The analysis of gross vs. net revenue recognition under Ind AS 115 Revenue from Contracts with Customers can be a highly complex and judgemental exercise. This analysis particularly impacts new-age digital, internet-based companies across several sectors. The revenue number in the P&L is very crucial, because the valuation of the entity is largely dependent upon it. In this article, we look at this issue under different scenarios, using a base set of facts. The views expressed herein are strictly the personal views of the author under Ind AS standards. Additional evaluation and consideration may be required with regards to IFRS standards, particularly the views of the regulator where a filing is considered.

Accounting Standard references – Ind AS 115 Revenue from Contracts with Customers

Revenue

Revenue is defined as ‘Income arising in the course of an entity’s ordinary activities’.

Customer

As per paragraph 6 of Ind AS 115, ‘A customer is a party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration.’

Consideration payable to customer

As per paragraph 70 of Ind AS 115, ‘Consideration payable to a customer includes cash amounts that an entity pays, or expects to pay, to the customer (or to other parties that purchase the entity’s goods or services from the customer). Consideration payable to a customer also includes credit or other items (for example, a coupon or voucher) that can be applied against amounts owed to the entity (or to other parties that purchase the entity’s goods or services from the customer). An entity shall account for consideration payable to a customer as a reduction of the transaction price and, therefore, of revenue unless the payment to the customer is in exchange for a distinct good or service (as described in paragraphs 26-30) that the customer transfers to the entity. If the consideration payable to a customer includes a variable amount, an entity shall estimate the transaction price (including assessing whether the estimate of variable consideration is constrained) in accordance with paragraphs 50-58.’

As per paragraph 71 of Ind AS 115, ‘If consideration payable to a customer is a payment for a distinct good or service from the customer, then an entity shall account for the purchase of the good or service in the same way that it accounts for other purchases from suppliers. If the amount of consideration payable to the customer exceeds the fair value of the distinct good or service that the entity receives from the customer, then the entity shall account for such an excess as a reduction of the transaction price. If the entity cannot reasonably estimate the fair value of the good or service received from the customer, it shall account for all of the consideration payable to the customer as a reduction of the transaction price.’

Basis of Conclusion in IFRS 15

Ind AS 115 does not contain the basis of conclusion of IFRS 15. However, since the two standards are the same, the IFRS 15 basis of conclusion can be used for interpretation of Ind AS 115.

|

BC

255

|

In

some cases, an entity pays consideration to one of its customers or to its

customer’s customer (for example, an entity may sell a product to a dealer or

distributor and subsequently pay a customer of that dealer or distributor).

That consideration might be in the form of a payment in exchange for goods or

services received from the customer, a discount or refund for goods or

services provided to the customer, or a combination of both

|

|

BC

257

|

The

amount of consideration received from a customer for goods or services, and

the amount of any consideration paid to that customer for goods or services,

could be linked even if they are separate events. For instance, a customer

may pay more for goods or services from an entity than it would otherwise

have paid if it was not receiving a payment from the entity. Consequently,

the boards decided that to depict revenue faithfully in those cases, any

amount accounted for as a payment to the customer for goods or services

received should be limited to the fair value of those goods or services, with

any amount in excess of the fair value being recognised as a reduction of the

transaction price

|

ANALYSIS

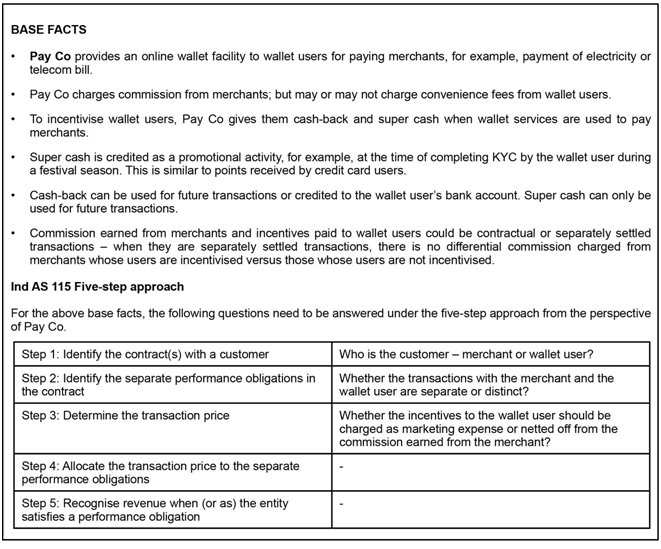

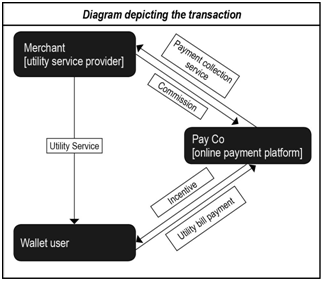

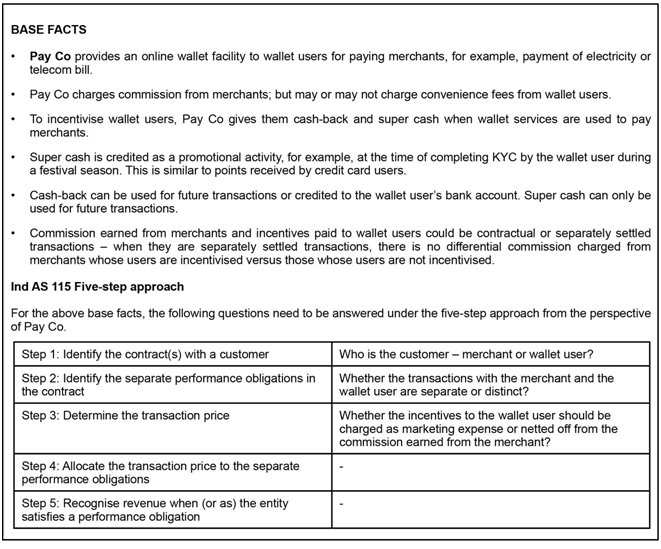

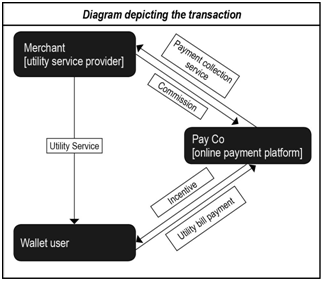

Step 1 – Who is the customer – merchant or wallet user?

As per the definition in paragraph 6, only the merchant should qualify as the customer of Pay Co and not the wallet user as in case of the wallet user, there is no consideration attached. However, in the case of those services wherein a fee is also charged from the wallet user, they, too, would be considered as customers of Pay Co.

Step 2 – Whether transaction with merchant and wallet user are distinct?

Based upon the contractual agreement, Pay Co earns commission from the merchant on every payment made through Pay Co’s platform. On the other hand, wallet users are offered incentives from time to time under different schemes launched by Pay Co. Generally, the incentives are offered as a promotional campaign for a short duration of time rather than on each transaction. The intent of cash-back / super cash offered is not to give discount / credits to the wallet user on a transaction-by-transaction basis, but to promote the usage of the payment platform. The cash-back offered to a wallet user can also be more than the commission earned from the merchant as the cash-backs are purely sales-focused and not for any particular transaction.

The contractual agreement with the merchant is long term in nature; however, the cash-backs offered to wallet users are offered only sporadically and completely unrelated to the merchant agreement. Additionally, the commission is earned by Pay Co from all its merchants; however, the cash-back / super cash is given only to a handful of wallet users. Hence, these are two distinct transactions with no relation to each other. In rare cases, the incentives provided to the wallet user are required as per the contract with the merchant; therefore, in such cases, the transaction with the merchant and the wallet user would not be considered as distinct.

Step 3 – Whether the incentives to the wallet user should be charged as marketing expense or netted off from the commission earned from the merchant?

It may be noted that there is no differential commission charged from merchants whose users are incentivised versus those whose users are not incentivised. Where Pay Co does not receive any consideration from the wallet user, the user is not considered as a customer of Pay Co and thus any cash-back / super cash offered to the user is treated as a marketing or promotional expense.

Where Pay Co charges a convenience fee from users, the user is considered as a customer of Pay Co based on the definition of customer under Ind AS 115. Consequently, any cash-back / super cash offered to the wallet user is recorded as reduction from revenue to the extent of the convenience fee earned from the wallet user. The super cash is netted of with revenue (as reduction) to the extent of revenue amount, i.e., only to the extent of convenience fee and any further amount of super cash on said transaction will be recorded as marketing expense and will not be adjusted against commission earned from the merchant, because the transaction with the merchant and with the wallet user are considered distinct / separate.

In a rare case, where the incentive is paid to the wallet user, on the basis of the agreement with the merchant, the same is deducted from revenue. If this results in negative revenue, the same is presented as marketing expenses, because revenue by definition cannot be a negative number.

The above principles are used in the Table below, and the responses to different scenarios are also depicted thereafter:

|

|

|

|

|

|

Figures

in INR

|

|

|

Scenario

A

|

Scenario

B

|

Scenario

C

|

Scenario

D

|

Scenario

E

|

|

Commission from merchant

|

100

|

100

|

100

|

100

|

100

|

|

Convenience fee

|

0

|

0

|

20

|

20

|

0

|

|

Cash-back / super cash

|

10

|

110

|

10

|

25

|

25

|

|

Contractual?

|

Yes

|

Yes

|

No

|

No

|

No

|

|

|

|

|

|

|

|

|

Revenue

|

90

|

0

|

110

|

100

|

100

|

|

Marketing expense

|

0

|

10

|

0

|

5

|

25

|

ANALYSIS OF SCENARIOS

In Scenario A, the cash-back / super cash is contractual, i.e., the incentive is paid to the wallet user as per the contractual terms with the merchant. The obligation to pay the incentive to the wallet user is not distinct or separate from the transaction with the merchant. Consequently, the incentive is reduced from revenue.

In Scenario B, the incentive is again contractual, therefore the incentive is reduced from revenue, which results in a negative revenue. The negative revenue of INR 10 is presented as marketing expense, because by definition revenue cannot be negative.

In Scenario C, the incentive is not contractual. A convenience fee is charged to the wallet user. Therefore, both the merchant and the wallet user are customers. The net revenue from the merchant customer is INR 100, the net revenue from the wallet user customer is INR 10 (20-10) and the total revenue is INR 110.

In Scenario D, the incentive is not contractual. A convenience fee is charged to the wallet user. Therefore, both the merchant and the wallet user are customers. The revenue from the merchant is INR 100, which is presented as revenue, and the revenue from the wallet user a negative revenue of INR 5 (20-25), which is presented as a marketing expense.

In Scenario E, only the merchant is the customer and INR 100 is the revenue. The INR 25 incentive paid to the wallet user is a marketing expense, because it is not paid to a customer or to the customer’s customer in a linear relationship.

CONCLUSION

Ind AS 115 does not establish clear-cut rules on several matters. For example, one may argue that negative revenue should be combined with positive revenue and the net number should be presented as revenue, instead of presenting negative revenue as an expense. These are matters on which the ICAI will need to develop a point of view.