INDIRECT TAX STUDY CIRCLE

Indirect Tax Study Circle Meetings on 6th, 24th and

27th December, 2018 at BCAS Conference Hall.

Indirect Tax Study Circle organised three Study Circle

Meetings on 6th, 24th and 27th December, 2018 in which

participants discussed practical approach and various

aspects that need to be kept in mind in GST Audit and

documentation thereof. The discussion was done based

on contents of Annual Return (GSTR-9) and members

broadly covered Part II of GSTR-9C i.e. audit of B2B, B2C

supplies, Exports and Supply to SEZ, Stock Transfers,

Advances, Credit notes and Debit notes etc., for taxable

and exempt outward supplies. The extent of checking and

auditors’ responsibility was also discussed.

The benefit of meeting was also extended to outstation

members by live streaming the sessions. All the sessions

were very interactive and informative and members

participated in large numbers.

“Workshop on Data Analytics for Business and

Audit with Power BI” held on 14th December, 2018

at BCAS Conference Hall.

Technology Initiatives Committee of the Society conducted

a half day workshop on Data Analytics for Business and

Audit with Power BI on 14th December, 2018 at BCAS

Conference Hall.

The session was led by CA. Nikunj

Shah having rich experience in

training and consulting on Data

Analytics for Business Decision

making, Audit and Investigation. He

explained that Microsoft Power BI is

a business intelligence platform that

offers business analytics toolset. It is designed to assist

businesses in their efforts to systematically analyse data.

The Speaker highlighted current limitations of excel

usage and thereby deliberated on the features of Power

BI. He discussed key reasons for shifting to Power BI

applications and gave the demo of Power BI features and

also shared his in depth knowledge on the issues such as

(a) How to analyse data from single and multiple sources

(b) How to create your individual dataset based on

multiple sources and transform your results into beautiful

and easy-to-make visualisations (c) How to share your

results with your colleagues or collaborate on your project

(d) How to make best use of Cloud based features of

Power BI (e) How to generate reports.

The session was highly interactive and the Speaker

resolved all the queries raised by the participants who

benefited a lot and appreciated the efforts put in by the

speaker and group leaders.

Full day seminar on “Estate Planning, Wills &

Family Arrangement/Settlement – Critical Aspects”

held on 15th December, 2018.

The Full day seminar on

Estate Planning, Wills & Family

Arrangement/Settlement – Critical

Aspects was held by the Corporate

and Allied Laws Committee at Indian

Merchants Chamber, Churchgate.

The event was attended by over

85 participants

including more than 10 outstation

participants. President CA. Sunil

Gabhawalla gave the opening

remarks followed by introductory

words from the Chairman of

the Corporate and Allied Laws

Committee, CA. Chetan Shah.

Mr. Nishith Desai gave keynote address explaining

the basic principles of estate planning and how the mechanism to put the same into

effect is changing with increase of

global mobility.

CA (Dr.) Anup Shah explained the

succession laws for Hindus, the

developments in the laws relating

to succession, practical aspects of

creating a will and essential do’s

and don’ts that one should keep in

mind before choosing an appropriate

vehicle for succession planning. He

briefly dwelled upon the FEMA and

other issues that would also merit

consideration in picking the right

vehicle.

Ms. Shipra Padhi gave an insight on

documentation aspects and spoke on

the intricacies of various documents

covered in Estate planning, Family

settlement/arrangements including

Wills.

CA. Pradip Kapasi enlightened

on the taxation aspects of family

arrangements with the help of various

relevant case laws. He discussed

various taxation issues arising out

of family arrangements including

partitions of families, validity of family

arrangements as upheld by Courts

and position taken by the courts in issues arising from

the same. He also touched upon stamp duty implications

arising in such transactions.

CA. Yogesh Thar explained the tax

implications of Trusts and Estate. He

deliberated upon the tax principles

on trusts, HUF taxation and filing of

returns of income of the deceased,

returns of the executors of estate as

also the practical issues arising in

such cases.

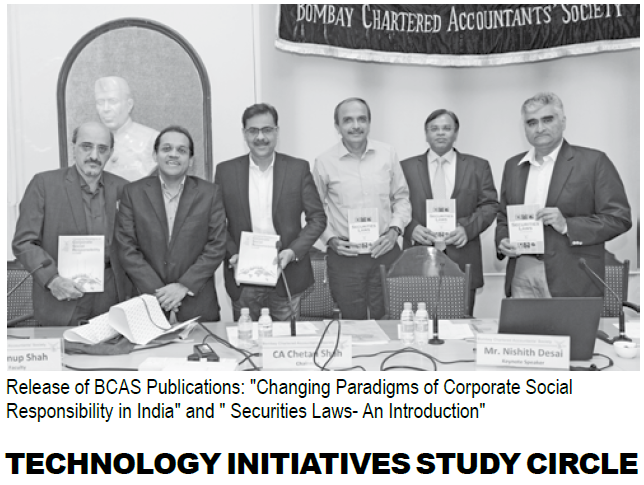

With the interactive session and their insights on the

subject shared by the speakers, the participants benefited

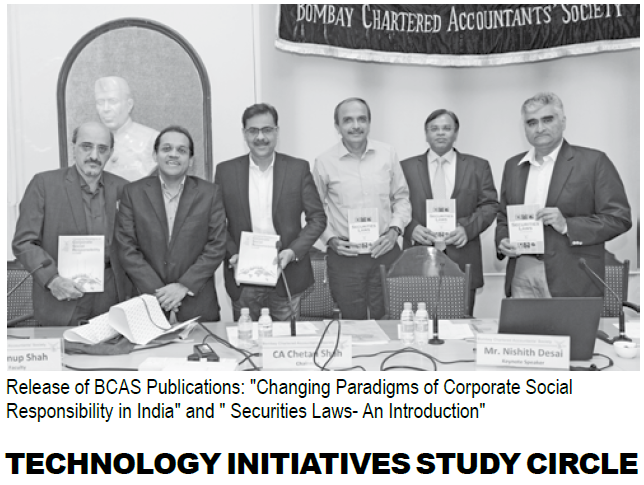

immensely. On this occassion BCAS Publications: “Changing

Paradigms of Corporate Social Responsibility in India” and

“Securities Laws-An Introduction” were also released.

TECHNOLOGY INITIATIVES STUDY CIRCLE

Technology Initiatives Study Circle Meeting on

“Zoho Project Management” held on 18th December,

2018 at BCAS Conference Hall.

Technology Initiatives Committee of the Society conducted

a Study Circle Meeting on “Zoho Project Management”

on 18th December, 2018 at BCAS Conference Hall. The

study circle was led by Mr. Eshank Shah, Chartered

Accountant and Chartered Financial Analyst (USA) and

Head of Startup and Transaction Advisory at Banshi Jain

and Associates (BJAA).

CA. Eshank Shah discussed Zoho application and shared

his in depth knowledge with the participants. He also

explained Zoho Application from Planning and execution

stage to capture details of engagements stage including

the benefit of Zoho Application and how to use more

effectively in a business environment. He further resolved

all the queries raised by the participants during the session.

The session was a huge takeaway for the participants

who appreciated the efforts put in by the speaker and

group leader.

Workshop on NBFCs (including IND AS

Implementation Challenges and Regulatory

Updates) held on 21st and 22nd December, 2018.

Accounting and Auditing Committee organised a

workshop on NBFCs on 21st and 22nd December, 2018 at

Orchid Hotel, Vile Parle (East), Mumbai.

The NBFC sector is of late facing several challenges.

Besides the business and regulatory challenges, the

sector is also facing Ind AS implementation (for companies in the 1st implementation phase) challenges and other

compliance challenges of GST etc. Further NBFC sector

is growing at a substantial pace but it is RBI’s endeavour

to ensure prudential growth of the sector, keeping in view

the multiple objectives of financial stability, consumer and

depositor protection and need for more players in the

financial market, addressing regulatory arbitrage concerns

while not forgetting the uniqueness of the NBFC sector.

In view of regulatory norms being notified on a frequent

basis, including Ind AS implementation challenges for

NBFCs and there being changes in Statutory Audit

requirements and various developments in the Taxation

arena, BCAS conducted a Two days’ Workshop on

NBFCs. The Workshop was structured into five sessions

which dealt with important aspects of key regulatory

updates, Issues in IND AS applicability in respect of

Financial Instruments and ECL model applicability,

Statutory Audit Aspects under the Companies Act, 2013,

Disclosure requirement under revised Schedule III and

Taxation Development and issues in

the Direct taxes and GST for NBFCs.

The Workshop started with the

inaugural address by BCAS President

CA. Sunil Gabhawalla, who provided

his view points on the importance of

NBFCs in the overall development

of the financial sector in India. CA.

Himanshu Kishnadwala, Chairman

of the Accounting & Auditing

Committee introduced the structure

of the Workshop.

The first session was commenced

by CA. Bhavesh Vora who lucidly

dealt with the important aspects of

key regulations. While dealing with

the same, he also took participants

through the overall maturing of the

NBFC sector over last three decades

and gave valuable insights on

the regulatory impacts on various

categories of NBFCs.

The second session was dealt

with by CA. Viren Mehta on the

implementation issues of Ind AS

with respect to classification of

Financial Instruments based on the business models and measurement of various Financial

Instruments.

Another session was by CA. Rukshad

Daruvala, who dealt with the important

topic of key issues and requirement

in respect of applying the Expected

Credit Loss Model which deals with

provisioning requirement of Advances

of NBFCs by way of various examples.

Concluding session on Day 1 was

by CA. Sumit Seth, who appraised

the participants with the new

requirements of the schedule III

disclosures including various critical

disclosures required under the Ind

AS regime.

On Day 2, the first session dealing

with Statutory Audit aspects under

the Companies Act, 2013 was

addressed by speaker CA. V. Venkat.

He dealt elaborately with the unique

requirements while conducting

audit of NBFCs and shared his vast

experience with the participants and

explained the importance of Audit

under the current economic scenario.

The second session was taken

up by two speakers: explaining

in detail the nuances of Direct

taxes by CA. Yogesh Thar and

GST requirement by CA. Parind

Mehta. They made the session very

interactive and shared their practical

experience of tax applicability to the

NBFC sector.

Before the concluding session,

participants were shown a 45 mins video on practical

Fraud in the industry and had a short discussion on the

same.

Overall the Workshop was an enriching experience for

the participants.

Training Session for CA Article Students on ‘GST

Annual Return’ and ‘GST Audit from Article’s

Perspective’ held on 4th January, 2019 at BCAS

Conference Hall.

The Students Forum under the auspices of HRD

Committee organised a Training Session for CA Article

Students on the above-mentioned topics on 4th January,

2019 at BCAS Conference Hall.

The first session on GST Annual

Return was taken by CA. Raj Khona

followed by a session on GST Audit

by student Speaker Mr. Dynanesh

Patade and CA. Jigar Shah. Ms.

Neelam Soneja, the student coordinator

introduced the speakers for

the session and spoke about various

activities conducted by BCAS Students Forum.

CA. Raj Khona explained the entire Form GSTR-9 clause

by clause and dealt with the various issues / complexities

involved in the annual return form. He highlighted few key

areas which article students should keep in mind while

filing the annual returns.

In the second session, CA. Jigar

Shah in his opening remarks briefly

introduced the topic and gave a brief

insight on various aspects of GST

Audit. Mr. Dynanesh Patade, the

student speaker thoroughly explained

the entire form GSTR-9C and shared

his meticulous detailing in conducting

GST Audit. He also gave useful tips to the article students

on how to effectively conduct GST Audit. The mentor for

the session CA. Jigar Shah then presented the certificate

of appreciation to Mr. Dynanesh Patade and applauded

the meticulous presentation made by him.

With the due dates for GST Audit fast approaching and

every CA firm wanting its articles to be well equipped

with the nitty-gritties of GST Annual return and GST

Audit, the training session saw a record participation

by 150+ students. The session ended with student coordinator

Ms. Neelam Soneja proposing vote of thanks

to the speakers for sparing their valuable time and also

thanked the audience for participating in huge numbers.

Both the sessions were interactive whereby the speakers

answered all the queries raised by the participants.

HDTI STUDY CIRCLE

Study Circle Meeting on “Achieving Cohesiveness

(Like Mindedness) amidst diversity of beliefs

and opinions” held on 8th January, 2019 at BCAS

Conference Hall

Human Development and Technology Initiatives

Committee organised a study circle meeting on the topic

“Achieving Cohesiveness (Like Mindedness) amidst

diversity of beliefs and opinions” on 8th January, 2019

at BCAS Conference Hall which was addressed by Ms.

Amrita Singh having 16+ years of hands on Designing,

Training, and Coaching experience. She explained that

at office or at home, we come across situations where

our opinions and beliefs are diverse and we have varied

goals based on this. We need to align our individual goals

to the organisational goals or like the family as a whole to

successfully work together.

The Speaker took the participants through various

situations and discussed how to deal with the same

successfully. She also mentioned about the types of

personalities and the four quadrants like Kool Blue,

Green Earth, Fiery Red and Sunshine Yellow wherein

each person fall into. Each of these personalities have

typical characteristics and each may also have some

characteristics in the other quadrants as well. One can

judge what quadrant one belongs to and improve to

adjust in order to be successful. The participants found

the topic very interesting and relevant in the day to day

personal and professional life and got hugely enlightened

on the subject.

Lecture Meeting on “Changing Risk Landscape

for Audit Profession with special emphasis on

NFRA and other recent developments” held on 9th

January, 2019 at BCAS Conference Hall.

BCAS organised a lecture meeting on

the captioned subject on 9th January,

2019 at BCAS Conference Hall which

was addressed by CA. Narendra P.

Sarda.

The Speaker discussed about the

‘Changing Risk Landscape for

Audit Profession with special emphasis on NFRA and

other recent developments’ i.e. (i) Increasing Risk and

Challenges, (ii) Specific Scam, (iii) Fraud and Failures,

(iv) National Financial Reporting Authority (NFRA), (v) CA

Institutes’ roles in the new regime and Members response

to the recent developments, (vi) Other regulatory changes

impacting the Audit Profession. Various changes and

increasing uncertainties in the audit profession, increasing

use of Fair values, increasing internal and external risk,

regulatory issue, intricacies of reporting requirements and

expectations from Auditors were also well covered and

explained by way of practical examples well designed

to understand the complexities of the Changing Risk

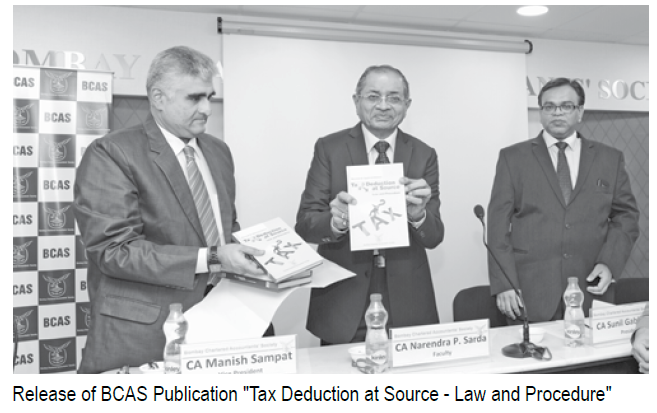

Landscape for the Audit Profession. On this occassion

BCAS Publication “Tax Deduction at Source- Law and

Procedure” was released.

He also explained the various functions and Powers

of NFRA, companies to whom NFRA applies, NFRA

rules, 2018 and various pros and cons of NFRA. He

further elaborated the role of ICAI and response of the

auditors to this new regulatory authority. The lecture

meeting was attended by more than 100 participants

from various Industries and Practice arena. The meeting

was very interactive and the participants got enlightened

immensely.

FEMA STUDY CIRCLE

FEMA Study Circle Meeting on “Critical issues under

Export/Import of Goods and Services” held on

15th January, 2019 at BCAS Conference Hall

A FEMA Study Circle Meeting was held on 15th January,

2019 at BCAS Conference Hall where CA. Kirit Dedhia

and CA. Parag Kotak led the discussion on the topic of “Critical issues under Export/Import of Goods and

Services”. The Group leaders discussed meaning of

the term “Export” and “Import” in relation to the goods,

software and services. Discussion was also on services

other than software where SOFTEX form is to be filed.

The Group leaders discussed agency commission,

setting off and netting off of export receivables against

import payables, export claims, period of realisation,

reduction of invoice value, write off of export receivables

and few compounding orders. The members appreciated

the efforts put in by the group leaders and learnt a lot from

the rich experience of speakers.

INTERNATIONAL ECONOMICS STUDY

GROUP

International Economic Study Group Meeting on

“Road to 2019 Elections and a Nayi Disha for India”

held on 16th January, 2019 at BCAS Conference Hall

International Economics Study Group had their meeting

on 16th January, 2019 to discuss “Road to 2019 Elections

and a Nayi Disha for India” at BCAS Conference Hall. Shri

Rajesh Jain (studied at IIT, Mumbai & Columbia University,

USA, runs India’s largest digital marketing company,

Netcore) led the discussions and presented his thoughts

on the subject. He presented various scenarios for the

2019 elections, implications of each of the scenarios;

options available to BJP etc.

Mr. Jain also expressed concern about India’s economy

post-election due to atmosphere of uncertainty, voters

opting to change rulers rather than rules to solve

our ‘Hamesha’ problems of poverty, unemployment,

corruption, farm distress, SMEs distress etc. He also

suggested consumption-led growth to propel economy,

employment, reduce poverty, reduce over dependence of

rural population on agriculture etc., by monetising surplus

public assets by returning to the people (rightful owners),

a concept of “Dhan Vapasi”. He also suggested an idea of

relooking at our 70+ years old Constitution.

The meeting was very informative and interactive and the

Speaker resolved all the queries raised by the participants.

The participants learnt a lot from the rich experience of

the Speaker.