and may add up quite quickly. However, a word of caution: Some of these activities may also be in violation of the professional code of ethics and may give rise to disciplinary proceedings against the professional concerned. It would perhaps be better for most professionals to avoid carrying out the activities that are contemplated by the 3rd and 9th May, 2023 Notifications in the course of carrying on their professions.