The intensity was brewing slowly in the court. Spectators were biting their nails, not knowing which shot will be fired next. Both players were not letting their guard down. The crowd was silent, the referee’s movement oscillated with the player’s delivery and the linesman kept a check on every movement. The match was telecast live on various channels. Young aspirants were seeing their heroes showcasing their skills – and just then the siren went berserk.

I woke up shaking, shut the alarm and realised that it was a dream. Although it might have seemed like that, but it was not a match at the Australian Open, rather, it was two learned tax experts arguing their case in the Income Tax Appellate Tribunal. It was telecast live on the ITAT’s channel and subscribers could watch any hearing going on across the country. ‘What a dream’, I whispered to myself, considering that it might have been the after-effect of the recent budget proposal of turning the ITAT faceless. However, instead of ruminating on the bizarre story, I thought about daydreaming and penned down my thoughts on my wish list for the future of the Income Tax Appellate Tribunal (ITAT).

The ITAT was established in 1941 and has been the torch-bearer of judicial fairness in the country. It can be compared to cricketer M.S. Dhoni in his heydays. It is the last fact-finding authority (the finisher), the first appellate authority outside the Income Tax Department (the ’keeper) and has led the way for being the Mother Tribunal of all the other tribunals in the country (the Captain). And the fact that the Department winning ratio in ITAT is just 27%1, it overturns many high-pitched assessments (the DRS winner) and it keeps on doing its work without making much of a fuss (the cool-headed).

I still remember the first day when I entered the Tribunal as a first-year article assistant. Though my only contribution to the paper book at that time was numbering the pages, I realised the holiness of the inner sanctum of the Tribunal when my manager insisted that I be meticulous on page numbering and he even reviewed the same after I finished it. The showdown was spectacular and I was awestruck by the intellect and inquisitiveness shown by the Honourable Tribunal members.

_______________________________________________________________________________

1 Economic Survey, 2017-18

That was the story of the past; now let’s focus back on the dream. The ITAT has stood the test of time and it is only possible because it is agile and adaptive to changes. Keeping with that spirit, I present my 7-point wish list for the future of the ITAT.

1. Less-Face and not Face-Less: Changes which might not have been sought by a Chief Technical Officer of an entity in a decade have been brought by Covid-19. Companies adapted and learnt to work from home and now are seeing multiple ways of saving costs through technical upgradation. Similarly, all cases in the Tribunal should be categorised into three: (a) Basic – Does not require a hearing and can be judged just based on submission; (b) Complex – Requires video hearing; and (c) Complex and high value – Requires in-person hearing. This will be cost and time-efficient for the Tribunal, the tax practitioners and the clients. Since in-person attendance will not be required, it will open a lot of opportunities for tax practitioners from tier-2 and tier-3 cities to grow their litigation practice.

2. One Nation – One Law – One Bench: In spite of numerous benches, currently there is a huge backlog of cases (88,0002). With the technological upgradation (mentioned at point 1 above) in place, Tribunal members from across the country could preside over hearings related to any jurisdiction. This will not only reduce the workload from overloaded benches but will also reduce the hectic travelling of Tribunal members who go on a tour to set up benches in several locations. This may also result in a spurt in the setting up of additional benches and Tribunals which can work in two shifts, having separate members if required.

3. Jack of all trades and master of one: A decade back, the accounting profession was mostly driven by general practitioners who were masters in all subjects. With rising complexities and frequent changes in the law, very few can now deal with all the intricacies of even a single income tax law. Most of the big firms have separate teams for Transfer Pricing, International Taxation, Individual Taxation, Corporate Taxes and so on. Owing to these complexities, the Honourable Tribunal members must spend a lot of time studying minute details of every case. If a ‘dynamic jurisdiction’ is in place (see point 2), judges of a specialised area / section can preside over all similar cases. This will ensure detailed, in-depth discussion on each topic and the results will be similar and swifter.

_______________________________________________________________________________

2

https://timesofindia.indiatimes.com/business/india-business/88000-appeals-pending-before-income-tax-appellate-tribunal-chairman/articleshow/74322517.cms

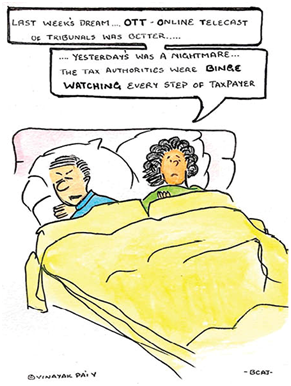

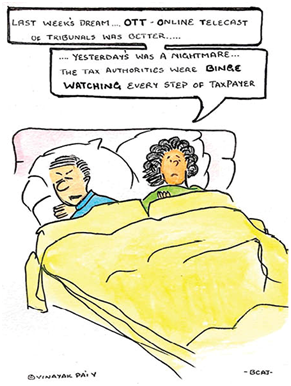

4. OTT platform: Online telecasts of Tribunals can be done for viewers which will not only help tax practitioners and students learn some technical aspects, but will also help them to learn court craft. This will give confidence to newcomers and more lawyers and chartered accountants would be inclined to join litigation practice.

5. ETA: Currently, a lot of the time of a professional is spent waiting for his hearing. Once full digitisation kicks in with video conferencing facility, an ETA (Expected Time of Appeal!) could be provided. This would help tax professionals to schedule their day better.

6. Error 404 – Page not found: Many times, digitisation leads to further problems rather than solutions. A robust internal technical system which allows uploading of documents without size limit, writing of replies without word limit and allowance of documents to and from in the hearing would help the cause of e-hearing. Additionally, the facility of explaining through a live digital whiteboard and PowerPoint presentation would be the cherry on the cake.

7. Circular reference: Often, a case is remanded back to the Assessing Officer for finding the facts. Then, the whole circular motion of the A.O., CIT(A) and ITAT starts once again, which delays the decision-making. With the help of technological advancement, if a special cell is created at the ITAT level to finalise the facts and present them to the bench, it would surely ensure speedy justice.

The list can go on and on with the emphasis on technological upgrading and efficient utilisation of resources. However, the one thing that I don’t want to be changed is the way in which ITAT has upheld the principle of natural justice. This is one thing by which I was mesmerised as a young kid and I want any other person joining the profession to feel the same. I would be extremely grateful if some portion of my dream does come true.

Jai Hind! Jai Taxpayers!