By Manish Sampat | Paresh Clerk | Vijay Maniar | Zubin Billimoria

Chartered Accountants

“CARO 2020 is applicable for the statutory

audit of financial statements for periods beginning on or after 1st

April, 2021. ICAI had issued a detailed Guidance Note (GN) on the same

in June, 2020. A module is also available on the ICAI Digital Learning

Hub. Schedule III was also recently amended inter alia to align the

reporting requirements under CARO 2020 by statutory auditors.

BCAJ is

pleased to bring you a clause-by-clause analysis via a series of

articles authored by four audit practitioners who have been auditors all

their lives. Each article will zoom into a clause or two and provide a

‘commentary’ on reporting issues and practices, views, and perspectives

to supplement the broad guidance covered by the GN. The purpose of this

series is to bring out practical nuances to the reader. The series will

cover only new clauses and modifications and exclude those already

covered by CARO 2016. We hope this will steer and support the readers

towards better understanding and reporting. –

Editor”

MODIFICATIONS / ADDITIONAL REPORTING REQUIREMENTS

The

clause on reporting in respect of fixed assets has been there in the

earlier versions, too. CARO 2020 has modified parts of the first clause

and added reporting requirements as given below:

Modifications

a. Change in the terminology to Property, Plant and Equipment (PPE) in line with Accounting Standards and Schedule III.

b. Separate reporting requirement on maintenance of proper records for Intangible Assets.

c.

No reporting required for non-availability of title deeds, where the

company is a lessee and the lease agreement is executed in favour of the

company.

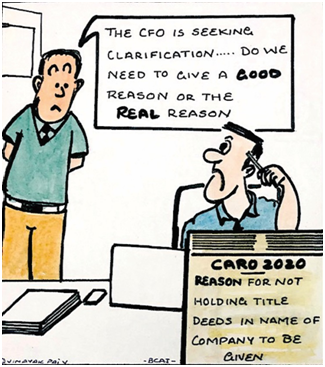

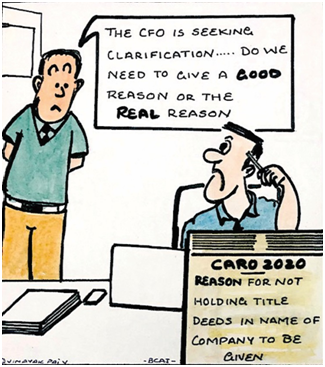

d. In

cases where title deeds of immovable properties are not held in the

name of the company, additional details in a prescribed format as under

are required to be given:

|

Description of the property

|

Gross

carrying value

|

Held in

the name of

|

Whether

promoter, director, their relative or employee

|

Period

held –

indicate range where

appropriate

|

Reason

for not being held in the name of the company

(also

indicate if in dispute)

|

Additional reporting

a.

Whether the company has revalued its PPE (including Right of Use Assets)

or intangible assets or both during the year and, if so –

- whether the revaluation is based on valuation by a Registered Valuer, and

- if change is 10% or more in the aggregate of the net carrying value of each class of PPE or intangible assets.

b. Whether any proceedings have been initiated or are pending against the company for holding any benami property under the Benami Transactions (Prohibition) Act, 1988 and rules made thereunder; and if so, whether the company has appropriately disclosed the details in its financial statements.

SPECIFIC CONSIDERATIONS

Specific considerations to be kept in mind whilst reporting on the above changes are discussed under the following broad heads:

Additional disclosures under amended Schedule III

While reporting on these matters, the auditor will have to keep in mind the amended Schedule III disclosures as under:

a.

The auditor will have to ensure that there is no material inconsistency

between the financial statement disclosures and his reporting under the

Order. Disclosure of

changes in the aggregate net carrying value due to revaluation of each class of PPE and Intangible Assets by

10% or more in the aggregate and whether

revaluation is based on the valuation by a Registered Valuer as defined in Rule 2 of the Companies (Registered Valuer and Valuation) Rules, 2017.

b. The information as specified earlier in respect of title deeds of Immovable Properties not held in the name of the company, except that the

disclosure should be given in the aggregate for the following line

items in the Balance Sheet, separately for Land and Building, as against the description of each individual property as per the Order:

- PPE retired from active use and held for sale, non-current assets held for sale (Ind AS entities)

As disclosures under Schedule III are along the lines required to be given, it is imperative for the auditor to reconcile the information disclosed therein for completeness and accuracy.

c. In respect of proceedings initiated or pending in respect of benami property held, the following details are required to be disclosed:

i. Details of such property, including year of acquisition,

ii. Amount thereof,

iii. Details of beneficiaries,

iv. If held in the books, reference thereof to the item in the Balance Sheet,

v. If not held in the books, then the facts along with reasons thereof,

vi.

Where there are proceedings against the company as an abettor of the

transaction or as the transferor, details thereof shall be provided,

vii. Nature of proceedings, status thereof and company’s view of the same.

Practical challenges in reporting

The reporting requirements outlined above entail certain challenges which are discussed below:

a. In respect of properties owned jointly with others where the title deeds are not held in the name of the company, the above details are required to the extent of the company’s share.

b.

Similarly, if the company has changed its name, this will require

reporting under this clause till the new name is updated in the title

deed.

c. Identification of benami properties: The reporting on proceedings in respect of benami properties may pose challenges, especially if the properties are not reflected in the books.

In such cases, apart from the normal procedures like review of the

minutes, scrutiny of legal expenses, review of minutes of board of

directors, audit committee, risk management committee, other secretarial

records, listing of all pending litigations and also obtaining

management representation (which have been referred to in the Guidance

Note). The auditor may also obtain independent confirmation from the legal counsel as to whether any such proceedings, other than those in respect of properties reflected in the books are pending, as per SA 501 – Audit Evidence – Specific Considerations for Selected Items.

d. The reporting under this clause is required only in cases where proceedings are initiated or pending against the company as ‘benamidar’

and not otherwise. Hence, even if notice is received but no proceedings

have been initiated, reporting is not warranted. The reporting is

required by the auditor of the company holding any benami property but not as an auditor of the company which is the beneficial owner.

e. Compilation of data for Intangible Assets: Since the requirement for reporting on maintenance of records for intangible assets has been newly introduced, many companies may not have a proper inventory thereof, except the details of the payments made or expenses capitalised on an individual basis. This could pose challenges to prepare a comprehensive itemised listing of all intangible assets and reconciling the same with the books. It is imperative that in such cases a one-time exercise is undertaken

to reconstruct the records and the nature of documentary evidence like

licences, agreements, internal SOPs (for internally generated

intangibles) which is available is also specified. This would also

facilitate easy identification in future. Wherever required, an

appropriate management representation should be obtained regarding the completeness of the data.

f. Awareness of the legal requirements: There

are certain situations where the auditor would have to familiarise

himself with the legal requirements. These mainly pertain to the

following:

i. The provisions of the Benami Property Transactions Act, 1988 and the related Rules.

Though relevant extracts of current regulations are given in the ICAI

Guidance Note, the auditor will have to keep abreast with the changes

therein, if any.

ii. Identifying the list of promoters of the company and their relatives:

Promoter and Relative have not been defined under the Order. However,

amended Schedule III (for disclosures related to holder of title deeds)

states that both ‘Promoter’ and ‘Relative’ will be as defined under the Companies Act, 2013.

Though a few promoters could be traced to those named in the prospectus

or identified in the annual return, the auditor will have to rely on

secretarial and other records and / or management representation to

determine those who have control over affairs of the company directly or

indirectly, whether as a director or shareholder or otherwise, or in

accordance with whose advice, directions, or instructions the Board is

accustomed to act and can be considered as promoters. In case there is

no such party, even then a specific representation should be obtained.

iii.

Ascertaining whether the requirements under the Trade Mark, Copyright,

Patents, Designs and IT Acts as well as the licensing requirements under

telecom, aviation, pharma and other similar industries have been

complied with in respect of the Intangible Assets.

iv. Being aware of the laws dealing with registration of immovable properties, including those pertaining to specific states.

In case of doubt, the auditor should seek the views of the company’s legal counsel or their own expert. This will be in line with SA 500 – Audit Evidence regarding using the Managements’ Expert

(by assessing the complexity, materiality, risk, independence,

competence, capability and objectivity, amongst other matters) and SA

620 – Using the Work of an Auditors’ Expert (by assessing the

complexity, materiality, risk, adherence to quality procedures,

competence, capability and objectivity, amongst other matters),

respectively. In either case, the requirements of SA 250 – Consideration

of Laws and Regulations in an Audit of Financial Statements should be

complied with.

g. Business combinations and acquisitions: The following matters need to be considered in case of such situations:

i.

In case a company has acquired another entity and the same is merged in

terms of an approved scheme, immovable properties of the transferee

company are considered deemed to be transferred in the name of the

acquiring company. However, till the time the acquiring company complies

with local / state-specific procedures, including payment of stamp

duty, etc., it would not be actually transferred in the name of the

acquiring company and, hence, would require factual reporting.

ii. In case of business combination as per Ind AS 103, where the acquiring company has identified intangible assets acquired as

a part of the transaction, the nature, and basis, whether or not the

same is in the books of the transferor needs to be evaluated and

recorded. Further, for intangible assets recorded on consolidated

financial statements, though there is no requirement for reporting by

the auditor, as the Order is only applicable on standalone financial

statements, it would be a good practice for the company to separately

list them in the intangible asset register.

h. Revaluation:

As per the ICAI Guidance Note, this clause is applicable only to the

entity which adopts the revaluation model. Hence, fair valuation of PPE

on first-time adoption, acquisition of assets / business on slump sale

basis or under business combination, change in ROU asset due to lease

modification as per Ind AS 116, re-measurement due to changes in foreign

exchange rates, etc., will not require reporting under this clause.

Further, impairment of PPE accounted under cost model is outside the

purview of reporting.

In case an entity adopts the revaluation model for PPE and Intangible Assets, there could be two scenarios as under:

i. Valuation by an external valuer:

In such cases, the fact should be indicated and the auditor should

check the necessary documentation as to whether he is registered under

Rule 2 of the Valuation Rules specified earlier. In such cases, the

auditor needs to ensure that the management ensured that the principles

laid down in Ind AS 113 on Fair Valuation are adhered to by the valuer.

The auditor should keep in mind the requirements under SA 500 – Audit

Evidence regarding using the Managements’ Expert, indicated earlier.

ii. Internal valuation: The

Order does not seem to mandate that a company needs to get a valuation

done by an external valuer. In such cases, the auditor will have to

exercise a

greater degree of professional scepticism and review

the basis and assumptions for arriving at the revised fair value keeping

in mind the requirements of Ind AS 113 as indicated earlier,

irrespective of the accounting framework. The requirements under SA 540 –

Auditing Accounting Estimates, Including Fair Value Accounting

Estimates and Related Disclosures (covering the extent of use of market

specific inputs and their relevance, assessment of comparable

transactions, basis and justification of unobservable inputs, amongst

others) also need to be kept in mind. In case of any

doubt, the auditor should seek the

assistance of their own valuation expert keeping in mind the requirements under SA 620 – Using the Work of an Auditors’ Expert, discussed earlier.

CONCLUSION

The

above changes have cast onerous responsibilities on the auditors and in

many cases the auditors would need to go beyond what is stated in the

Order because the devil lies in the details!