A. CIRCULARS

(i) Clarification about Assigning proper officer under Sections 74A,75(2) and 122 of CGST Act – Circular no.254/11/2025-GST dated 27.10.2025

Fresh guidelines regarding assignment of proper officers under Sections 74A, 75(2) and 122 of CGST Act,2017 & CGST Rules are provided.

B. NOTIFICATIONS

i) Notification No.17/2025-Central Tax dated 18.10.2025

The CBIC has extended the due date for filing GSTR-3B returns for the month of September 2025 and for the quarter of July–September 2025 till October 25, 2025.

ii) Notification No.18/2025-Central Tax dated 31.10.2025

The Central Goods and Services Tax (Fourth Amendment) Rules, 2025 are published to introduce a faster, technology-enabled, and taxpayer-friendly GST registration process within three working days. These amendments come into effect from 1st November, 2025.

C. NOTIFICATION RELATING TO RATE OF TAX

i) Notification No.18/2025-Central Tax (Rate) dated 24.10.2025

The above notification seeks to amend Notification No. 26/2018-Central Tax (Rate) dated 31.12.2018, to provide definition of “Nominated Agency”. This change is effective from November 1, 2025.

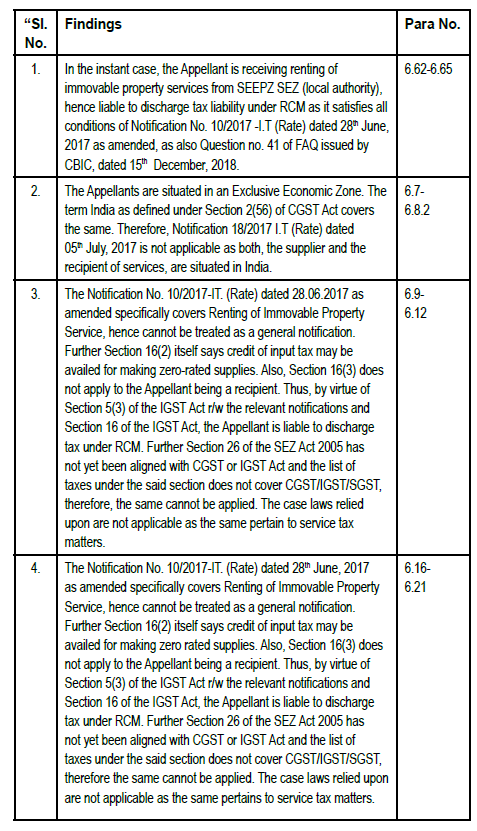

D. ADVANCE RULINGS

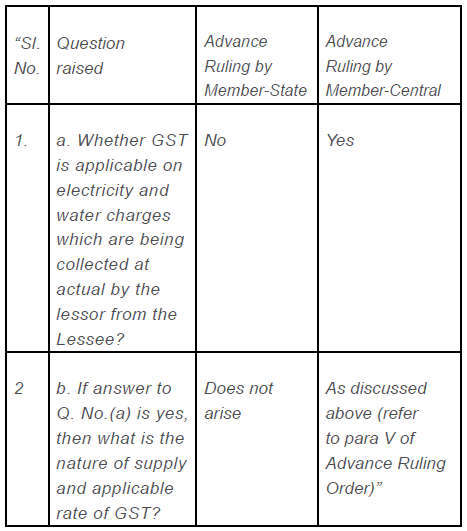

Issue: Hotel accommodation vis-à-vis Renting of immovable property – applicable rate of Tax

Orsino Hotels & Resorts LLP

(AAR Order No.08/WBAAR/2025-26 dt.22.8.2025)(WB)

The facts are that the applicant is engaged in the hotel business through its property named Orsino Spa Resort located in Darjeeling. The resort comprises 45 rooms and offers various amenities such as a spa, banquet facilities, a bar, a multi-cuisine restaurant, and a cafe. The applicant has entered into a contractual agreement with the Reserve Bank of India (RBI) on 19th March 2025 to provide continuous accommodation services for RBI officers and their families. As per the agreement, the applicant is obligated to provide a minimum of two double-bedded “Premium Rooms” per day at a pre-agreed rate. The agreement is valid from 1st April 2025 to 31st March 2026, with a provision for extension. Applicant has raised following questions:

“(i) Whether the accommodation services provided by the applicant to RBI having room tariff of less than ₹7500 per day per unit, as part of the agreement for providing accomodation (rooms) services to RBI staff, are taxable under GST at the rate of 12%

(ii) If not, under which HSN code and tax rate will the services be taxed?”

The applicant explained the nature of services which are all akin to facilities provide in hotel room, with Check in time-12 noon, check out time-11:00 am. The RBI is to pay the room tariff per day at an agreed rate. The applicant has charged GST @ 12%.

One of the factors was that RBI is to deduct TDS under Section 194I of the Income Tax Act, 1961, in respect of the payments made by RBI for the accommodation services under the said contract.

The applicant brought to notice of the ld. AAR the definition of “Hotel Accommodation” as provided in Notification No.11/2017-Central Tax (Rate) dated 28.06.2017 as well as GST Rate applicable on such accommodation services w.e.f. 18.7.2022, which are as under:

| Room Tariff | GST Rate |

| Value of supply less than ₹7500 per day per unit | 12% |

| Value of supply more than ₹7500 per day per unit | 18% |

It was submitted that since, the room tariff per unit per day for these accommodation services provided to RBI as per the agreement does not exceed ₹7500, GST rate applicable to applicant shall be 12%.

The applicant also made submission about difference in renting of property vis-a-vis hotel accommodation.

The ld. AAR analysed position vis-à-vis the facts of the case.

The ld. AAR observed that accommodation services refers to providing residential or lodging services for a short period where the tariff for a unit of accommodation is usually declared per unit per day. Accommodation services may include certain other facilities depending on the policy of the hotel.

The ld. AAR also referred to recent changes in the GST Act vide Notification no.05/2025-Central Tax (Rate) dated 16.1.2025 in respect of accommodation services given by the hotel.

The ld. AAR also discussed about various plans available in hotel regarding food facility and modalities connected there with. As compared to above, in renting of premises, the demarcated premises are allotted to the customer. Since this is not position, the ld. AAR held that transaction cannot fall in ‘renting of immovable property’.

The ld. AAR observed that the issue appears to have arisen as RBI is deducting TDS under section 194I of the Income Tax Act which provides for TDS in respect of payment made for renting of immovable property.

The ld. AAR observed that two acts (Income Tax Act and GST) are different. The ld. AAR held that so far as the concept of hotel accommodation services in the GST is concerned there is no reference to the Income Tax Act and it has nothing to do with the Income Tax Act. Therefore, for the purpose of the GST Act, hotel accommodation services will come under serial no. 7 (i) or (vi) of the Notification No. 11/2017 and Central Tax (Rate) Dated 28.06.2017 and liable to GST rate accordingly, irrespective of treatment given by RBI under Income Tax Act.

The ld. AAR held that since the value of supply has not exceeded ₹7500/- for one room as per the agreement with RBI, the applicable rate will be 12%.

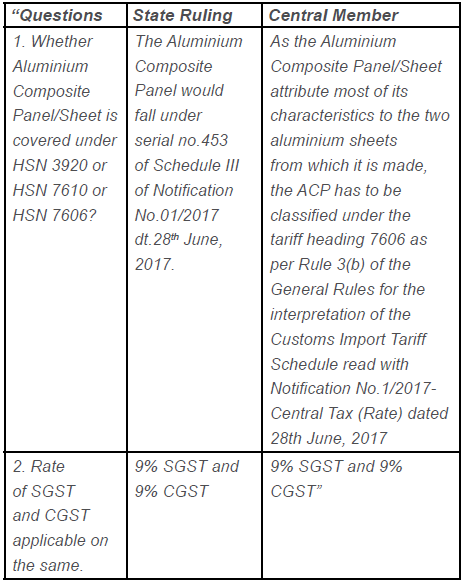

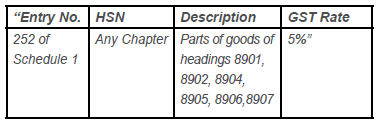

Issue: Classification – Pre-packaged and Labelled Goods

Neeli Sea Foods Pvt. Ltd.

(AAR Order No.11/AP/GST/2025 dt.16.9.2025)(AP)

The applicant is engaged in the business of processing and exporting of shrimps. Applicant procures raw shrimp locally from farmers and processes it at the factory. Shrimp processing includes washing, de-veining, peeling, de-heading, tail removal, sorting, grading, and freezing. However, further processing can be done independently based on the customer’s requirements to produce the desired results.

Processed frozen shrimps are packaged separately in accordance with the buyer’s specifications. The Applicant employs the following packaging methods:

a) Primary packaging: The final product is packed into individual pouches or boxes, weighing between approximately 250 grams and 2.5 kilograms.

b) Secondary Packaging: The aforementioned pouches or boxes (i.e., primary packaging) are placed into master cartons, with a maximum weight limit of 25 kilograms.

The primary packaging serves as the principal container for the processed shrimps. These pouches should be stored within master cartons to facilitate convenient transportation. Both the primary and secondary packaging are printed with comprehensive details regarding the product, such as the type, weight, branding information and other relevant specifications (i.e. packaged and labelled). The shrimps so packed are exported to international buyers.

Applicant raised following issues before the ld. AAR:

“- Whether the export of processed frozen shrimps (HSN 0306), which are packaged in individual printed pouches or boxes and subsequently placed inside a print master carton (of up to 25 Kilogram each) that includes the design, label, and other specification provided by the buyer, attracts GST?

– Whether the export of processed frozen shrimps (HSN 0306), packaged in individual plain pouches or boxes and subsequently placed inside a plain master carton (of up to 25 Kilogram each), attracts GST?”

Applicant made reference to relevant entry like entry 2 of Schedule I of Notification No. 01/2017-CGST(R) dated 01.07.2017 updated from time to time and lastly on 13.7.2022. Reliance was also placed on various earlier ARs.

Based on above legal position the ld. AAR observed that as per the provisions of the Legal Metrology Act, 2009 (1 of 2010) and the rules made there under, as the inner packing is printed and is having pre-determined quantity it immediately attains the characteristics of ‘pre-packaged and labelled’ category, meant for retail sale, irrespective of the fact whether the outer packaging is printed or not. Under these circumstances, the inner packaging which ranges from 250 grams to 2.5 kilograms becomes liable to GST, as the same fall within the ambit of ‘pre-packaged and labelled’ category which is mandated to bear the declaration.

The ld. AAR made reference to FAQ dated 18.7.2022 as well as Ministry of Finance clarification on doubts/queries regarding the GST levy on ‘pre-packaged and labelled’ goods vide Press Release dated 18th July 2022.

The ld. AAR concluded the issue as under:

“The supply of shrimps in pouches or boxes of upto 25kg, which are duly pre-packaged and labelled as per Legal Metrology Act 2009 is a taxable supply which is neither exempted nor nil rated supply. As per the Notification no 06/2022 (CT Rate), dated 13th July 2022, GST has been made applicable on supply of such “pre-packaged and labelled” commodities attracting provisions of Legal Metrology Act, 2009. Therefore, where the quantity involved is 25Kgs or less in respect of specified commodities including shrimps (HSN 0306, as per S.No.4 of schedule 1 of notification 01/2017-central tax (rate) dated 28th June 2017) which are pre-packed, they would mandatorily get covered within the ambit of Legal Metrology Act, 2009, and the rules made there under. Accordingly, we are of the considered view that GST would be applicable on the supply of “pre-packaged and labelled” shrimps, capacity upto 25 kgs, and it will be liable for GST @ 5%, irrespective of the fact whether it is for domestic supply or for export outside the country.”

Accordingly, the ld. AAR answered both issues in affirmative.

Issue: Nature of Composite Supply

Greater Visakhapatnam Smart City Corporation Ltd.

(AAR Order No.14/AP/GST/2025 dt.16.10.2025)(AP)

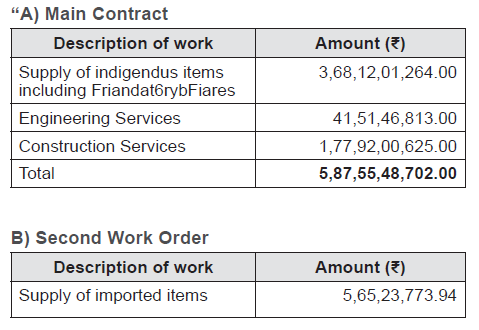

The applicant is a special purposes vehicle (SPV) incorporated as Public Limited Company under the Companies Act, 2013, owned by the State Government of Andhra Pradesh and the Greater Visakhapatnam Municipal Corporation (GVMC). The applicant has undertaken two convergence projects with smart city funds towards development of sewerage system and supply of recycled water to industries.

The applicant has entered into renewed tripartite agreement dated 10.06.2025 between Greater Visakhapatnam Municipal Corporation (GVMC), Greater Visakhapatnam Smart City Corporation Limited (GVSCCL) and M/s. Hindustan Petrol Corporation Limited (HPCL) towards supply of recycled water to M/s. HPCL, wherein GVMC and GVSCCL provided sewerage infrastructure situated in Visakhapatnam, comprising of various equipments and facilities.

Clause 9 of the tripartite agreement towards supply of recycled water specifies that Metering for determining the exact quantities of the Product supplied shall be done at the Delivery Point in the premises of HPCL. Applicant shall install a meter with a standby at the Delivery Point i.e. at M/s. HPCL. There is also clause for levy of charges for maintenance of meters, instrumentation, automation etc at the rate of 0.75% of monthly supply of recycled water bill. In above process applicant has installed only flow meters in the premises of M/s. HPCL to measure recycled water and no other instrumentation/automation of applicant are installed at the premises of M/s. HPCL.

With the above background following questions were raised before ld. AAR.

“1. Whether the maintenance charges of flow meters installed at the end user premises to record the recycled water falls under composite supply.

2. If yes, the rate applicable to principal supply i.e., nil rate can be applied to Ancillary supply also i.e., maintenance charges of flow meters also.

3. If not? What is the applicable GST rate and what is the SAC/HSN code applicable to the same?”

The ld. AAR observed that applicant has installed only flow meters at the consumer’s end to record water flow and no other automation or instrumentation systems involved at HPCL’s premises. It was also noted that the maintenance charges are being collected separately on a monthly basis as a percentage of the recycled water supply bill. The ld. AAR was to determine as to whether such maintenance of flow meters constitutes a part of a composite supply along with the supply of recycled water, and if not, what rate of GST would be applicable for such activity.

The ld. AAR referred to definition of ‘Composite Supply’ and analysed clauses of tripartite agreement in light of same. The ld. AAR observed that as per the provisions contained in Para 5(a)(vi) and 5(b)(vi) of the agreement, applicant is levying separate charges upon HPCL at the rate of 0.75% (plus applicable taxes) of the monthly bill value, towards maintenance of meters, instrumentation and automation etc., which are further subject to revision, as and when deemed necessary.

It was further observed that such maintenance charges are not subsumed within the consideration payable for the supply of “product and clear water,” which has been distinctly provided for under Para 5(a)(i) and 5(b)(i) of the said agreement. Noting above contractual separation, the ld. AAR observed that it clearly establishes that the maintenance of flow meters is being charged as an independent service, in addition to the primary supply of recycled water.

Therefore, the ld. AAR held that the maintenance of flow meters is to be treated as a standalone supply of service, falling under Heading 9987 – Maintenance, repair and installation (except construction) services, taxable at 18% (9% CGST + 9% SGST) under Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 as amended.

Accordingly, the ld. AAR gave ruling in negative.

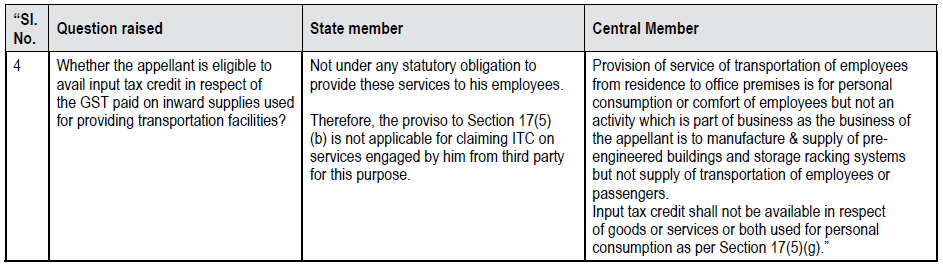

Issue: ITC through TRC-06 challan

Becton Dickinson India Pvt. Ltd.

(AAAR Order No.AAAR/06/2025(AR) (A. R. Appeal No.05/2025/AAAR dt.8.10.2025)(TN)

The present appeal is against the Advance Ruling No. 20/ARA/2025 dated 09.05.2025 – 2025-VIL-88-AAR passed by AAR (TN) on the application for AR filed by the Appellant.

The appellant has put various questions for opinion of ld. AAR. The short gist is that the appellant wanted to know whether it is eligible to ITC for payment of IGST though TR-6 challan in Customs department. The ld. AAR rejected the same and gave ruling in negative.

The facts are that the appellant is importer and imports from its group companies. For above purpose the appellant has a limited risk distributorship agreement (“LRD agreement”), and as per the same, the goods are supplied by the overseas companies to the appellant at a price which would ensure that the appellant earns an Arm’s Length Price (ALP) operating profit margin. At the end of the financial year as per the Income Tax Laws, the ALP margin is determined and compared with the actual margin earned by the appellant on the sale of imported goods. In case the actual margin earned by the Appellant is more than the ALP margin, then the appellant transfers the differential margin through a pricing adjustment (“true up”) by the overseas entity from whom the goods were to imported, and vice versa. While doing so the appellant has to discharge differential duties through TR-6 challan.

The ld. AAR denied ITC for above payment on ground it is neither Bill of entry or other similar documents, for the purpose of Section 16(2) of CGST Act.

The ld. AAAR held that the documents prescribed under Custom Act like Bill of Entry are document valid for section 16(2). The ld. AAAR noted that TR-6 challan is not a document prescribed under the Customs Act or the rules made thereunder, but it is a challan prescribed under the ‘Treasury Rules of the Central Government’, under which any person can pay money into the treasury or Bank on Government Account. The ld. AAAR observed that it does not contain all the details relating to assessment encapsulated in a ‘bill of entry’. Since TR-6 lacked legal backing as authenticated document under Customs Act, the ld. AAAR concurred with ld. AAR and confirmed the order of AAR.

Regarding second query about application of section 16(4) to TR-6 challan, the ld. AAAR held that since TR-6 itself not eligible to ITC, no question of considering application of section 16(4) arises.

The third query was, whether section 16(4) applies to reassessment Bill of entry for availing ITC. The ld. AAAR referred to section 16(4) and observed that when the provisions of Section 16(4) of the CGST Act, 2017 applies ‘mutatis mutandis’ to the IGST Act, 2017, the document ‘Bill of Entry or any similar document’ also gets covered under the said provision and that the time limit prescribed u/s.16(4) applies to documents like Bill of Entry.

Accordingly, the ld. AAAR confirmed the AR and rejected appeal on all issues.

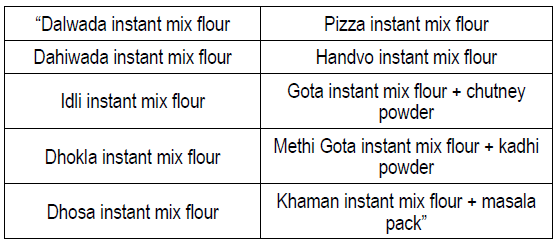

Issue: ‘Supply’ – Scope

Laila Nutra Pvt. Ltd.

(AAR Order No.12/AP/GST/2025 dt.22.9.2025)(AP)

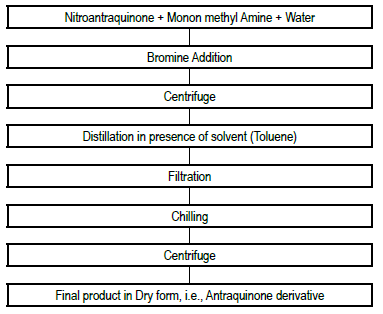

The applicant is engaged in the business of extraction of Concentrate from Herbs and Other Products.

The applicant had a wide range of Research and Development facilities including in Ayurvedic and Herbal Medicines. Applicant carries out R&D activities on certain raw materials, which are further extracted in to concentrates and exported to other countries. Along with four other institutes, applicant was selected to implement a designated project. Among the selected institutes, the applicant was the only one equipped with both an extraction facility and a Research& Development (R&D) facility.

As per instruction from the Central Council for Research in Ayurvedic Sciences (CCRAS), the applicant is responsible for procuring various raw materials

from different sources/vendors, extracting

concentrates from them, and distributing these extracts to the other institutes for further research and development. In certain cases, the applicant also undertakes further research and development on selected extracts. Upon completion of the project, the applicant is required to submit the final project documentation to the Ministry of AYUSH (MoA), through CCRAS.

Presently applicant is awarded two contracts viz:

“Project 1: Research, analysis, and manufacturing of 100 kg each of 5different raw material extracts for further testing by other selected institutes. (Grant sanctioned from Government: ₹10 Cr approximately)

Project 2: Further testing, safety analysis, and reporting on one of the products manufactured in Project 1. (Grant sanctioned from Government: Rs. 10 Cr approximately).

The deliverables under Project 1 include 100 kg of each of 5 different raw material extracts (which constitute less than 10% of the project cost), along with detailed research and analysis on these extracts.

Under Project 2, the deliverable is a comprehensive Testing, Safety, and Analysis Report on one of the extracts developed in Project 1. This report is intended to be placed in the public domain to serve as a reference for other Ayurveda and Herbal Medicine manufacturers in the long term.”

There are further procedural rules to be followed by applicant as Sub-Nodal Agency.

The applicant had sought advance ruling on the following:

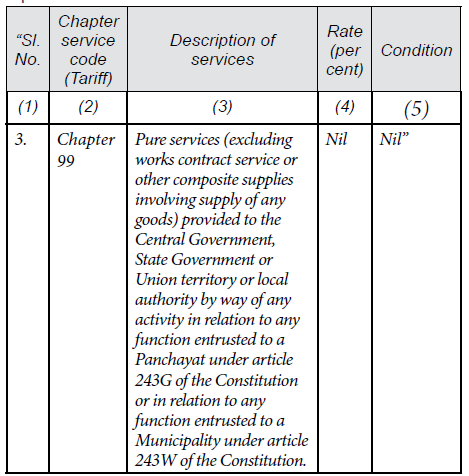

“1. Whether the Research and Development activity undertaken by the applicant for the Ministry of AYUSH (MoA), through the Central Council for Research in Ayurvedic Sciences (CCRAS), under a grant-in-aid arrangement, falls within the scope of ‘supply’ as defined under Section 7 of the CGST Act, 2017?

2. If the aforementioned Research and Development activity is considered a ‘supply’ under Section 7 of the CGST Act, 2017, whether such activity qualifies for exemption under Entry No. 3 or Entry No. 3A of Notification No.12/2017-Central Tax (Rate) dated 28.06.2017, as amended?”

The applicant was contending that the applicant has neither proprietary rights nor control over the results of the R&D to claim any form of disposal or transfer thereof and hence not within scope of ‘supply’.

To determine questions (1), the ld. AAR referred to Section 7 which specifies the scope of ‘supply’.

The ld. AAR observed that under sub-section (a) of Section 2(31) of the Act, the consideration for the supply of goods or services may be paid by the recipient or any other person. Hence, even if it is assumed that services supplied by the applicant are not received by CCRAS but are received by the beneficiaries i.e., general public and medicine manufacturers, the amount paid by CCRAS to the applicant is still covered under the definition of ‘consideration’ paid for the said supply of goods or services by the applicant and is covered in the definition of ‘supply’ given under Section 7(1) of the Act. The profit motive held not important, considering combined reading of all above definitions, including that of the “business”.

Grants held to be consideration as it is not ‘subsidy’. It is also observed that R&D services, even when not resulting in the transfer of ownership or IP, are still services under GST as per definition of ‘services’ in Section 2(102) of the CGST Act.

Regarding question of exemption under entry 3 or 3A of Notification 12/2017-Central Tax (Rate) dt.28.6.2017, as activity falling under Articles 243G/243W, the ld. AAR held that the said exemption is not available as the service is not provided to Panchayat or Municipality, nor it is directly related to any functions given in said Articles.

Accordingly, the supply is held taxable under GST, and the applicant is held liable to discharge GST at the applicable rate.