Corporate Governance standards are being continuously strengthened with the focus on improving the quality of governance norms and disclosures by listed entities. Related party transactions have always been a key focus area for the regulators. Significant amendments have been made in the Companies Act, 2013 (2013 Act) as well as in the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (Listing Regulations) to regulate such transactions and their disclosure in financial statements. The regulators made various amendments in the 2013 Act and Listing Regulations to align the requirements prescribed under the two, for example, omnibus approval by Audit Committee for repetitive related party transactions; however, SEBI regulations continue to be more stringent, for instance, the definition of related party under the Listing Regulations will result in the identification of significantly higher number of related parties vis-à-vis those under the 2013 Act.

The three important aspects of related party transactions which merit consideration are (a) Identification [who are considered related parties (RP) and when], thresholds (values or %), approvals (depending on the former who will approve – Audit Committee / Shareholders / Government) and disclosure (and their timelines) in financial statements and to be filed with the regulators. For minority shareholders such steps are of great importance to protect their interests and allow them to take decisions…Information on RPs also give better insight into performance and monitoring of movement of funds.

Section 188 of the Companies Act, 2013 deals with ‘related party transactions’, i.e., transactions specified in the section with any person who falls within the definition of ‘related party’ as per section 2(76) of the Act. Apart from section 188, there are several other provisions in the 2013 Act that deal with specific types of transactions with specific types of parties which may be covered within the definition of ‘related party’, for example, section 185 deals with loans to Directors and to certain other parties in which the Directors are interested; section 192 places restrictions in respect of non-cash transactions with Directors and certain other specified persons; and a number of sections that deal with managerial remuneration.

Further, the Listing Regulations also prescribe specific regulations which govern RPTs for the listed entities. While some provisions are common, however, with the recent amendment to the regulations, the Listing Regulations have been made much more stringent as discussed in this article.

With the aim to review and strengthen the regulatory norms pertaining to RPTs, undertaken by listed entities in India, SEBI constituted a Working Group in November, 2019 comprising members from the Primary Market Advisory Committee (PMAC)1, including persons from the industry, intermediaries, proxy advisers, stock exchanges, lawyers, professional bodies, etc.

On the basis of the recommendations of the working group, SEBI as per Notification dated 9th November, 2021 has further amended provisions relating to RPTs under the SEBI Listing Regulations.

____________________________________________________________

1 Reference may be made to SEBI Meeting – Review of Regulatory Provisions

EFFECTIVE DATE

The SEBI LODR Amendment Regulations are applicable in a phased manner; certain amendments will be effective from 1st April, 2022, while the remaining amendments will be effective from 1st April, 2023 (as specified in the regulations).SEBI LODR has been amended, inter alia, in respect of the following:

* Definition of ‘related party’ (RP) and ‘related party transactions’ (RPT),

* Change in monetary limits for classification of material RPTs,

* Disclosure requirements for RPTs,

* Process to be followed by Audit Committee for approval of RPTs.

The objective of this article is to provide an overview of the recent amendments made by SEBI and the auditor’s role in the audit of RPTs.

OVERVIEW OF THE AMENDMENTS

Definition of related party

The working group constituted by SEBI felt that the promoter or the promoter group may exercise control over and influence the decision-making of the listed entity. Accordingly, the recommendation was made to consider every person or entity forming part of the promoter or promoter group, irrespective of their shareholding in the listed entity, as a related party.

Existing regulations consider any person or entity to be a related party if he / she or it belongs to the promoter or promoter group of the listed entity holding 20% or more of shareholding in the listed entity.

The amended regulations consider any person or entity to be a related party if

* he / she / it is belonging to the promoter or promoter group of the listed entity (i.e., irrespective of shareholding) or

* if any person or entity is holding 20% or more equity shares either directly or on a beneficial interest basis as per section 89 of the 2013 Act at any time during the preceding financial year and effective from 1st April, 2023 if any person or entity is holding 10% or more of equity shares at any time during the immediately preceding financial year. This amendment will cover persons or entities holding shares as above even if he / it does not form part of the promoter or promoter group of the listed entity.

The rationale behind lowering of these amendments has been explained in the SEBI agenda2 which states that a significant percentage of Indian businesses are structured as intrinsically linked group entities that operate as a single economic unit, with the promoters exercising influence over the entire group. Thus, the promoter or promoter group may exercise control over a company irrespective of the extent of shareholding. There is also the possibility of a shareholder not being classified as a promoter but who may be exercising influence over the decisions of the listed entity by virtue of shareholding.

With the revised definition of related party and the changes in threshold to 10% w.e.f. from 1st April, 2023 it may pose a practical challenge for companies in identification of related parties, in conducting their day-to-day business since companies will need to keep track of such entities at any time during the past financial year, and transactions with such entities will require Audit Committee approval. Companies need to evaluate whether such a shareholder may have ceased to hold any shares in the listed entity in the year of applicability of the amended regulations or in a subsequent year.

_________________________________________________________

2 Reference may be made to the SEBI meeting – Review of Regulatory Provisions

DEFINITION OF RELATED PARTY TRANSACTIONS

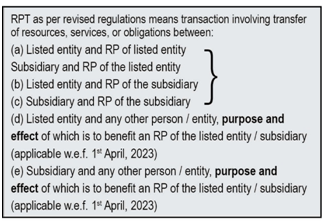

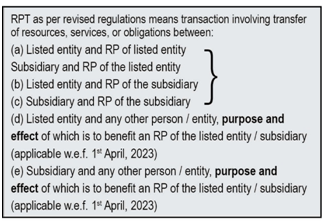

The scope of the term has been made significantly wider, principally with a view to bring transactions with subsidiaries (listed or unlisted, Indian or foreign) within its ambit.As per existing regulations, the definition covers transfer of resources, services or obligations between a listed entity and an RP, regardless of whether a price is charged, whether there is a single or a group of transactions.

Some of the corporate actions such as issue of securities on preferential basis, rights issue, buy-backs, payment of dividend, sub-division or consolidation, etc., where these provisions are uniformly applicable / offered to all shareholders in proportion to their shareholding, have been excluded from the ambit of the definition.

SEBI has also revised thresholds for determining ‘materiality’ of an RPT. A transaction with a related party shall be considered material if the transaction(s) to be entered into individually or taken together with previous transactions during a financial year, exceed Rs. 1,000 crores or 10% of the annual consolidated turnover of the listed entity as per its last audited financial statements, whichever is lower (as per existing regulations, the threshold was only 10% of the annual consolidated annual turnover of the listed entity).

It is noteworthy that the scope of RPTs has been extended to include transactions that not only have a direct nexus with an RP but eventually also those which would indirectly benefit the RP. This will entail significant efforts from companies, and they will be required to scrutinise individual transactions with a third party and may also require listed entities to demonstrate that the RP is not benefited from a third-party transaction.

The meaning of purpose and effect’ has not been defined in the SEBI Regulations. In common parlance, purpose would mean to have an intent to benefit the RP and effect is that it actually happens indirectly; it is more of substance-based assessment and management will require to undertake critical evaluation of documentation and the commercial intention of the transaction.

PRIOR APPROVAL FROM AUDIT COMMITTEE AND SHAREHOLDERS

The amended regulations require prior approval of the Audit Committee and shareholders of the listed entity for all related party transactions and subsequent material modifications thereto… Provided that only those members of the Audit Committee, who are Independent Directors, shall approve related party transactions.

There is no need to have prior approval of the Audit Committee and shareholders of a listed entity for a related party transaction where the listed entity is not a party and its listed subsidiary is a party if Regulations 23 and 15(2) of SEBI Listing Regulations are applicable to such listed subsidiary.

|

1. The definition of the term ‘material modifications’

will be required to be defined by the Audit Committee and disclosed as part

of the policy on materiality.

An RPT to which a subsidiary of a listed entity

is a party (even if the listed entity by itself is not a party) shall require

prior approval from the Audit Committee of the listed entity, if the value of

such transaction (individually or together with previous transaction during

the F.Y.) exceeds

I. 10% of the annual consolidated turnover, as

per the last audited financials of the listed entity (with effect from 1st

April, 2022)

II. 10% of the annual consolidated turnover, as

per the last audited financials of the subsidiary (with effect from 1st

April, 2023)

|

The scope of an RPT which requires prior shareholders’ and Audit Committee approval has been expanded. Depending on the type of approval, prior approval may be taken, for example, for omnibus approval it may be before the next financial year, while for contract or transaction-based approval, it may be immediately before entering into an RPT. It is not clear whether the regulations will apply to RPTs which were entered into before 1st April 2022. While SEBI may issue a clarification in this regard, one may take a view that the regulations will be applicable prospectively considering there are no specific transitional provisions specified in the amended regulations.

DISCLOSURES

Schedule V to the Listing Regulations specifies the additional disclosures required to be provided by listed entities in their annual report. This, inter alia, includes related party disclosures and disclosures pertaining to the corporate governance report.

|

Existing timeline is as under:

For equity listed entities – disclosure for the

half year to be submitted within 30 days from the date of publication of its

standalone and consolidated financial results for the half year.

For high value debt listed entities – disclosures

for the half year at the time of submission of their standalone financial

results (on a comply or explain basis up to 31st March, 2023) and

on a mandatory basis from 1st April, 2023.

Revised timeline is as under:

For equity listed entities – within 15 days from

the date of publication of standalone and consolidated financial results for

the half year.

With effect from 1st April, 2023 – on

the date of publication of its standalone and consolidated financial results.

For high value debt listed entities – along with

its standalone results for the half year.

|

SEBI has issued another Circular dated 22nd November, 2021 which provides detailed disclosure formats of RPTs and information to be placed before the Audit Committee and the shareholders for consideration of the same.

AUDITORS’ ROLE IN AUDIT OF RELATED PARTY TRANSACTIONS

The corporate scandals over a period of time have indicated that related parties are often involved in cases of fraudulent financial reporting. The RPTs may provide scope for distorting financial information in financial statements and not presenting accurate information to the decision-makers and stakeholders. The audit of RPTs and transactions presents a particular challenge to auditors due to many reasons, including the following:

(1) Related party relationships and transactions are not always easy to identify due to complex structures

and arrangements;

(2) Management is responsible for identifying all related parties yet may not fully understand the definition of a related party under various regulations or may not want to provide information on the grounds of sensitivity;

(3) Many companies may not have effective internal controls in place for authorising, recording and tracking related party transactions.

(4) Auditors of smaller companies may find it difficult to identify related party relationships and transactions because management may not understand the related party disclosure requirements or their significance. It is therefore important for auditors to be clear about what needs to be disclosed so that they can advise management on the responsibility to prepare financial statements that comply with the relevant accounting framework.

ICAI issued SA 550 Related Parties which deals with the auditor’s responsibilities regarding related party relationships and transactions. Under the current auditing framework, auditors are required to focus on three areas:

1) identification of previously unidentified or undisclosed related parties or transactions.

2) significant related party transactions outside the normal course of business. Related parties may operate through an extensive and complex range of relationships and structures, with a corresponding increase in the complexity of related party transactions.

3) assertions that related party transactions are at arm’s length.

Auditors are required to evaluate whether the effects of RPTs are such that they prevent the financial statements from achieving a true and fair presentation.

With the given plethora of amendments in SEBI regulations, the responsibilities of auditors have been enhanced even further. The auditors need to understand the implications of the amendments on the company’s systems and processes of identification and disclosure of RPTs. The auditor may consider the following illustrative work-steps while conducting an audit of related party relationships and transactions to enhance the quality of the audit.

(i) Plan the audit of related party relationships and transactions by updating existing information, and by obtaining a list of related parties from clients, or compile a list based on discussions with clients. Needless to say, the auditor should consider the amendments to related party regulations for listed entities and their subsidiaries while obtaining such information.

(ii) Make inquiries from the management about changes from the prior period, the nature of the relationships, whether any transactions have been entered into and the type and purpose of the transactions.

(iii) Understand the nature, size and complexity of the businesses and use family trees or document group structures under various laws / statutes and regulations (e.g., income-tax – transfer pricing and indirect tax – GST) to help identify related parties and relationships between the client and related parties.

(iv) Consider the impact of undisclosed related party relationships and transactions as a potential fraud risk.

(v) Understand the controls, if any, that management has put in place to identify, account for, and disclose related party transactions and to approve significant transactions with related parties, and significant transactions outside the normal course of business. Also understand management’s plan to update such controls for change in related party regulations.

(vi) Perform procedures to confirm identified related party relationships and transactions and identify others including:

a. inspecting bank and legal confirmations obtained as part of other audit procedures.

b. inspecting minutes of shareholder and management meetings and any other records or documents considered necessary, such as:

* Other third-party confirmations (i.e., in addition to bank and legal confirmations)

* Entity income-tax returns, tax filings and related correspondence

* Information supplied by the entity to regulatory authorities

* Records of the entity’s investments and those of its pension plans

* Contracts or other agreements (including, for example, partnership agreements and side agreements or other arrangements) with key management or those charged with governance

* Significant contracts renegotiated by the entity during the period

c. Ensure compliance with all the requirements of sections 179, 180, 185, 186, 187 of the Companies Act, 2013 and rules thereunder.

d. When there are other components of the company that are not audited by the parent auditor, coordinate audit procedures with the component auditors to obtain necessary information relating to intercompany transactions and balances.

e. Review minutes and other agreements for support for loans or advances and for evidence of liens, pledges or security interests related to receivables from, or loans and advances to, subsidiaries.

f. Examine the agreements entered between the company and the related parties.

(vii) Consider any fraud risk factors in the context of the requirements of SA 240 Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements.

(viii) Establish the nature of significant transactions outside the company’s normal course of business and whether related parties could be involved, by inquiring of management.

(ix) Consider any arm’s length assertions and obtain supporting evidence from third parties.

(x) Document the identity of related parties and the nature of related party relationships.

(xi) Obtain a representation that management has disclosed the identity of related parties, relationships and transactions of which they are aware, and that related parties and transactions have been appropriately accounted for and disclosed.

(xii) Communicate significant related party matters arising during the audit to those charged with governance unless all of those charged with governance are involved in its management.

(xiii) Ensure that the accounting for and disclosure of related parties and related party transactions are appropriate and in accordance with the applicable financial reporting framework.

(xiv) Reporting of Key Audit Matter (KAM) and determining whether identification of related parties and transactions with related parties is a KAM. SA 701 states that events or transactions that had a significant effect on the financial statements or the audit, may include significant transactions with related parties, significant transactions outside the normal course of business, unusual transactions. The auditor should assess whether a KAM on RPT is required and which require significant auditors’ attention.

Amendments in Corporate Governance Report

The companies as well as auditors should take note of additional disclosures in the corporate governance report by the listed entity and its subsidiaries of ‘Loans and advances’ in the nature of loans to firms / companies in which the Directors are interested by name and amount. A compliance certificate from either the auditors or practising company secretaries regarding compliance of conditions of corporate governance is required to be annexed with the Directors’ report.

CONCLUDING REMARKS

The SEBI LODR Amendment Regulations on RPTs will ensure greater transparency and better corporate governance which will safeguard the interests of all stakeholders and strengthen the regulatory framework. These amendments also enhance the responsibilities of the Audit Committees and the Independent Directors with respect to RPT approvals; Audit Committees will need to define ‘material modifications’ to RPTs, require amendment to the RPT policy, revise data base of RPTs with RPTs of subsidiaries and their value. In the light of the amended provisions, listed entities would need to revisit their list of related parties, RPTs, identify material RPTs which need Audit Committee / shareholder approval and comply with the additional disclosure and documentation requirements. The listed entities will be required to identify new related party transactions based on a review of the present arrangements, update the related party policy to capture amendments and recommend updating of processes, controls for capturing additional data requirement.

The auditors have an important role to play in reporting on related party transactions given the existing responsibilities under Standards on Auditing and amendments made in the Companies (Audit and Auditor’s Reporting) Rules applicable for the financial year ending March, 2022 onwards which requires auditors to obtain representations from management that (other than those disclosed in the financial statements) no funds have been provided to intermediaries with an understanding that the intermediaries would lend or invest or provide guarantee, etc., on behalf of the ultimate beneficiaries. A similar reporting requirement has also been prescribed for receipt of funds from funding parties.