Whilst the clause on reporting in respect of inventories has been present in the earlier versions, too, CARO 2020 has modified parts of the first clause and added certain reporting requirements in respect of current assets which are given below.

Modifications

a. Whether in the opinion of the auditor the coverage and procedure for physical verification of inventories is appropriate;

b. Whether any discrepancy in excess of 10% or more in the aggregate for each class of inventory was noticed and the same was properly dealt with in the books of accounts.

Additional Reporting

a. Whether at any point of time during the year the company has been sanctioned working capital limits in excess of Rs. 5 crores in aggregate from banks or financial institutions, on the basis of security of current assets;

b. Whether the quarterly returns or statements filed by the company with such banks or financial institutions are in agreement with the books of accounts and if not, to give details.

PRACTICAL CHALLENGES IN REPORTING

The reporting requirements outlined above entail certain practical challenges which are discussed below:

Verification of inventory:

a. On the appropriateness of coverage and procedure for physical verification of inventory, the auditor will have to observe the performance of the management’s physical count taking procedure, control over movement of inventory, adequacy of design and effective operations of internal controls.

b. Apart from ensuring that proper written instructions are issued, it is also incumbent for the auditor to point out specific areas where the instructions are not clear or other procedural lapses like inadequate segregation of duties, cut-off procedures not adhered to especially for sales and work-in-progress in continuous process industries, as may be observed. It is important for the auditor to comment on the specific areas where he feels that the procedures are not adequate rather than commenting that the ‘procedures are generally adequate’.

c. Covid-19: The onset of Covid-19 has caused significant disruptions in the business operations of companies which could pose challenges in conducting physical verification of inventories. This, in turn, would make it difficult for auditors to ensure compliance with SA 501, Audit Evidence-Specific Considerations for Selected Items, which requires the auditor to obtain sufficient appropriate audit evidence regarding the existence and conditions of inventories. SA 501 requires attendance at location/s of physical inventory count, unless impracticable, and performing audit procedures on inventory records to determine whether the records accurately reflect actual inventory count results. Some of the challenges may be broadly analysed under the following situations:

• Management does not conduct an inventory count (not even any alternative audit procedure) on the balance sheet date:

In such cases, as per Key Audit Considerations amid Covid-19 issued by ICAI on physical inventory (ICAI’s Covid guidance), the management should inform the auditors and those charged with governance about the reasons for the same. However, if carrying out a count is not feasible, the auditor would need to evaluate the reasonableness of the circumstances and the internal controls with respect to the existence and condition of inventory. Depending upon the materiality, the auditor may use his judgement to modify his audit report in accordance with SA 705 (Revised) Modifications to the Opinion in the Independent Auditor’s Report. Further, its impact on auditor’s opinion on internal financial controls u/s 143(3)(i) of the Companies Act, 2013 (‘ICFR’) also needs to be evaluated, in addition to reporting under this clause regarding coverage of physical verification of inventory.

• Physical verification conducted at a date other than the balance sheet date:

In such cases, the design and operating effectiveness of controls over inventory would need to be evaluated before reporting. Further, the following considerations are also relevant:

i. Whether the inventory records are properly maintained;

ii. Understanding reasons for differences in the physical verification count and the inventory records;

iii. Performing roll-backward procedures, if the inventory count is done after the year-end or roll-forward procedures, if inventory count is done during the interim period;

iv. Evaluating whether any adjustment is required in roll-forward or roll-backward procedures due to differences observed as in (ii) above;

v. To consider whether the time between inventory count date and balance sheet date reflects appropriate assessment of the physical condition of the inventory.

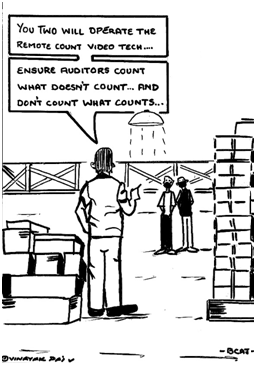

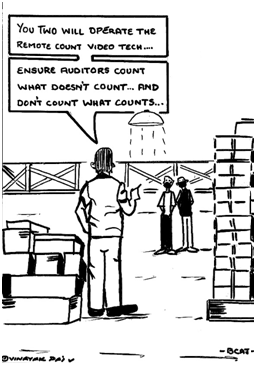

• Impracticable for auditor to attend the physical count:

This issue is relevant for the auditor to issue an audit opinion on the financial statements and not on CARO 2020. However, in order to have complete discussion on physical verification of inventory, specifically its increased importance during Covid pandemic times, the same is also discussed here.

- In the event that it is impractical for the auditor to physically attend the inventory count process, the auditor can perform alternative audit procedures to obtain sufficient appropriate audit evidence regarding the existence and condition of the inventory. In addition, to evaluate design and test the operating effectiveness of internal control over physical verification of inventory, the following may be considered:

i. Prepare a document substantiating the impracticality and unreasonableness of observing the count in person, given the Covid-19 situation;

ii. Use of web or mobile-based video-conferencing technologies (i.e., Microsoft Teams, Facetime, WhatsApp). In this case, care should be taken by the auditor that if inventory items cannot be identified with a unique reference number, etc., there is no chance of replacement of inventory during / after the count to avoid double counting. It would be advisable to retain the recording thereof as part of the audit documentation;

iii. Consider using an external party, e.g., an independent CA firm in that location (ICA) or Internal Auditor (IA), in which case the auditor needs to evaluate

a. Objectivity and independence of ICA / IA;

b. Inquire for any relationships that may create a threat to their objectivity;

c. Evaluate their level of competence;

d. Determine the nature and extent of work to be assigned;

e. Communicate planned use of ICA / CA with those charged with governance;

f. Obtain written agreements from the entity for the use of ICA / IA for providing direct assistance;

g. Direct, supervise and review the work performed by ICA / IA providing direct assistance, including provide instruction / work programme, including sample selection, communicate management’s inventory count instructions, etc., and, if possible, supervise the count while it is in progress.

When inventory is under the custody and control of a third party, e.g., bonded warehouse, job worker / contractor, etc., the auditor shall verify the procedures undertaken by the management to evaluate the existence and condition of that inventory. This could be by way of obtaining confirmation from the third party as to the quantities and condition of inventory held on behalf of the entity and / or perform inspection or other procedures appropriate in the circumstances. The auditor needs to focus on whether inventory with third party is for a longer than normal period and obtain reasons for the same.

In the event the entity has specialised inventory where inventory count is not based on a normal physical verification process but on the confirmation of quantity / quality by an expert, the auditor will review the certification obtained by the entity and compare it with the book records. For example, in the case of coal, tonnage is calculated by considering the height, width, length of the stock yard and the moisture content in the coal to arrive at its tonnage. The entity will normally take the help of engineers in this process who would be internal or external experts.

a. Appropriate coverage: Even if the company has instituted proper procedures for physical verification, it is imperative that the coverage thereof is adequate and appropriate with respect to the nature, size, materiality, location, feasibility of conducting physical verification and risk of material mis-statement involved. This could involve significant judgement and an interplay of several factors, some of which are discussed hereunder:

• Classification of inventory – This is important for assessing the extent of coverage as also for evaluating the impact of discrepancies. Whilst the class of inventory is broadly specified in the Accounting Standards for manufacturing and trading companies, the same is not clear for service companies since all of it may not be amenable for quantification. Further, even if the classification for manufacturing and trading companies is appropriate to determine the adequacy of verification, an A-B-C analysis is desirable for which the basis would need to be evaluated for reasonableness. Further, the auditor also needs to examine whether there is a control system in place to identify and mark slow-moving, obsolete or damaged inventory.

• Periodicity of verification – The auditor would need to verify the periodicity of such verification and whether all the material items of inventory have been covered at least once in a year or as per the systematic plan as designed by the management. This would depend upon the nature of inventory, the A-B-C classification discussed above and the number of locations involved.

b. Dealing with discrepancies: The auditor should, based on his understanding of the business and operating effectiveness of internal controls, verify explanations provided by the management for discrepancies between inventory as per the books and as physically verified and steps taken by them to reconcile. Some of the common causes for discrepancies are:

• Incorrect data entry on receipt

• Issues not recorded

• Misplaced stocks

• Loss due to theft or natural calamity

• Human errors or incorrect unit of measurement used

• Inventory records not updated

• Supplier frauds

• Goods distributed as free samples

• Weight loss / gain due to passage of time

Under the modified (changed) reporting requirement, the auditor will have to report on any discrepancy noticed in excess of 10% or more in the aggregate for each class of inventory. Each class of inventory will have to be identified as per AS 2, ‘Valuation of Inventories’ / Indian Accounting Standard (Ind AS) 2, ‘Inventories’ and the internal policies of the management. The count at the time of physical verification will have to be compared with the book records and discrepancies in excess of 10% or more in the aggregate for each class will have to be reported. It may be worth it to note that the threshold limit of discrepancies of 10% should be applied to the value and not to the quantity. Hence, if the inventory has been valued other than at cost, e.g., net realisable value (NRV), the discrepancy of 10% needs to be compared with NRV.

It is worthwhile to note that this clause deals with discrepancies observed during physical verification only and not with discrepancies observed during audit. Further, even if the management has a valid explanation for the discrepancies, the fact needs to be brought out while reporting under this clause.

Working capital facilities:

a. This is a new reporting requirement wherein the auditor has to review quarterly returns or statements filed by the company with banks and financial institutions in case the sanctioned working capital limits with them are in excess of Rs. 5 crores in aggregate and to report if these are not in agreement with the books of accounts.

b. Collation of all working capital facilities: For calculating the limit of Rs. 5 crores, it is important to note that sanctioned amounts (not disbursed amounts) and both fund and non-fund-based amounts are required to be considered at any point of time during the year (as against only at the year-end) on the basis of security of current assets. This could present challenges in identifying the completeness thereof since sanctioned facilities as well as non-fund-based facilities are not reflected in the books of accounts. Accordingly, the auditor would need to make specific inquiries and obtain a representation and corroborate the same with the requisite documentary evidence like sanctioned letters, confirmations from the lenders, review of the minutes, ROC filings for charge created, etc. The aggregate of the sanctioned limit from all banks and financial institutions is also required to be collated. In case of a company which operates from multiple locations and working capital facilities are negotiated locally, care should be taken to ensure that all such sanctioned facilities are combined for the purpose of reporting under this clause. The auditor will also have to cross-verify the same with the relevant disclosures, if any, in the financial statements.

c. This clause is not applicable to unsecured sanctions or sanctions on the basis of security other than current assets or withdrawals above the sanctioned limit, e.g., in case the company has a combined sanctioned working capital limit of Rs. 4.75 crores but the same is overdrawn by Rs. 0.30 crore. In this case, the total outstanding working capital facility is in excess of Rs. 5 crores, however, since the aggregate sanctioned limit is less than Rs. 5 crores, this clause would not be applicable.

d. Considering the discussion in paragraphs (b) and (c) above, in case the sanctioned working capital limit exceeds Rs. 5 crores, the auditor is required to review quarterly returns and statements filed by the company with such banks / financial institutions and report if they are in agreement with the books of accounts and, if not, give details thereof.

The auditor will have to consider materiality of discrepancies, its relevance to the users of financial statements and their professional judgement while reporting discrepancies.

e. Each bank and financial institution may have its own requirements of submission of statements and returns. These submissions may be monthly, quarterly, yearly or of any other frequency, including event-based. However, for the purpose of reporting under this clause only quarterly statements / returns and that too which have relevance with the books of accounts of the company need to be considered, compared and reported.

Though this clause is applicable only if sanctioned working capital limits are provided based on the security of current assets, however, the responsibility of the auditor is to compare all the information provided in the quarterly statements / returns which can be compared with the books of accounts and is not restricted only to current assets. Such information may include aging of inventory and receivables, trade payable, property plant and equipment, other information, etc. So long as information can be compared with the books of accounts, it will be the responsibility of the auditor to report.

f. Challenges for MSMEs: Reconciliation of the details of statements / returns submitted to the lenders with the books of accounts on a quarterly basis could pose difficulties in case of MSMEs since they may not be regular in updating their accounting records. These MSMEs will have to keep their books of accounts updated based on which statements / returns submitted to banks and financial institutions can be compared, failing which their auditor will issue a disclaimer while reporting under this clause.

g. It is hoped that the introduction of this reporting requirement would lead to better discipline and improvement in internal controls which would result in a win-win situation for companies, lenders and auditors.

IMPACT ON THE AUDIT OPINION