“Once a new technology rolls over you, if you’re not

part of the steamroller, you’re part of the road.”

Steward Brand

INTRODUCTION

Taxes are as old as civilization, so the ‘Value Added Tax’

(VAT), hardly 63 years old, may seem to be relatively

young in the history of tax. For India, that embraced this development in taxation over the last half-century. Limited

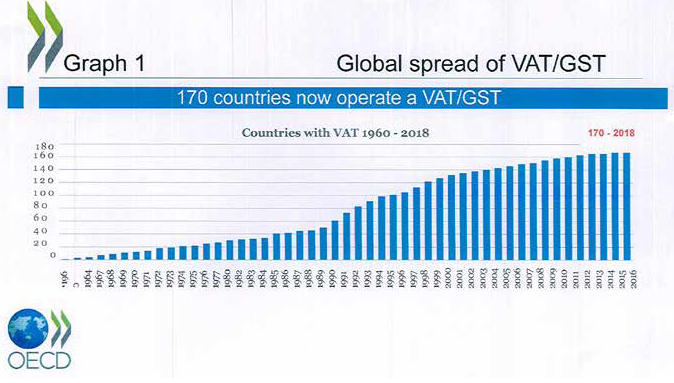

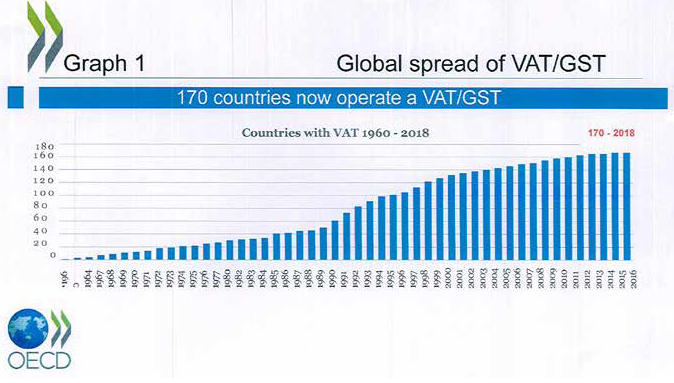

to fewer than 10 countries in the late 1960s, VAT/GST is a

‘Consumption Tax’ of choice of some 170 countries today.

Presently, all member countries of the Organization of

Economic Cooperation and Development (OECD),

except United States, have VAT systems in place [See

Graph 1]. Significantly, UAE and Saudi Arabia have also fundamental ‘Indirect Tax Reform’ in the form of ‘Goods

and Services Tax’ (GST) only in July, 2017, it may even

resemble a ‘New-born Baby’ that has just arrived in the

world from the mother’s womb!

[The words ‘VAT’ and ‘GST’ are used synonymously

in this article.]

GLOBAL SPREAD OF VAT

The spread of VAT has been the most important implemented VAT from January 1, 2018, whereas, other

Gulf Cooperation Council (GCC) countries – Kuwait,

Qatar, Bahrain and Oman – are expected to levy VAT

from 2019.

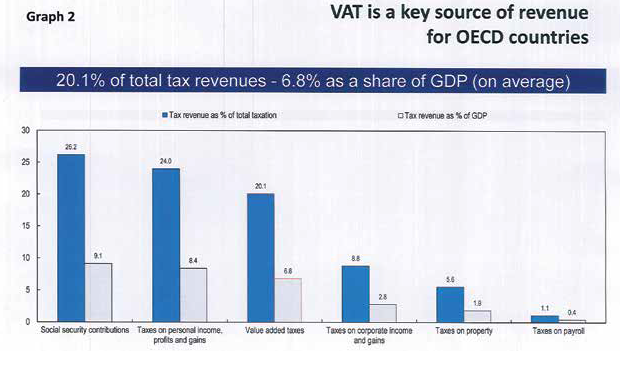

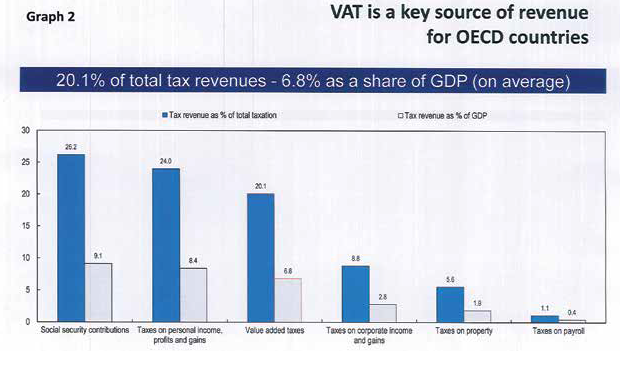

In terms of revenue, VAT is now the largest source of

taxes on general consumption in OECD countries on

average. Revenues from VAT as a percentage of GDP

increased from 6.8% in 2012 to 7.0% in 2014 on average; and from 20.05% in 2012 to 20.07% in 2014 as a share of

total taxation. [See Graph 2].

INDIA’S ‘MIDNIGHT TRYST’ WITH GST

Finally, GST was launched from the Central Hall of Parliament

with much gaiety and fanfare in the midnight of June 30, 2017,

marking an opening of a new chapter in the indirect tax history

of the country. What was equally significant was the fact that

with the introduction of GST, a new era of ‘Cooperative

Federalism’ was perceived to have begun!

INDIAN GST – FAULT LINES BECOME VISIBLE

However, the fault lines inherent in the design and structure

of the country’s GST system soon became visible!

Exclusion of several key commodities from GST and

resultant distortion of credit chain, significant restrictions

placed on the entitlement of Input Tax Credit (ITC)

resulting into cascading effect of tax, multiple rates,

long list of exemptions, low threshold and ill-conceived

business processes are but only a few ills that plagued

the Indian GST design from its inception. The biggest

‘let-down’ turned out to be the GSTN Portal! Multiple and

complicated returns, cumbersome Return-filing process,

ill-conceived statutory requirements reflecting revenueoriented,

rigid and ‘i-don’t-trust-you’ attitude coupled with

hopelessly ill-prepared GSTN portal have ensured that

the GST implementation and compliance by ‘more-thanwilling’

taxpayers are anything but smooth! The poorly

drafted, hastily implemented and badly administered GST

laws have only added to the woes of the taxpayers. The

situation has reached such an impasse that the whole system appears to be running on extensions, promises

and assurances!

INDIAN GST DESIGN –WHAT LIES AHEAD?

GST has a potential and the intrinsic characteristics to be ‘a

blessing’ – instead of ‘a curse’ as being perceived by many

today – provided it is designed and structured intelligently

and diligently. The system should be supported by subsystems

such as minimalist number of rates; moderate tax

rate; minimum exemption; high exemption threshold; neatly

defined key expressions; minimal and clear classification;

simple valuation provisions; seamless credit chain; clean

and clutter-free business processes; robust, insightful and

forward-looking ‘dispute redressal machinery’ and many

more. Anything contrary to this would be a humungous

curse for the economy.

TO SUM UP…….

Demonetisation and GST have several common attributes.

The most striking one is the discourse of short-term pain

and long-term gain. However, the latter can be enjoyed

only if one does not succumb to the former. The objective

to plug the informal economy – mainly prevalent in MSME

Sector – into formal set-up may have benefits. But the cost

can outweigh the benefits if done forcefully through radical

reforms. Moreover, the decision to grow competitive should

be a matter of choice and not compulsion. Presently,

lower exemption threshold coupled with cumbersome

compliance can prove to be counter-productive and push

small businesses towards new ways of tax evasion, thereby

breeding corruption.

A mega reform like GST is nothing short of a paradigm

shift. Such reforms often gives rise to two broad categories

of inconveniences, foreseen and unforeseen. Presently,

most of the inconveniences were of ‘foreseen’ category

and could have been avoided. Nevertheless, now is not

the time to cry over ‘what it could have been?’ but, to

concentrate on ‘what it should be’.

It is, indeed, heartening to note that the benevolent and

responsive GST Council has pro-actively undertaken

mid-course corrections. Going by the decisions taken by

the Council in last three meetings, the Council appears

to be determined to ease the woes, particularly that of

compliance load, of the taxpayers and this itself should

‘smoothen the ruffled feathers’ of the taxpayers, at least,

for the time being!

CHANGING GLOBAL TAX HORIZON

Even while the GST Council faces the challenges of

finding ‘elusive design’ that may fit the bill and the right

matrix of the business processes and of building a solid

GST structure, the global tax landscape is going through a

period of fundamental change. The policy-makers and the

tax experts across the world are re-thinking how taxes are

or ought to be levied. Changes have been triggered by the

unimaginable advancement and rapid spread of technology,

digitalisation, new supply chains and an increased scrutiny

of multinational tax practices! These changes will certainly

have destabilising – if not, devastating – impact on the

taxation across the world including India and will inevitably

bring forth its own set of formidable challenges. Obviously,

these changes and challenges can be ignored by one

only at one’s own peril!

In the ensuing paragraphs, these technology-driven

changes and their likely impact on VAT system are briefly

discussed. But before that, it would be advantageous to

understand the meaning of ‘VAT’ and the core principles on

which the foundation of VAT rests.

VAT – MEANING AND ITS CORE PRINCIPLES

International Tax Dialogue, 2005 defines ‘VAT’ as ‘a broad

based tax levied at multiple stages of production (and

distribution) with – crucially – taxes on inputs credited

against taxes on output. That is, while sellers are required

to charge the tax on all their sales, they can also claim

a credit for taxes that they have been charged on their

inputs. The advantage is that revenue is secured by being

collected throughout the process of production (unlike a

retail sales tax) but without distorting production decisions

(as turnover tax does)’.

In November, 2015, OECD published its ‘International

VAT/GST Guidelines’ (Guidelines). The Guidelines are the culmination of nearly two decades of efforts to

provide internationally accepted standard for consumption

taxation of cross-border trade, particularly in services and

intangibles. The Guidelines aim at the uncertainty and risks

of double taxation and unintended non-taxation that result

from the inconsistencies in the application of VAT in crossborder

context.

The overarching purpose of a VAT is to impose a broadbased

tax on consumption, which is understood to

mean final consumption by households. A necessary

consequence of this fundamental proposition is that the

burden of the VAT should not rest on businesses.

The central design feature of a VAT, and the feature from

which it derives its name, is that tax is collected through

a staged process. This central design feature of the VAT,

coupled with the fundamental principle that the burden of the

tax should not rest on businesses, requires a mechanism

for relieving businesses of the burden of the VAT they pay

when they acquire goods, services or intangibles. There

are two principal approaches to implementing the staged

collection process of VAT, one is invoice-credit method

(which is a ‘transaction-based method’) and other is

subtraction method (which is ‘entity based method’).

Almost all VAT jurisdictions (including India) of the world

have adopted the invoice-credit method.

This basic design of the VAT with tax imposed at every

stage of the economic process, but with a credit for taxes on

purchases by all but the final consumer, gives the VAT “it’s

essential character in domestic trade as an economically

neutral tax”. As the introductory chapter to the Guidelines

explains:

“The full right to deduct input tax through the supply chain,

except by the final consumer, ensures the neutrality of the

tax, whatever the nature of the product, the structure of

the distribution chain, and the means used for its delivery

(e.g. retail stores, physical delivery, internet downloads).

As a result of the staged payment system, VAT thereby

“flows through the businesses” to tax supplies made to final

consumers”.

It is, thus, evident that the two core principles on which the

VAT system is based are:

◆ Neutrality principle

This is the core principle of VAT design. The Guidelines set

forth the following three specific precepts with respect to

‘basic neutrality principles’ of VAT:

• The burden of VAT themselves should not lie on taxable businesses except where explicitly provided for in

legislation;

• Businesses in similar situations carrying out similar

transactions should be subject to similar level of taxation;

• VAT rules should be framed in such a way that they are

not the primary influence on business decisions.

◆ Destination principle

This principle seeks to achieve neutrality in cross-border

trade.

The Guidelines provides: “For consumption tax purposes,

internationally traded services and intangibles should

be taxed according to the rules of the jurisdiction of

consumption.”

Keeping the above core principles of VAT system in mind,

let us now advert to certain key challenges facing the tax

system.

I. TAX CHALLENGES OF THE DIGITAL

ECONOMY

On March 16, 2018, OECD released ‘Tax Challenges

arising from Digitalisation – Interim Report 2018’. The

Interim Report is a follow-up to the work delivered by the

OECD in October 2015 under Action 1 of the Base Erosion

and Profit Shifting (BEPS) Project, which was focused on

addressing the tax challenges of the digital economy.

The Report states that ‘Digitalisation is transforming many

aspects of our everyday lives, as well as at the macro-level

in terms of the way our economy and society is organized

and functions. The breadth and speed of change have

been often remarked upon, and this is also true when one

considers the implications of this digital transformation on

tax matters’. The Report acknowledges the far-reaching

implications of digitalisation and its disruptive effects,

beyond the international tax rules, on other elements of

the modern tax system, bringing forth opportunities and

challenges. From the design of the tax system through

to tax administration, relevant developments include

the rise of business models facilitating the growth of the

‘gig’ and ‘sharing’ economies as well as an increase in

other peer-to-peer (P2P) transactions, the development

of technologies such as block chain and growing data

collection and matching capacities.

Chapter 7 of the Report titled “Special feature – Beyond

the International Tax Rules” explores some of these

changes including Online platforms and their impact on

the formal and informal economy. There is no denying

the fact that global e-commerce is becoming increasingly

important. The rapid growth of multi-sided online platforms is attributed to digitilisation. The estimates suggests B2C

sales of US$ 2 trillion annually and is registering an annual

growth of 10 to 15 per cent. Based on an average VAT rate

of 15%, this represents US$ 200 billion in tax revenues!

(It may be noted that US operates a sales tax and has

not embraced VAT as yet). Currently, online shoppers are

tagged at 1.6 billion and are estimated to rise to 2.2 billion

in 2022. E-Commerce admittedly creates challenges for

administrations (VAT and Customs) in terms of collection

since non-taxation creates an unlevel playing field.

The Interim Report notes that the opportunities presented

by multi-sided platforms as regards taxation are two-fold:

i. Facilitate integration into the formal economy;

ii. Drive growth and increase revenues

The Report then identifies the following issues that must

be addressed in order to realise the benefits as well as to

address some of the challenges arising from the operation

of online platforms:

• Understanding the tax implications of the changing

nature of work

• Fostering innovation and ensuring equivalent tax

treatment with similar, existing activity

• Improving the effective taxation of activities facilitated

by online platforms

In sum, the digital economy has become increasingly

entwined with our physical world. The Indian digital

economy is expected to be worth about US$ 35 billion

and it is growing at a pace of 24-25 per cent a year. Given

the high disruption that digital economy has brought

about and its blistering growth rate, a few key questions

arise – how should the digital ecosystem be taxed? How

can governments earn revenue from services that span

borders, as some of the world’s most valuable enterprises

like Google, Facebook and Amazon spread their reach in

emerging markets like India? What share of their revenue

can the Indian Government look at taxing? Is Indian GST

system geared up to address the challenges and seize the

opportunities presented by digitisation?

II. BLOCKCHAIN TECHNOLOGY AND ITS

IMPACT ON THE TAXWORLD

In early 2016, construction workers in London unearthed

hundreds of Roman writing tablets, including some of the

earliest known examples of receipts and IOUs. The find

reminded all that, essentially, the way in which we record

the transactions has barely changed in 2000 years. But will

we say the same five or ten years from now?

‘Blockchain’ – a relatively obscure technology until only a few years ago – is about to make the step from the theoretical to

practical. When it does, it will fundamentally change the way

businesses, people and governments operate.

‘Blockchain’, to put it simply, is a ‘secure distributed

ledger that simultaneously records transactions on a

large number of computers in a network’. In this type

of secure, shared database, participants have their own

copies of the stored data. Strong cryptography ensures

that transactions can be initiated only by certified parties,

that changes are validated by participants collectively and

that the outputs of the system are immediate, accurate and

irrevocable.

BLOCKCHAIN AND INDIRECT TAX

Indirect taxes like VAT are ‘transaction-based taxes’ and

often follow chains of transactions and their tax liabilities.

Obligations are often “triggered” by key events that need

to be documented and recorded securely. These events

include the performance of a service or the delivery of

goods, the conclusion of a contract, the manufacture of

a product and by an act of importing or exporting goods

and services.

However, by and large, the indirect tax systems have

their foundations in physical transactions and trade. The

rise of the sharing economy, digital business and new

business models have caused many people to think about

the current tax systems. Blockchain has emerged at a

time when many in the tax world are speculating about

the efficacy and relevance of the current tax system in

the modern, digital era. While the financial and business

world is naturally excited about Blockchain, ‘Tax’ is one

area where this technology could have a profound impact.

Blockchain’s core attributes, namely, Transparency,

Control, Security, Real-time information and ability to detect

fraud and error mean that it has significant potential for use

in tax regime. Naturally, the tax administrations around the

world – including Indian tax administration – have started

considering the adoption of the Blockchain technology.

Some of the likely near-term uses of Blockchain that could

have an impact on indirect taxes are:

a. Blockchain regimes

VAT and customs administrations could create blockchains

for the transmission of tax data and payments between

taxpayers and government portals. These blockchains

could involve taxpayers in a single jurisdiction or they could

cross multiple jurisdictions.

b. Real-time compliance and reporting

Tax administrations around the globe are already

demanding real-time information from businesses in order

to assess and support their VAT liabilities and deductions.

Blockchain could greatly increase the speed, accuracy and

ease of collecting this data, thereby improving the quality

of VAT compliance while reducing the cost of compliance.

c. Tax Invoices

Tax invoice is the most critical VAT document. In a

Blockchain-based regime, it is likely that for a VAT invoice

to be valid, it will require a digital fingerprint, derived through

the VAT blockchain consensus process.

The fingerprint would immediately confirm that the block

under scrutiny is permanently linked to the previous and

subsequent blocks. The entire history of the commercial

chain (forward and backward from this transaction) could

be followed and scrutinised by a tax official in an office, by

a robot or by a customs officer at a border.

d. Customs documentation

Customs declarations and export controls depend on

various detailed and accurate information, often provided

by third parties. The veracity and reliability of this

information is vital.

Blockchain can enable the customs officer to verify, with

complete accuracy, various information and also the origin

and nature of the goods at every stage of the chain.

As this technology would allow them to verify every aspect

of a shipment with certainty, they could maintain supply

chain security with fewer officers who could target their

inspections more accurately.

e. Supporting refunds, reliefs and rebates and

combatting fraud

The use of immediately verifiable information

could allow taxpayers to support claims for VAT

deductions (or ITC) and customs rebates and reliefs.

Blockchain technology could also be useful in tracking if

and when VAT has been paid and in doing so, reduce VAT

fraud. Blockchain could also help to drive behavioural

change because of the risks and consequences of

non-compliance which may even lead to ‘permanent

exclusion’ from the blockchain network. In these ways, it

is likely that blockchain could help reduce the ‘tax gap’ to

some extent.

f. Smart audits

Using blockchain technology, indirect tax administrations

could carry out independent risk analysis facilitated by

artificial intelligence.

To sum up, Blockchain technology has tremendous

potential, not only to transform business, but also the tax

regimes across the world. Blockchain has the potential to

streamline and accelerate business processes, to improve

cybersecurity and to reduce or eliminate the role of trusted

intermediaries in industry after industry. The technology

has already many real-world applications and many more

applications are likely to be adopted in future.

III. 3D PRINTING AND ITS IMPACT ON

TAXATION

In 3D printing, we once again have a new technology that

could upend supply chains, business models, customer

relationships – entrepreneurship itself. 3D printing takes

mass distribution and innovation to the next level, while

realigning the very geography of work and trade.

Any significant technology that emerges impacts different

industries at different times, places and levels of disruption.

It also raises tax, legal and policy implications that can trip

up corporate leaders and global policymakers alike as they

are in full stride toward the future.

3D printing – a process of making solid objects from the

instructions in a digital file – has the potential to be every

bit as revolutionary as the PC was in the 1980s or even as

the factory production line was in the early 20th century. It

is also creating unprecedented opportunities to customise

products and reduce manufacturing costs.

But 3D printing also presents a minefield of challenges for

tax authorities around the world. This is because almost

all of the taxable value for a business selling product to

be 3D printed is contained within its intellectual property

(IP) – namely, the digital file’s ownership and authorisation

of its use, rather than in its manufacture, transport and

point of sale.

a. Disrupting long-standing business models

3D printing brings particularly complex global tax challenges

because it threatens to bypass long-standing protocols

used to set taxes on the movement of goods and supply

of services. 3D printing will absolutely disrupt the existing

model of taxation of goods and services grounded in the

physical movement of things or the provision of services.

The question ‘where value is created’ lies at the centre of

any discussion about the taxation of goods and services.

While VAT applies at the point of consumption, in some

taxing jurisdictions of the world, taxes are levied on raw

materials or intermediate stages where value is created,

such as in a factory and on shipment or warehousing.

3D printing disrupts these assumptions by transferring

manufacturing from factories to printing devices located

nearer the consumer, potentially even in their homes.

b. Intellectual Property takes centre stage

If consumers have 3D printers at home, much of the

taxable value may migrate there, where the supply chain

ends, greatly reducing the potential for supply chain taxes.

IP, as a matter of fact, sets the stage for any discussion

of 3D printing and taxation. Any 3D printing tax strategy

needs to consider that IP ownership and authorisation

will account for much more of a product’s value. With the

anticipated shrinkage in manufacturing, customer support

and sales personnel that will accompany this process, tax

authorities’ focus on IP is expected to intensify.

c. Transfer pricing and geographical challenges

Another tax challenge is the effect of 3D printing on

transfer pricing within multinational companies. Every time

a company changes its supply chain, it needs to change

how it shares costs related to taxable functions. If a local

distributor begins printing replacement parts, it could be

considered a factory, so the related transfer pricing would

change. Under current tax laws, it is unclear how or by how

much.

As we enter a new world of 3D printing, there are few

comparables in the current world of manufacturing.

d. Beware of double taxation

As production costs fall, 3D printing could also affect the

percentage of a product’s value that resides in any given

manufacturing location. In a 3D printing world, the value of

a product becomes more intangible than tangible.

So when tax authorities in different geographical locations

ask where the base of product’s profit is located and who

gets the right to tax it, they could come up with very different

answers, setting the stage for double taxation.

e. Global jurisdictional challenges

Business will also face location-sensitive tax questions

related to globally distributed manufacturing via 3D printing including permanent establishment (PE), exit taxes and

“substantial contribution” provisos.

f. 3D printed products can confound customs

Companies and governments often find themselves

contesting the value of imports, as products are shipped

across borders and through customs controls. Such crossborder

calculations could become a whole new equation,

as the increasing placement of 3D printers in local markets

changes global trade flows. While the raw materials or

components used in 3D printers may still cross borders the

old-fashioned way, more of a product’s value will be defined

by the digital blue prints that invisibly traverse the globe.

3D printing could also change the cross-border tax equation

for the value of raw materials and components. If the value

of raw material declines in relation to parts or products, it

could in turn affect customs duties.

The governments will then be looking to replace lost tax

revenue, and pressure could mount for a product’s digital

blue print to become the taxable item.

To sum up, 3D printing, yet another ‘disruptive technology’

will surely turn the business world upside down and the tax

profile of a business inside out!

IV. ROBOTS AND TAXATION

What happens if a new technology causes men to lose their

jobs in a short period of time, or what if most companies

simply no longer need many human workers? These

gloomy prospects loom large because of the advancement

and wide-scale spread of ‘robotic technology’.

Last year, Bill Gates, the co-founder of Microsoft proposed a

tax on robots to fund government expenditure on cushioning

the potential dislocation of millions of workers by the

widespread introduction of robots, and to limit inequality.

However, the arguments ‘for’ and ‘against’ the ‘Robot Tax’

continue across the world and it is not intended to dwell

into the same here.

What one needs to clearly acknowledge is the fact that

we appear to be at a technological ‘tipping point’ in the

diffusion of robotic technology across commerce, industry,

professions and households. It could spread like wildfire.

This could unleash what the economist Joseph Schumpeter

apocalyptically described as a ‘gale of creative destruction’

and set into motion a ‘process of industrial mutation that

incessantly revolutionises the economic structure from

within, incessantly destroying the old one, incessantly

creating a new one’.

The pace of automation is accelerating. In 2015, global

expenditure on robotics rose to US$ 46 billion. Sales of

industrial robots are growing by around 13% a year,

meaning that the ‘birth rate’ of robots is practically doubling

every five years.

The widespread introduction of robots could substantially

reduce the government’s revenues, while simultaneously

creating an increased demand for its support for displaced

workers until they find alternative employment. The heated

debate on ‘whether to tax robots or not’ revolves around

this central issue. However, even while the issue is being

debated, it is imperative that as a first step in taxing robots,

the legislation clearly defines ‘what a robot is?’.

There is currently no clear or agreed definition of what

constitutes a ‘robot’. The term generally conjures up mental

images of mechanical men or even humanoids like the

laconic Terminator, as portrayed by Arnold Schwarzenegger

in films. But, in practice, it would be challenging to identify

robots by sight. As David Poole has noted, ‘A robot is not a

unit equal to a human. Most are not physical robots, they’re

software robots. It’s no different, really, to a spreadsheet!’.

Given the range and sophistication of robots likely to come

into development, the definition needs to be ‘form neutral’;

i.e. it should include all autonomous robots, bots and similar

smart AI machines. Any proposed definition should be

tested from not just from legal perspectives, but also from

economic, technological and constitutional approaches.

The government, obviously, has a range of possible tax

policy options which include:

• Taxing robots

• Increasing the corporation tax rate

• Lumpsum taxes

• Taxing forms on the imputed notional income of their

robots

• Robot levy

• Imposing a ‘payroll tax’ on computers

• Disallowing relief on the acquisition of robotic

technology

• Increasing the cost of robots

• Increasing the rate of VAT payable on value added by

robots.

To conclude, the governments will be required to urgently

develop a legislative definition and ethical-legal framework

for robots. They should also take steps to introduce

corporate reporting requirements on their deployment, to

gather information that would facilitate remedial action like

the introduction of new taxes. At present, a palpable lack of

leadership in facing up to the substantial risks posed by the rapid diffusion of robotic technologies is on display across

the governments of the world.

VAT: EMERGING GLOBAL TRENDS

Even while the various ‘disruptive technologies’ looming

large on the horizon gear up to wreak havoc with the tax

regimes across the globe, some clear trends or changes

are clearly visible or emerging in the global developments

of indirect taxation. These emerging trends sweeping the

indirect tax landscape are likely to define and reshape the

traditional design and structure of VAT system.

Given that over 60 years have elapsed since first VAT,

serious deliberations are on amongst the tax experts and

policymakers on the need to “reform this revolutionary ‘tax

reform’”, and the contours of such reforms, keeping a close

watch on the emerging global trends.

The discussion in the ensuing paragraphs briefly outlines

these emerging global trends in the field of VAT. The

discussion is based on two independent papers published

by two of the Big 4 Accounting firms. [For reference, see

‘Acknowledgements’]

EMERGING GLOBAL TRENDS IN INDIRECT

TAX

Recently, the Global Indirect Tax Leader at EY published

an article titled ‘Indirect Tax: Five Global Trends’ in the

Bloomberg BNA Indirect Taxes Journal. The article outlines

five key trends sweeping the global indirect tax landscape

which are :

1. VAT and GST rates are stabilizing, but remain high

Following the banking crisis of 2008, VAT and GST rates

increased globally. The average rate of indirect taxes

peaked at 21.5% in the EU and 19% in the OECD. Of

late, these increases have slowed down and may even be

reversing.

2. Reduced VAT and GST rates and exemptions are

making a come back

Related to the post-2008 trend of increased rates, many

countries have broadened their VAT or GST base by

removing exemptions and restricting reduced rates.

However, this trend also seems to be slowing and may be

reversing.

3. The global reach of VAT and GST expands

Globally, VAT and GST have rapidly replaced previousgeneration

single-stage retail sales taxes. Very few

countries do not have a VAT or GST.

4. Digital Tax Measures proliferate

Tax administrations are grappling with the problem of how

to tax cross-border e-commerce and electronic services,

such as, digital downloads, because untaxed online sales

distort competition and reduce tax receipts. Governments

have responded to the growth of digital commerce by

adapting tax laws and using technology to collect tax and

monitor tax information.

5. Tax administrations embrace technology

As well as finding new ways to tax the digital economy, tax

administrations are applying digital technology to administer

indirect taxes more effectively, imposing requirements such

as the electronic submission of VAT or GST declarations,

mandating the use of e-invoicing, and introducing new

reporting standards and real time collection.

While the above trends are, indeed, clearly visible in the

VAT/GST systems around the world, a detailed paper titled

“VAT: A pathway to 2025” published in International Tax

Review in November 2017 by Indirect Tax Team of KPMG

China, seeks to provide a different perspective and insight

in the emerging trends which are likely to sweep indirect

taxes beyond what one can already clearly see.

Starting with a quick snapshot of the ‘here and now’,

the article claims that there has never been a time when

there has been a greater certainty about the future global

direction of indirect taxes, at least over the next few years.

This claim is sought to be buttressed by three propositions:

First, VAT and GST rates throughout the world are at

an all-time high, and there is very little pressure being

brought to bear to either increase or decrease them.

Therefore, any global shift from ‘a rates perspective’ is

unlikely to be seismic, certainly as compared to what

took place globally in the period from 2008 to 2015.

Second, from 2016 through to 2018, we will have seen

several major economies throughout the world implement

a VAT or GST either for the first time or through the

expansion or rationalisation of their existing indirect tax

systems.

Third, in a global context, the period from 2015

through to 2019 (or thereabouts) will be remembered

for the proliferation of digital tax measures – whether

they are measures to tax the cross-border provision

of services that can occur digitally and without the

creation of a permanent establishment, or through a

new measure to tax the business-to-consumer (B2C)

importation of goods through e-commerce platforms.

However, the article asserts that while the OECD’s

recommendations were clearly designed with a view to

implementation in the EU, when applied to countries in

Asia Pacific region, they would be problematic, given

certain fundamental and structural weaknesses of the tax

systems of the countries of this region.

The article then poses a question – ‘Are there bigger

changes afoot with indirect taxes as we move into the

second quarter of the 21st century?’ With a clear intent

to prompt discussion and debate and add some colour

and controversy, while a pathway to 2025 is lighted, the

article posits three key indirect tax trends which are briefly

discussed below:

1. VAT and GST systems will more closely resemble

retail sales taxes

After adverting to the fundamental principles on which VAT

systems are intended to operate, the article states that

under this system, it is an implicit understanding that in a

typical supply chain when there is a flow of goods from say:

a. the manufacturer to the wholesaler;

b. the wholesaler to the retailer; and

c. then from the retailer to the end-consumer,

the only transaction that truly ‘matters’ from a VAT or

GST perspective in the sense that it raises the revenue to

which the tax is directed is transaction (c). The process of

collecting the tax and allowing input credits in transactions

(a) and (b) is merely an administrative mechanism to

reinforce the integrity of tax administration throughout the

wholesale supply chain.

However, from a tax adviser’s perspective, many of the

challenges which one confronts each day are focused on

the problems when the system breaks down in relation

to transactions (a) and (b) – that is, in ensuring the fiscal

neutrality of those transactions, leading to inefficiency,

non-competitiveness and tax cascading through the

supply chain.

The governments may therefore move from VAT system

into a tax system that more closely resembles a single

stage retail sales tax, mainly for three reasons:

First, technology will enable the settlement of tax obligations

between the supplier and the recipient instantaneously,

without the need for any real payment, crediting or refund.

Second, with a view to overcome the problems caused

by fraud – carousel or ‘missing trader’ fraud being the

most prominent -, the governments have resorted to the

reverse charge mechanism in place of VAT and more

recently, a number of EU countries have implemented,

or propose to implement ‘split payment’ methods for VAT

collection, whereby the recipient diverts the VAT included

in the purchase price directly to a bank account held for the

benefit of the tax authorities.

The fraud or evasion is often perpetrated in B2B transactions,

not B2C transactions. So, if there is a recognition already

that by taxing or crediting B2B transactions, the system is

prone to fraud or evasion, then, why do it?

Third, the concept of the supplier accounting for output tax

and recipient claiming input tax in B2B transactions will be

rendered superfluous. What one is left with is a retail sales

tax, that is, a single stage tax that applies to transactions

with end-consumers only.

The article, however, hastens to add that it is not necessarily

suggested that VAT or GST systems will be replaced as a

matter of form with retail sales taxes – rather, it is suggested

that VAT or GST systems will, as a matter of substance,

operate similarly to retail sales taxes.

2. Indirect Taxes to be managed almost exclusively

through technology

While growing automation of indirect tax determination

and administration process, both in government and

business, is clearly on display in last few years, the

technology developments in the broader economy itself will

mean that indirect taxes will be managed exclusively

through technology.

Indirect taxes are, by their very nature transaction-based

taxes. As more and more transactions occur in the digital

world, the logical outcome is that the indirect taxes

whose liabilities flow from these transactions will also be

managed and administered digitally. [See the discussion

on the ‘impact of technology on taxation’ in the preceding

paragraphs].

It is predicted that the role of the indirect tax adviser

will, therefore, be akin to the conductor of an orchestra

– not playing the instruments, but directing the

musicians and ensuring they keep time. The role of the

indirect tax adviser will be to maintain a watch over

the technology, testing the controls, and addressing

problems when they are detected.

The shift to automation will not simply be because the

technology will improve to help manage tax compliance,

but the tax itself will be adapted to fit the technology. The automation will be a function of two forces coming together

– technological advances to help manage tax compliance,

and developments in tax legislation to help the technology

apply in a more automated way.

3. The tax base for indirect taxes will be expanded in

ways not previously contemplated

It is stated that the principles which have, hitherto, defined

or shaped the indirect tax structure over the years may

not hold in 2025. The following developments which

have recently been enacted in China have been cited by

the article as leading a pathway for the rest of the world

to follow:

a. The pre-condition of being a ‘business’ or

‘entrepreneur’ for VAT/GST registration will no

longer apply

Virtually, all VAT systems (including GST system of India)

around the world have a pre-condition for registration and

VAT obligations that supplier is engaged in a business or

commercial or economic activity or is an entrepreneur.

China’s VAT system, by contrast, has no such precondition.

Instead, China’s VAT system imposes registration

and payment obligations on ‘units’ and then imposes

different obligations depending upon turnover thresholds.

The question that arises is whether a profit making

pursuit, coupled with a de minimis exclusion (where the

compliance costs would exceed the tax collected) is all

that is really needed as a precondition for imposing VAT

or GST liabilities. The private consumer/business divide

would then become redundant, in favour of a system that

more closely resembles what one already sees in China.

b. VAT/GST systems will even tax consumer-toconsumer

(C2C) transactions

Digital market places now facilitate trade between private

individuals. These developments in commerce are

commonly labelled as ‘sharing economy’, ‘crowd funding’,

‘crowd sourcing’, and ‘ride sharing’.

The central question is, why should the profit or gains

derived from these activities fall outside the VAT or GST

net? The bigger issue is that VAT or GST systems need to

be adapted to tax the value added, irrespective of whether

it is by a traditional business or a consumer sitting online.

In China, there is no real distinction drawn between

business and non-business activities.

c. Customs duty will need to find a new tax base

Customs duties are inherently narrow in their tax base in

that they typically apply only to goods, nor services. The

question is whether customs duty is at risk of a terminal

decline in its tax base unless changes are made. Is it

possible that customs duties will be expanded to services,

and if so, how would they be collected and administered?

d. VAT/GST will apply to financial services

The traditional reasons cited for not taxing financial services

under VAT or GST was the inability to apply the tax on a

transaction-by-transaction basis. However, that rationale

was conceived in an era when margins were the dominant

model rather than fee-based services.

Early steps to dismantle this were taken in places like

New Zealand (with GST imposed on insurance, through

a cash-based tax), in South Africa (with VAT on fee-based

services), in Australia (with the introduction of the reduced

ITC regime to remove the bias against outsourcing and

to achieve a broadly similar tax outcome to exemption),

in New Zealand again (with B2B zero rating) and more

recently, in China (with a broad-based VAT on financial

services with few exemptions).

The experiments in applying VAT to financial services are

shown to be largely working.

e. The tax base for VAT/GST will be expanded in other

areas too

Even the traditionally exempted areas such as healthcare

and education could potentially be taxed.

The challenge in this area is in balancing the desire for

good policy (which may support the removal of exemptions)

with the political realities of doing so (where taxing the

necessities of life may be seen as politically unpalatable in

some countries).

f. Taxes like a VAT/GST that are founded in

transactions or flows will continue to grow in

importance

The noticeable trend of a decline in the average global

corporate tax rate and increase in the average VAT/GST

rate may continue. In an era of unprecedented dislocation

and disruption to historical business models, what will

emerge is taxes that are imposed on ‘transactions’, or

on ‘cash flows’, and directed to the place where

‘consumption’ occurs.

While not predicting the demise of corporate taxes, it is

predicted that the corporate taxes will transmogrify until they more closely resemble the features of a VAT or GST.

FINAL THOUGHTS

After more than 60 years, VAT may now be at a turning

point in its life. At this juncture, the rapidly changing

climate poses serious challenges for the policymakers,

lawmakers, economists and the tax experts, including

the GST Council in India. The challenge lies in predicting

the intersection of two key developments – the first being

the profound changes we are witnessing to the economy

itself through technological developments that have been

labelled as the ‘fourth industrial revolution’; and the

second being an increasing reliance on indirect taxes

as they mature into a dominant form of taxation in the

21st century.

For Indian GST system, the frequent changes so far made

post-introduction of GST indicate that the government is

learning by its mistakes. In the words of Deng Xiaoping,

it is ‘crossing the river by feeling the stones’. But let

us not lose sight of the above formidable challenges that

lie over the taxation horizon even while we shape (or reshape)

our own GST design and structure! The GST

Council, led by the Union Finance Minister, seems to be

working only on the immediate challenges confronting the

system. However, the world is changing in the way and at

the speed which we cannot comprehend. What, therefore,

is required for the Council is to establish, even while fixing

the short-term challenges, a mechanism that starts working

on identifying the long-term challenges with the aim of

enabling the country’s tax systems to keep pace with the

seismic-level changes sweeping the taxation landscape.

“We must develop a comprehensive and globally

shared view of how technology is affecting our lives

and reshaping our economic, social, cultural, and

human environments. There has never been a time of

greater promise, or greater peril.”

Klaus Schwab, Founder and Executive Chairman,

World Economic Forum

ACKNOWLEDGEMENTS:

1. ASSOCHAM India and Deloitte (2015) – “Goods and

Services Tax (GST) in India – Taking stock and setting

expectations”

2. Banerjee Sudipto and Sonia Prasad – “Small

Businesses in the GST Regime”

3. Black Stefan – “Robots, technological change and

taxation” – Published on Tax Journal; September 14, 2017

4. Bulk Gijsbert, EY – “Indirect Tax: Five Global Trends”

– Published on International Tax Blog; April 13, 2017

5. Bulk Gijsbert and Barr Ros, EY (2017) – “How

blockchain could transform the world of indirect tax”

6. Charlet Alain and Owens Jaffrey – “An International

Perspective on VAT” – Tax Notes International, September

20, 2010; Vol.59, No.12

7. Charlet Alain and Buydens Stephane- “The OECD

International VAT/GST Guidelines: past and future

developments” – World Journal of VAT/GST Law; (2012)

Vol.1 Issue 2

8. EY (2017) – “In a world of 3D printing, how will you be

taxed?”

9. Flynn Channing, EY (2015) – “3D printing taxation –

Issues and impacts”

10. Hellerstein Walter, Professor Emeritus, University of

Georgia School of Law (October 2015) – “A Hitchhiker’s

Guide to the OECD’s International VAT/GST Guidelines”

11. Nicholson Kevin and Lynn Laetitia, PWC, UK – “How

blockchain technology could improve the tax system”

12. OECD – “Consumption Tax Trends (2016); VAT/GST

and Excise Rates, Trends and Administration Issues”

13. OECD/G20 Base Erosion and Profit Shifting Project –

“Tax Challenges Arising From Digitilisation – Interim Report

2018 (Inclusive Framework on BEPS)”

14. Owens Jeffrey, Piet Battiau, Alain Charlet – “VAT’s

next half century: Towards a single-rate system?”

15. O’Sullivan David, Consumption Taxes Unit, OECD

– “Global Developments in VAT/GST – Overview and

Outlook”

16. Poddar Satya and Ahmad Ehtisham – “GST Reforms

and Intergovernmental Considerations in India”.

17. Rao Govinda M. and Rao Kavita R., NIPFP (2005)

–“Trends and Issues in Tax Policy and Reform in India”

18. Rao Govinda M. – “GST Bill; First step, but with birth

defects” – Published in Financial Express, May 05, 2015

19. Shailendra Kumar, TIOL. “GST Roll-out with hiccups;

white paper on Future DESIGN warranted” – TIOL – COB

(WEB) – 561; July 06, 2017

20. Shailendra Kumar, TIOL- “Revamped GST calls

for change in Basic Design!” – TIOL-COB(WEB)- 583;

December 07, 2017

21. Shailendra Kumar, TIOL- “Rebooting of GST – A TIOL

word of caution for the Council” – TIOL-COB(WEB) -589;

January 18, 2018

22. Shailendra Kumar, TIOL – “Dear FM, Let’s not rush

into, India can ill-afford semi-cooked GST laws” – TIOLCOB(

WEB) -513; August 11, 2016

23. Steveni John and Smith Paul, PWC – “Blockchain –

will it revolutionise tax?” – July 01, 2016

24. Walker Jon – “Robot tax – A Summary of Arguments

“For” and “Against” – Last updated on October 14, 2017

25. Wolfers Lachlan, Shen Shirley, Wang John and

Jiang Aileen, KPMG China – “VAT: A pathway to 2025”

– Published on International Tax Review; November

28, 2017