India’s leadership wishes that India be recognised as an economic superpower.

But there is one catch in fulfilling this intent. Can we become an economy that comes in the first five in GDP rankings (although due to our large population, per capita we may still be very low) if we do not really ‘own’ our businesses in financial structures and do not supposedly pay our due share of taxes?

How can there be an entrepreneurial push to an economy when so much of quality time is spent not on expanding business and exploiting opportunities, but on creating ‘suitable business, financial and tax structures’?

Why are Indians considered a model minority culturally overseas when within the country we see examples of businesses defaulting on loans and interest payments with the term ‘wilful defaulter’ being specially coined for them and being accused of ‘tax evasion’?

[Please refer link (as example) – https://wap.business-standard.com/article/companies/around-rs-10-52-trn-corporate-debt-may-default-over-3-years-india-ratings-120030200388_1.html.]

‘Wilful defaulter’ is someone who has the ability to pay but is organising his business with the intent not to pay.

There are two macro-economic and financial problems that India is facing today:

(I) High debt capital gearing, and

(II) Intent of tax evasion (direct and indirect).

(I) High debt capital gearing

A classic case of high capital gearing and borrowings to fund business outcome comes from a major

telecom service provider (source – ‘moneycontrol.com’, standalone financials).

Between the years 2016-17 and 2020-21, this telecom company had these important events:

i) Increase in equity capital – Rs. 25,130.07 crores;

ii) Increase in tangible & intangible assets – Rs. 86,637.52 crores;

iii) Increase in long-term borrowings – Rs. 105,777.67 crores;

iv) Increase in short-term borrowings – Rs. 39.35 crores;

v) Losses incurred in this period – Rs. 86,561.43 crores.

One can see that the increase in share capital to fund losses and increase in tangible and intangible assets is much lower than the increase in borrowings. The company has also used operating creditors to fund its business.

In the case of a large Indian entity whose major business is in oil and gas, between the years 2016-17 and 2020-21, the increase in reserves and surplus due to undistributed profits is Rs. 182,980 crores, while the increase in long-term and short-term borrowings is Rs. 92,447 crores. Clearly, there is a good match between increased borrowings and increased profits after tax for the period under review.

‘High Capital Gearing’ in Indian corporates is resulting in a skewed debt to equity ratio. This high debt when not serviced by payments on due dates of interest and principal instalment due, results in the corporate being ultimately called a ‘Non-Performing Asset’ (by bankers as lenders) and the process of recovery of dues starts.

NPAs pose a serious problem for the financial viability of India’s financial lending sector.

(Please see link – https://www.business-standard.com/article/finance/banks-gross-npas-may-rise-to-13-5-by-sept-financial-stability-report-121011200076_1.html.)

NPAs are unfair to the savings class of citizens because they destroy the net worth of banks – very unfairly, the insurance for the individual saving and keeping money in banks is restricted to Rs. 5 lakhs per bank. How this figure of Rs. 5 lakhs has come about is not known. Anybody who has studied Indian middle class savings patterns knows that a very large part of their savings corpus is in bank deposits. More than the borrower being impacted by action against him, the bank customer is hit hard, again very unfairly. Why has the RBI as regulator not thought of protecting the bank depositor by insisting that all deposits should be fully insured for bank default is not known. If the DICGC (Credit Insurance and Credit Guarantee Corporation) which is a 100% subsidiary of RBI does not have the financial muscle to carry the entire risk liability, one can always bring in Indian and overseas insurers for providing the default risk cover.

The issue that needs attention is why do corporates accumulate such high debt (mainly from the banking sector)? The reality is that once the banking sector was opened to private players and long-term funding got opened in foreign exchanges, both the then Development Finance Institutions, ICICI Ltd. and IDBI Ltd., chose to become commercial / retail banks.

As the push for infrastructure came from the Government of India, commercial bankers became financiers of long-term debt (instead of just working capital funding). Bankers who were working capital funding entities started moving into long-term capital funding without truly understanding the implications. The intent of this article is not to comment on fraudulent behaviour or political intervention in sanctioning of loans. That is a different matter and proving of criminal conduct and punishment thereof is outside the scope of this article.

Corporate promoter groups in multiple business types saw an opportunity to draw large debt (facilitated by the financial markets meltdown in 2008 and 2009) and exploited the situation. The absence of the ‘skin in the game’ philosophy resulted in debt being incurred on unmerited and unviable business expansion / extension or new business proposals. In the hope of keeping the engines of growth firing, the banking sector funding went into undependable and unviable projects. Why did banks and financial institutions continue their funding despite ‘High Capital Gearing’ being visible is the question to be asked. The ease of getting borrowings has compounded the problem. Ultimately, the borrower is facilitated and the depositor is ruined!

To be fair, there is no doubt that in many over-leveraged business segments like the realty sector during Covid-19, the business entities have worked towards reducing debt by sale of business, liquidation of assets, etc.

SOLUTION

One part of the solution to avoid ‘High Capital Gearing’ and funding thereof is to have a much better overview of lending proposals and their appraisal at the lenders’ end (banks and financial institutions).

The other part which is systemic in nature is to remove the Income tax shield advantage of interest cost. Any entity has two sources of funds:

1) Shareholders capital – This funding is less popular because returns to shareholders come after corporate or business Income tax.

2) Borrowings – This funding is more popular because interest paid on debt funds is an eligible item of deductible expense, thereby reducing their cost impact for the business.

If a business wishes to give a shareholder dividend of Rs. 1,000 at a corporate income tax rate of 30%, it needs to earn Rs. 1,400+. However, Rs. 1,000 paid as interest on borrowings being eligible for income tax deduction as expense, actually costs Rs. 700 to the business (tax shield Rs. 300).

This business structuring and Income tax differential treatment of interest payment and returns to shareholders post tax, has moved the pendulum unswervingly towards debt from shareholders’ funds. Also, Indian corporate and business management is still very much dependent on family-based promoter groups who clearly would like to keep their exposure to risk at the lowest level. The principle of ‘as little skin in the game’ is followed.

Owing to this family / promoter development in Indian corporates, and maybe because the law is not facilitative enough, we do not have aggressive ‘business control’ wars and that has closed off the option of takeover by a rival if the business is languishing or going down. The IBC comes in much later at the point where insolvency is declared.

This is why in India the promoters’ exposure when business goes down is very low, thanks further to low capital invested. The high risk exposure is taken by the unsecured creditors and debt holders who are the ones taking the ‘haircut’. Hence, we are seeing the way the existing promoter is fighting to retain control of the entity in the Insolvency and Bankruptcy proceedings. Companies languish but don’t die.

(Please see link – https://m.economictimes.com/news/company/corporate-trends/view-india-is-no-country-for-dying-companies/articleshow/85552085.cms.)

Our laws and our infrastructure to ensure timely implementation of laws are often not in sync with one another. This is fully exploited by a defaulting promoter. As the late Mr. Arun Jaitley said, ‘There are sick defaulting companies, but no poor promoters’!

Business Income tax should be based on profit before interest and tax, thereby removing the tax shield that is provided by interest. To compensate for this additional tax outgo, the rate on business income tax should be brought down by about 300 to 500 basis points (3 to 5%). By putting both sources of funds, at the same tax treatment level, the incentive to move towards debt and reduce equity contribution should diminish.

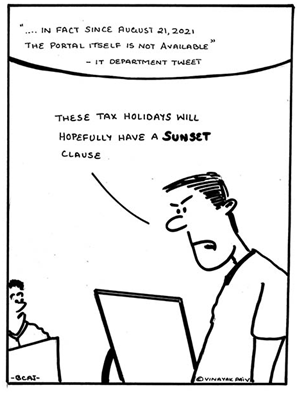

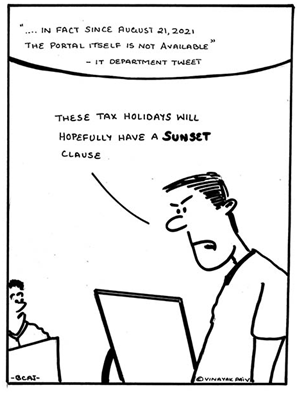

(II) Intent of tax evasion (direct and indirect)

There is no point in repeating ad nauseam that as per Finance Ministry Officials Indians evade both direct and indirect tax. Of course, nobody talks of the fact that agricultural income does not come under Income tax and therefore all international comparisons of percentage of direct taxpayers and percentage of total direct tax collection to total tax collected from individual assessees gets terribly vitiated.

GST has tightened indirect tax compliance to a great extent, but it could still do better on compliance matters. It is one thing to keep saying that Indians are tax-evaders and another to create an environment where tax evasion is not contemplated because it gives very marginal advantage.

SOLUTION

The solution is evident from the problem. There is a need to break the Chinese wall separating the Direct Tax Administration from the Indirect Tax Administration. GST has an issue because it is borne by the end customer who gets no credit on tax and it becomes a cost to him. That is why we have the sales without invoice, the unverified composition dealer sales, etc. Where the income tax payer can take GST credit (CGST, SGST, IGST) totally, he will be quite pleased.

The author is not aware whether fungibility between direct and indirect tax is available in other economies. All economies do have direct and indirect tax payment by the ultimate consumer. However, the Indian situation is different. We need to incentivise the ultimate taxpayer so that tax revenues are buoyant.

Amend the tax laws such that a direct tax payer is permitted GST paid on his personal purchases funded by income (taxable) as a credit. The moment this is done, the customer will insist on getting a proper ‘GST Invoice’. Of course, this GST invoice must have the assessee’s name and PAN #or Aadhaar #. Once the GST invoice is made, the details of a GST dealer will be available. A direct tax payer for the sake of taking GST credits on direct tax liability payable, will file his income tax return, thereby increasing the numbers of income tax returns filers.

Increased GST Returns filings will benefit state governments also in SGST and share of IGST.

It is preferred that agriculture income also comes within the income tax net, although this may have serious political consequences and may need to wait for implementation. Farmers buying agriculture equipment, seeds, fertilisers will be benefited.

In fact, if after full GST deduction the income tax assessee has a tax refund, 40% of that should be given / paid to him as incentive and the other 60% stand cancelled.

Our tax authorities (both direct and indirect) will need to do some original tax thinking. Just stating that Indians evade tax is insulting and does not improve tax compliance. Let them think of a solution that is not very convoluted and cumbersome.

The taxpayer must feel advantaged in filing the direct tax return, The authorities have to integrate direct and indirect tax, since the end customer is paying for the same and is the same person.

The answer to both the above serious problems lies in making the final individual taxpayer the centre of Government and regulatory authorities’ policies. The solution is available, it has to be accepted and implemented.

Of course, there will be serious resistance to the above proposals from the Revenue Ministry and from businesses, for being ‘impractical and unviable’. However, both proposals are of benefit to the individual – whether as bank depositor, shareholder of over-leveraged entities or as taxpayer (direct and indirect tax). The time has come to be different in thinking and implementing policies.

(The author is grateful for the usage of news links which have collaborated his point of view)