1 Issued in September 2015.

2 As prescribed under Rule 11 of the Companies

(Audit and Auditors) Rules, 2014.

3 In general parlance it implies an attempt to mask

loan default by giving new loans to help delinquent borrowers to repay/adjust

principal or pay interest on old loans.

A cursory reading of some of the new auditors’ requirements (e.g. lending and borrowings masking the ‘Ultimate Beneficiary’) might give the impression that these requirements expand the boundaries of an audit engagement requiring the auditor to perform procedures that are generally performed in an investigation. However, it might be noted that these reporting obligations have been prescribed in relation to the audit of financial statements. Accordingly, the auditor should consider Standards on Auditing and other guidance in planning and performing the audit procedures to address the risk of material misstatement as stated above. Some of the considerations are as follows:

• Substance vs. legal form– Schedule III to the 2013 Act and CARO 2020 have significantly enhanced the reporting obligations relating to loans, guarantees, etc. The auditor should verify that the controls have been established to critically assess the substance of the transaction irrespective of the legal form. To illustrate – basis relevant facts and circumstances, it might be appropriate to conclude that extension of a loan (such as one day prior to the expiration of tenure) is in substance evergreening of loans even though the loan is not technically ‘overdue’ – which is the trigger for reporting under CARO 2020.

• Critical assessment of funding needs of the borrower and its utilisation of funds- Schedule III provides disclosures relating to conduit lending/ borrowing transactions, etc, masking the ‘Ultimate Beneficiary’ and related matters. Further, management must also provide representations to the auditor that there are no such transactions except for that disclosed in the financial statements. Under the Companies (Audit and Auditors) Rules, 2014, the auditor must comment whether such management representation has been obtained and whether the representation is materially misstated. The auditor should assess whether the controls have been established to evaluate the funding needs of the borrower (prior to granting of loans) and periodically obtain end-use report of the funds from the borrower.

• Efficacy of periodic book close process- The auditor should review existing book close process and assess whether reliable information is generated which enables accurate filing of quarterly returns/ statements with the lenders. Where differences exist – assess whether proper explanations for differences have been documented and approved as per the authority matrix of the company.

• Competence of objectivity of management experts- Controls regarding assessing the competence and objectivity of management experts involved if any e.g., in case of revaluation of property, plant and equipment/ intangible assets, assess compliance with Companies (Registered Valuers and Valuation) Rules, 2017 to the extent applicable.

• Avoid hindsight- Presentation of comparative information for new disclosures pursuant to the requirements of Schedule III might involve making necessary estimates and require the exercise of judgement. The auditor would need to be ensure that the estimates/ judgement involved are based on the information available as at the end of the previous year and without using hindsight information e.g., trade receivable under litigation till end of previous year has been disclosed as disputed trade receivable in the previous year even though such litigation has been disposed of by the end of the current year.

MATERIAL4 UNCERTAINTY RELATING TO GOING CONCERN

Circumstances affecting management’s assessment of going concern might change rapidly in the current environment, e.g., adverse key financial ratios or challenges in the realisation of financial assets and payment of financial liabilities may cast significant doubt on the company’s ability to continue as a going concern. As required under Standard on Auditing, 570, Going Concern, the auditor is required to report in a separate paragraph in the audit report if a material uncertainty relating to going concern exists.

• Schedule III to the 2013 Act now requires companies to disclose:

• Certain financial ratios in the financial statements (e.g., debt service coverage ratio) and explain any change in the ratio by more than 25% as compared to the preceding year.

• Ageing of trade receivables and trade payables.

• CARO 2020 requires the auditor to comment whether material uncertainty exists on the company’s ability of meeting its liabilities within a period of one year from the balance sheet date.

It might be noted that the going concern assessment under Standards on Auditing and reporting under CARO 2020 is not is the same – though there might be interlinkages. Under CARO 2020, the auditor’s responsibility is limited to assessing a company’s solvency i.e. material uncertainty, if any on the company’s ability to meet its liabilities; whereas going concern assessment is a much wider assessment of the entity. The auditor would need to assess whether a material uncertainty exists related to events or conditions that, individually or collectively, may cast significant doubt on the company’s ability to continue as a going concern e.g. a Company that is in the business of selling garments under a brand licensing agreement, might face a material uncertainty relating to going concern, if the license is not expected to be renewed. Another situation might be, where a company has hived off substantially all of its business and, absence of any concrete business plan, might indicate that material uncertainty relating to going concern exist.

The Guidance Note requires the auditor to make appropriate disclosures to state the inherent limitations on IFCFS and the limitations in consideration of such controls operating as at the balance sheet date for the future operations of the company. The assessment of material uncertainty relating to going concern involves judgement about inherently uncertain future or outcomes of events/ conditions. These judgements can be made only on the basis of what is known at the balance sheet date. The outcome of future operations of the company cannot be reliably predicted for all events/ conditions. In the current business and economic environment, what may be a reasonable assumption today may no longer be so, a short time later. Hence there are limitations in the operation of IFCFS for the company’s future operations. Following are examples of uncertainties that might create limitations on IFCFS operating as at the balance sheet date:

• Uncertainties around management’s ability to execute its turnaround strategy such as addressing reduced demand and to renew or replace funding especially where market value of unencumbered assets has deteriorated.

• Effect of business disruptions e.g., disruption of supply chain.

• Effect of actions of the company on its long-term solvency e.g., deferral of payment of trade payables may affect long term solvency of the company.

• Where support letter has been provided by the Parent company – the uncertainties around the ability of the Parent company to discharge the obligations of the subsidiary as and when they fall due.

Accordingly, where a material uncertainty relating to going concern has been identified, the auditor should assess the inherent limitations on the operation of the IFCFS regarding the future operations of the company and should appropriately disclose such limitations in the audit report pursuant to requirements of the Guidance Note.

MATERIAL PRIOR PERIOD ERRORS

While auditing the financial statements for the current year, material errors in the financial statements of the previous years might be identified. Prior period errors occurs if undisclosed income of previous years is identified in the current year or due to mathematical mistakes, mistakes in applying accounting policies in respect of recognition, measurement, presentation, or disclosure, etc. Examples of prior period errors could be where due to the effects of inadequate controls on cut-offs, excess revenue was recognised in previous years. Another example could be where unaccounted cash was generated from scrap sale of previous years.

• Schedule III to the 2013 Act requires companies to provide:

• Details of any transaction not recorded in the books of accounts that has been surrendered/ disclosed as income during the year in the tax assessments, unless there is immunity for disclosure under any scheme. The company is also required to state whether the previously unrecorded income and related assets have been properly recorded in the books of account during the year.

• Specific disclosures for Ind AS compliant company e.g., changes in other equity due to prior period errors.

• CARO 2020 has also prescribed reporting obligations for auditors in case of undisclosed income.

Under the Guidance Note, errors observed in previously issued financial statements in the current financial year or restatement of previously issued financial statements to reflect the correction of a material misstatement has been included as an indicator of material weakness5. Where a material weakness in IFCFS exists, the Guidance Note requires the auditor to modify the IFCFS opinion. In determining the type of modification, i.e., qualification, disclaimer, or adverse the auditor should assess its pervasiveness of the material weakness, which might include the following:

• Manner of treatment of the prior period error in the current year’s financial statements . As per the Guidance Note, pervasive effect on the IFCFS include those matters that impacts the audit opinion on the company’s financial statements. It might be noted that under Ind AS 8, the material prior period errors are corrected by restating the comparative amounts unless such restatement is impracticable. Under AS 4, comparatives are not restated but are normally included in the determining net profit or loss for the current period.

• The root cause which resulted in a material prior period error.

• The combination of the identified material weakness with other aspects of the financial statements, e.g., linkage with data used in management estimates or effect of the prior period error on the disclosures.

• The interaction of the control which failed to detect material misstatement with other controls, (e.g., the interaction of General IT controls, linkage to a transaction-level control or financial reporting process such as controls over the prevention and detection of fraud, significant transactions with related parties, controls over the financial statement close process).

PRIOR PERIOD ERRORS IDENTIFIED BY THE MANAGEMENT

There might be a situation where material prior period errors were identified by the management through its internal controls. Even in such case, the above mentioned considerations would be relevant to assess the consequential implications. As per the Guidance Note, the auditor should report if the company has adequate internal control systems in place and whether they were operating effectively as at the balance sheet date. It should be noted that when forming the opinion on internal financial controls, the auditor is required to test the same during the financial year under audit (and not just as at the balance sheet date) though the extent of testing at or near the balance sheet date may be higher, e.g. if the company’s revenue recognition was erroneous throughout the year but was corrected, including for matters relating to internal control that caused the error, as at the balance sheet date, the auditor is not required to report on the errors in revenue recognition during the year.

Accordingly, the auditor should assess the design and operating effectiveness of the new/ revised controls implemented by the management which aims to augment the book close process and avoid erroneous financial reporting. Where the new/ revised controls operate effectively by the balance sheet date and the auditor concludes that no material weakness exists as at the balance sheet date, the audit opinion on IFCFS would be unmodified.

EXEMPTION TO AUDITORS OF CERTAIN PRIVATE COMPANIES FROM REPORTING ON IFCFS

MCA has exempted auditors from reporting on IFCFS of a private company if such private company’s turnover is less than INR 50 crores as per latest audited financial statements and the aggregate borrowings from banks or financial institutions or anybody corporate at any point of time during the financial year is less than INR 25 crores. However, this exemption can be availed only if the private company has not committed a default in filing its financial statements under section 137 or annual return under section 92 of the 2013 Act. The assessment of the qualifying criteria poses certain challenges – some of them are discussed below:

ASSESSMENT OF TURNOVER CRITERIA

Financial statements under Schedule III do not disclose ‘Turnover’ but instead disclose ‘Revenue from operations.’ The items comprising turnover and revenue from operations are similar to a very large extent, but differences exist – as stated below:

|

Turnover as

defined under section 2(91) of the 2013 Act means aggregate value of the

realisation of amount made from:

• Sale,

supply or distribution of goods or

•

Services rendered, or both,

by the company during a financial year.

|

Under Schedule III Revenue From

operations comprise:

•

Sale of products,

•

Sale of services

•

Grants or donations received (in case of section 8 companies only) and

•

Other operating revenues.

|

It might be noted that there is no specific reference of ‘Other operating revenues’ in the definition of turnover. ‘Other operating revenues’ include revenue arising from a company’s operating activities, i.e., either its principal or ancillary revenue-generating activities, but which is not revenue arising from the sale of products or rendering of services.

In order to derive the amount of turnover, the auditor should:

• First, consider the amount of sale of products and sale of services as appearing in the latest audited financial statements.

• Next, the auditor should obtain a breakup of other operating revenues to identify items, if any, that might qualify as turnover e.g., sale of manufacturing scrap would qualify as turnover as it arises during the process of manufacturing of finished goods. Similarly, government grants recognised under other operating revenues should be excluded as it is neither earned from the sale of goods nor the rendition of services.

ASSESSMENT OF BORROWING CRITERIA

One of the conditions for availing the exemption is that if ‘at any point of time’ during the financial year, prescribed borrowings are less than INR 25 crores. This seems to imply that the exemption is available even if borrowings from banks or financial institutions, or any body corporate is less than INR 25 crores in any day of the year under audit. The proposition is explained through the following illustrations:

|

Borrowings

from banks/financial institutions/body corporate

|

Exemption

available?

|

|

As at 1

April 20X1

|

2 April

20X1 to 31 March 20X2

|

Balance

as at 31 March 20X2

|

|

Nil

|

Borrowing

of INR 100 crores raised

|

INR 100

crores

|

Yes

|

|

INR 500

crores

|

? Borrowing of INR 100 crores raised on 5

April 2021

? Entire borrowing of INR 600 crores repaid

on 30 March 20X2 (i.e., one day before year end)

|

Nil

|

Yes

|

|

INR 90

crores

|

INR 5

crores repaid

|

INR 85

crores

|

No

|

Accordingly, the auditor should obtain the movement of borrowings, if any, from prescribed parties and assess whether the thresholds for availing exemption are met.

IFCFS REPORT ON CONSOLIDATED FINANCIAL STATEMENTS

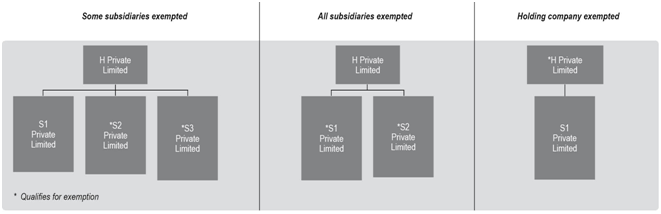

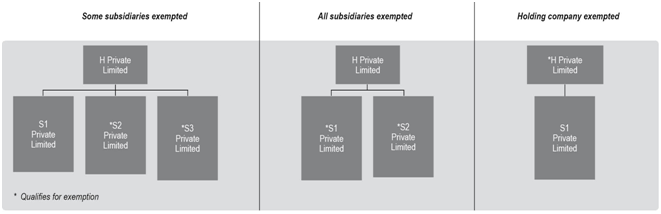

The consolidated financial statements of a private company might include certain subsidiaries/ associates/ joint ventures which are exempted from obtaining auditor’s report on IFCFS at standalone level pursuant to the MCA exemption, as discussed above. This creates quite interesting situations and poses unique challenges to the auditors of the holding company while opining on IFCFS of the consolidated financial statements:

Section 129(4) of the 2013 Act states that the provisions of the 2013 Act is applicable to the preparation, adoption and audit of the financial statements of a holding company shall, mutatis mutandis, apply to the consolidated financial statements. Accordingly, all consolidated financial statements prepared under the 2013 Act should be accompanied with the auditor’s report (including annexures thereon) unless specifically exempted under the 2013 Act. Thus, in the above illustrative scenarios as well, the auditor of the Parent company would need to report on IFCFS of consolidated financial statements.

The Guidance Note provides that reporting on the adequacy of IFCFS on consolidated financial statements would be on the basis of the audit reports as submitted by the statutory auditors at the standalone level. Hence, where IFCFS report has not been provided due to the exemption, auditors of such companies are not required to separately provide an audit report on IFCFS to the auditor of the Parent Company as this would nullify the MCA exemption. Thus, basis the Guidance note, in the above scenarios, the audit report of IFCFS on consolidated financial statements should state that the IFCFS report covers only those companies on which the IFCFS report has been provided at the standalone level. The auditor may consider including a statement in the introductory paragraph of the IFCFS report in this regard as this would clearly set out the coverage and scope of the IFCFS report on consolidated financial statements. The auditor should consider consequential changes to the IFCFS report regarding references of the exempted private company.

In a nutshell

• Considering the multitude of changes, an early dialogue with the stakeholders, including the auditors, would help mitigate implementation challenges to a large extent. For continuing requirements, auditors should reassess if any change in the audit strategy basis his experience would be necessary.

• The auditor should consider the consequential effect of observations in IFCFS on other aspects of audit report ,e.g., Reporting on adverse effect on the functioning of the company [Section 143(3)(f)].