STATUTORY AUDIT – BCAJ SURVEY ON PERSPECTIVES ON NFRA CONSULTATION PAPER

The BCAJ carried out a dipstick survey in October 2021 considering the National Financial Reporting Authority’s (NFRA) Consultation Paper [September 2021.] that brings out ideas to suggest that Statutory Audit fees are a burden, that only public interest entities require audit and that entities having Rs. 250 crores net-worth should be subjected to audit. The survey sought the views of Companies (Clients of Auditors) who avail the services of CA firms to carry out Statutory Audits.

ATTRIBUTES OF THE RESPONDENTS

64.9% of respondents represented Private Limited Companies, 16.2.% Group Companies (comprising of several companies of all sizes), 10.8% Listed/ Public Limited Companies, 4.1% One Person Companies and 4.0% regulated companies (such as NBFCs).

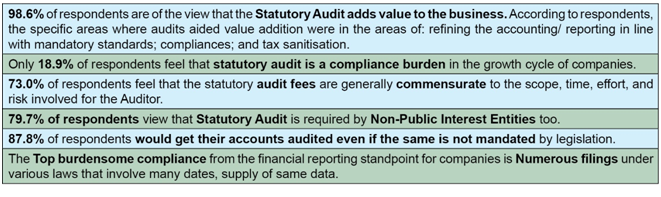

KEY HIGHLIGHTS

Survey Questions and Responses

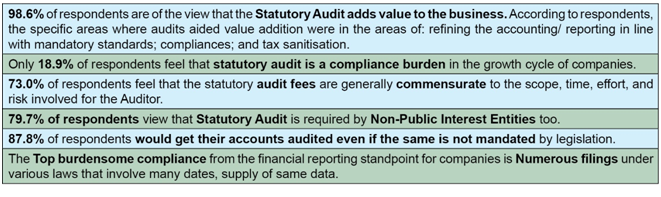

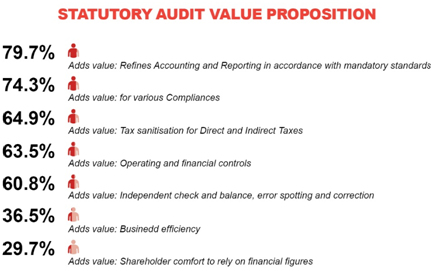

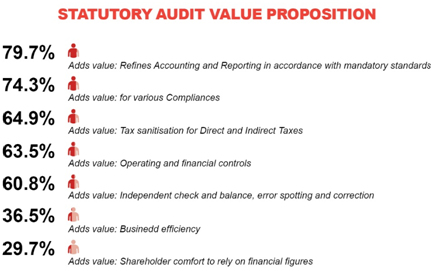

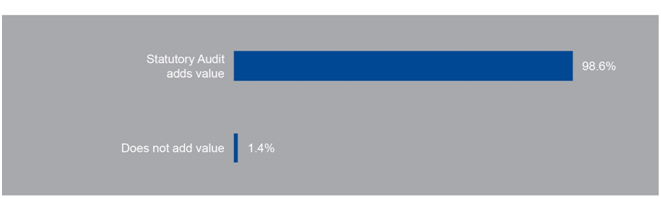

- VALUE PROPOSITION: In your view, which of the following areas does a Statutory Audit add VALUE in your business? [Select one or more options]

Other Comments by Survey Participants: Statutory Audit: eases Foreign Operations; Facilitates in quoting for tenders.

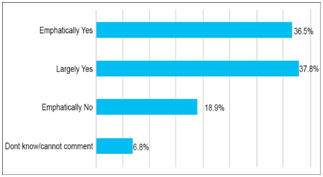

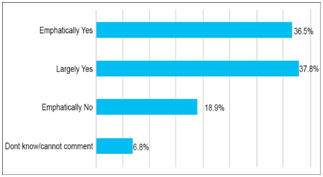

- COST vs VALUE: In the growth cycle of your company do you feel Statutory Audit is not a compliance burden / a ‘cost’ and adds value as mentioned in Q1 above to management / owners ? [Select one option]

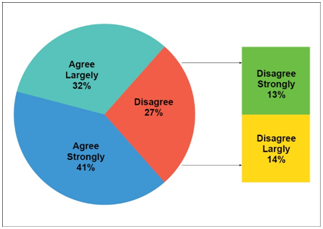

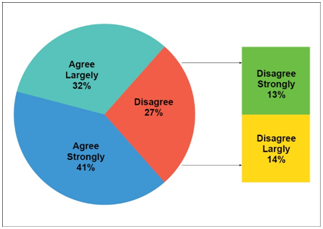

- FEES: Do you feel that the Statutory Audit Fees in your experience are generally commensurate to the scope, time, effort, and risk involved for the Auditor? [Select the most appropriate option]

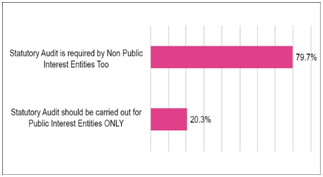

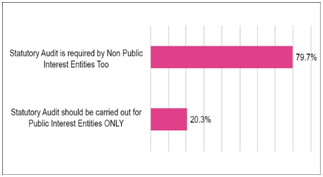

- PUBLIC INTEREST: Do you feel requirement of statutory audit should be SOLELY based on Public Interest criteria OR statutory audit serves multiple purposes especially for companies which are not Public Interest Entities such as for MSME companies? [Select one option]

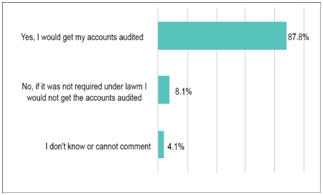

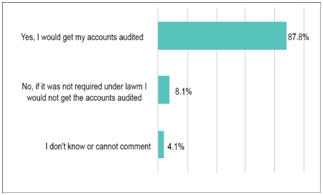

- OPTION: If audit was not mandatory or was optional would you still get your accounts audited for reasons other than “Compliance with the Act” since audited accounts give strength, sanctity, and dependability to financials? [Select one option]

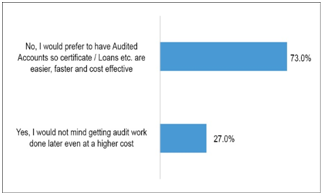

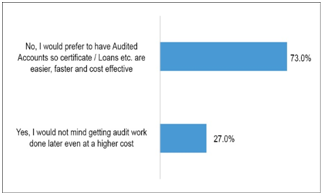

- CONSEQUENCES: If you chose not to opt for statutory audit and later require loans, or get notices, or require certificates under various laws – would you be willing to go through “Audit” of those areas for above purposes later on for more than one year? [Select one option]

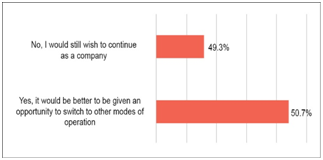

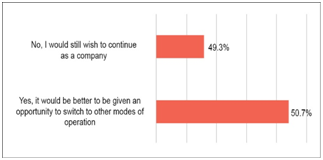

- CEASE TO BE A COMPANY – Hypothetically, if some categories of companies were to be exempted from Statutory Audits and other heavy compliances, would you rather wish to carry the business in a non-corporate format and therefore should be given an opportunity to change over to LLP or other modes for ease of operating without any questions / hassles from tax departments or MCA? [Select one option]

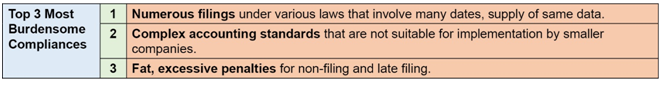

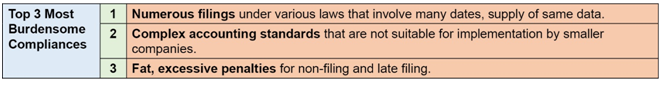

- BURDENSOME COMPLIANCES – In your view, which are the TOP THREE most burdensome compliances thrust upon small and medium companies from a financial reporting point of view?