By Chirag Mehta, Dushyant Bhatt, Chartered Accountants

INTRODUCTION

Most of the indirect tax statutes in India are based on selfassessment

procedure. Filing of returns is an important

part of implementing the tax and the self-assessment

scheme. In simple words, a return is a declaration that

a tax payer gives to the tax administration which would

broadly comprise of furnishing details of his outward

supplies (and the tax collected thereon), inward supplies

(and tax charged thereon) and the net tax payable or

refundable.

Due to the multiplicity of indirect taxes, a tax payer, at

present, may be required to file more than one return

under more than one of the applicable tax legislations.

Each of the applicable legislations would have its own form

of return requiring various details. This makes compliance

under existing indirect tax structure time-consuming and

cumbersome.

RETURN FILING PROCESS UNDER GST

REGIME

A return is defined u/s. 2(97) to mean any return prescribed

or required to be filed under the Act or any rules made

thereunder. While the procedure of self-assessment would

continue under the GST regime, the process of return

filing would witness a radical change. Broadly, the filing

process envisages furnishing information through three

statements/returns, which are required to be furnished by

three different dates as prescribed under the law. In view

of complete electronic compliance and matching concept,

the sensitivity of furnishing accurate data would assume

immense importance in the GST regime.

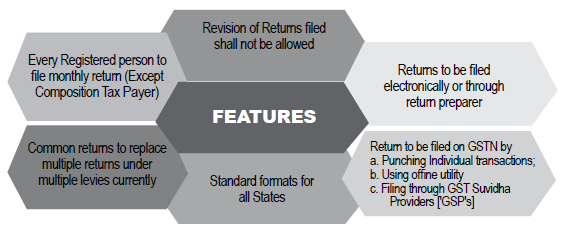

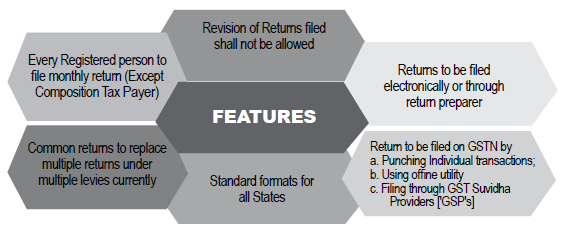

SALIENT FEATURES OF RETURN

COMPLIANCE UNDER GST

TYPES OF RETURNS UNDER GST

The types of returns, nature of compliance, periodicity

and references to statutory provisions and return rules

are tabulated hereunder:

| Form GSTR |

Nature of Compliance/ Category of tax payer |

Periodicity |

Due Date in the succeeding month |

Section/ Return Rule |

| 1 |

Furnishing details of outward supplies |

Monthly |

10th |

S. 37 Rule-1(1) |

| 2A |

Auto drafted details of supplies to the Recipient [paying tax u/s. 9] |

Monthly |

After 10th |

S. 37 Rule-1(3) |

| 2 |

Filing of monthly details of inward supplies |

Monthly |

15th |

S. 38(2)

R. Ret-2(1) |

| 1A |

Communication of auto drafted details of supplies to the Supplier |

Monthly |

After 15th |

S. 38(3)/(4)

R. Ret-1(4) |

| 3 |

Monthly Return |

Monthly |

20th |

S. 39(1)

R. Ret-3 |

| 4 |

Composition Taxable person |

Quarterly |

18th |

S. 39(2)

R. Ret-4 |

| 4A |

Auto drafted details to recipient being a

Composition Tax payer |

Quarterly |

After 10th |

S. 37 Rule-1(3) |

| 5 |

Return for Non- Resident Taxable persons |

Monthly |

20th |

S. 39(5)

R. Ret-5 |

| 5A |

Details of supplies of OIDAR services provided by person

located outside India to a non-taxable in India |

Monthly |

20th |

R. Ret-5A |

| 6 |

Return for Input Service Distributors |

Monthly |

13th |

S. 39(4) R.Ret-6 |

| 6A |

Auto drafted details to recipient being an ISD |

Monthly |

After 10th |

S. 37 Rule-1(3) |

| 7 |

TDS return |

Monthly |

10th |

S. 39(3) R.Ret-7 |

| 8 |

Statement of TCS |

Monthly |

20th |

S. 52(4

R. Ret-8) |

| 11 |

Inward Supply statement by UIN holders |

Monthly |

|

R.Ret-23 |

FORM GSTR1: DETAILS OF OUTWARD

SUPPLIES

The process of return filing under GST shall commence

with Form GSTR-1. A registered taxable person [‘RTP’]

shall furnish details of his outward supplies [including

deemed supplies under Schedule-1]. The various tables

in the form are summarised hereunder:

| Table |

CONTENTS OF GSTR -1 |

|

4 |

Details of B2B Taxable Outward Supplies [Inter and Intra State] to registered taxable persons holding GSTIN]:

◆ Taxable under forward charge

◆ Taxable under RCM

◆ Through E-Comm attracting TCS [E-Comm wise] |

Broad details to be furnished are as under: Recipient’s GSTIN/ UIN, Invoice details [Rate wise], taxable value, tax amount and place of supply (where it is different from the recipient) have to be furnished |

|

5 |

Details of Taxable Inter-State outward supplies to unregistered person [B2C] where invoice value is

> Rs.2.5 Lakhs:

◆ Supplies other than through E-Comm

◆ Supplies through E-Comm attracting TCS [E-Comm wise] |

Details to be furnished include:

◆ Details similar to Table 4 to be furnished [except GSTIN]

◆ Place of supply field is

mandatory |

|

6 |

Details of Zero Rated supplies and deemed exports:

◆ Direct Exports out of India

◆ Supplies made to SEZ Developer or unit

◆ Deemed Exports |

Details to be furnished include:

◆ GSTIN of the recipient [of the supplier in case of exports]

◆ Details of Invoice, Shipping Bill or Bill of Export

◆ Rate-wise details of taxable value and amount of IGST/Cess |

|

7 |

Details of B2C inter and intra- states taxable outward supplies not covered in Table 6 shall be covered in this table [Net of Debit/ Credit Notes]:

◆ Inter and Intra State supplies [Including made through E-Comm]

◆ Separate summary of supplies made through E-Comm [included above] to be given separately |

Details to be furnished include:

◆ Rate wise consolidated values and tax there on

◆ Identify State for Inter- State supplies

◆ Summary of supplies through E-Comm |

| 8 |

Details of value of NIL rated, exempted and Non-GST supplies to be furnished, classified as B2B Inter and Intra State and B2C Inter and Intra State |

|

9 |

Details of amendments to taxable outward supplies for earlier periods furnished in Table 4, 5 and 6 |

Details to be furnished include:

◆ Requires tagging amendments to original document

◆ Revised details of above documents like rate, taxable value, tax & State name |

| 10 |

Allows amendments relating to B2C supplies covered in Table 7 of earlier periods. Month wise revised details to be furnished where correction is required |

| Table |

CONTENTS OF GSTR -1 |

|

11 |

Details of advances received and adjustment of advances against outward supplies:

◆ Advances received in the current month

◆ Adjustments of advances against invoices issued during the current month

◆ Amendment to information furnished in Table 11 during earlier months |

Details to be furnished include:

◆ Rate wise details of advances received or adjusted in the current month against taxable outward inter and intra state supplies

◆ Identify place of supply

◆ Also provides separate table for amendment tod details furnished earlier |

|

12 |

HSN wise value of outward supplies made during the period. HSN codes would be mandatory as under: |

|

13 |

The GST Law and the rules made thereunder require a tax payer to issue number of documents for various purposes [E.g. Invoices, Credit note, debit note, receipt voucher]. This table requires the tax payer to provide a document summary. |

AUTO DRAFTED DETAILS OF SUPPLIES

– GSTR-2A/ 4A/ 6A

Auto drafted details of outward supplies furnished

by n-number of suppliers shall be communicated to

respective RTP’s in Form GSTR 2A [regular RTP’s],

GSTR-4A [Composition RTP’s] and GSTR-6A [ISD’s].

These shall be made available to the recipients after 10th

of the month following the tax period on the common

portal based on details furnished in GSTR 1, 5, 6, 7 and 8. The auto drafted details shall comprise of the following:

| Table |

Contents |

Source return |

| TABLE A |

| 3 |

Inward Supplies received from RTP [other than RCM supplies] |

GSTR-1/5 |

| 4 |

Inward Supplies from RTP on which tax is to be paid under RCM |

GSTR-1/5 |

| 5 |

Debit/ Credit Notes including amendments thereof |

GSTR-1 |

| PART B |

| 6 |

ISD Credit [Including amendments thereof] |

GSTR-6 |

| PART-C |

| 7 |

TDS/ TCS Credit (Including amendments thereof) |

GSTR-7/8 |

FORM GSTR2: FURNISHING DETAILS OF

INWARD SUPPLIES

Section 38 of the CGST Act states that every RTP shall

furnish details of inward supplies received during a month.

This process would require the RTP to first go through

the herculean task of reconciling the auto drafted details

made available in GSTR-2A with the actual supplies as

per his books of accounts. Supplies that are not auto

populated shall be entered by the RTP and he shall selfclaim

the credit thereon. Table-wise details to be furnished

in GSTR-2 are summarised hereunder:

| Table |

CONTENTS OF GSTR -2 |

|

3 |

Furnish details of taxable inward supplies [Inter and Intra State] from RTP [other than RCM supplies. Details to be furnished shall include:

◆ Rate-wise invoice level of supplies from RTP after verifying details contained in GSTR-2A. If invoice carries supplies attracting different rates separate disclosure shall be made for each such supply

◆ Entries in GSTR-2A may be kept pending for action [E.g. Supplies not received]

◆ At invoice level the RTP needs to identify the following in respect of each entry

• Nature of supply – Input, Input Services or Capital Goods

• Identify invoices where ITC is ineligible

• Identify amount of ITC available in the current period |

|

4 |

Details of following taxable inward RCM supplies to be furnished in this table:

◆ Received from RTP

◆ Received from unregistered person

◆ Import of services

[To the extent time of supply arises] |

RTP shall furnish following details

◆ GSTIN of supplier and rate wise invoice details

◆ Name of the State [where different from the recipient]

◆ Nature of supply – Inputs, Input services or capital goods

◆ Identify whether ITC eligible

◆ Amount of ITC available |

|

5 |

Details relating to supplies of inputs or capital goods received on a Bill of Entry from:

◆ Outside India [Direct Imports]

◆ Received from SEZ unit |

Details to be furnished are as under:

◆ GSTIN [Where supply from SEZ unit]

◆ Bill of entry details

◆ Rate-wise invoice details

◆ Nature of supply, ITC eligibility and amount available |

|

6 |

Details of amendments to details in Table 3,4,5 furnished earlier to be provided in this table relating to:

◆ Details in Table 3 or 4

◆ Import details in Table 5

◆ Original Debit and Credit Notes

◆ Debit or Credit Notes – amendments |

Details to be furnished are as under:

◆ Tag revised details to original document and the GSTIN

◆ For whichever sub-table correction is required furnish revised details by selecting the appropriate sub-table and month |

|

7 |

Values of following Inter/ Intra State supplies to be furnished in this table supplies from

◆ From Composition Tax payer ◆ Exempt Supplies

◆ NIL rated supplies ◆ Non-GST supplies |

|

8 |

Details of ISD Credit received:

◆ Document and levy-wise ISD credit received [and reversal on account of Credit Note]

◆ Identification of eligible ITC |

|

9 |

Details of TDS and TCS:

◆ TDS – Gross amount and TDS amount [Levy-wise]

◆ TCS – Gross amount less sales return and TCS amount [Levy- wise] |

| Table |

CONTENTS OF GSTR -2 |

|

10 |

This table requires furnishing following details:

◆ Advances paid for RCM supplies and tax thereon

◆ Adjustments of invoices against advance paid

◆ Correction to Information provided in this table in earlier months |

Details to be furnished: Advances liable for RCM Tax Rate, Advance paid, State

name and tax amount [Levy-wise] Adjustments of [For current month]

Same details as specified above Amendments to details furnished earlier

Furnish details for entire month against the sub-table that requires correction |

|

11 |

ITC reversal and reclaim shall be furnished [To be added to output liability]

Reversal to ITC would broadly include following situations:

◆ Non Payment to supplier within 180 days [S. 2nd proviso16(2)(d), Rule ITC-2]

◆ ISD Credit distributed is in the negative [Rule ITC 4(1)(j)(ii)]

◆ Pro-rata reversal of ITC on inputs or input services put to other than business use or used for exempted outward supplies [S. 17(1)/(2), Rule ITC-7(1)(m)]

◆ Pro-rata reversal of ITC on capital goods put to other than business use or used for exempted outward supplies [S. 17(1)/(2), Rule ITC- 8(1)(h)]

◆ Short reversal on account of final determination of amount to be

reversed under section 17(1) and (2) [Rule ITC 7(2)(a)]

Reclaim of ITC reversed would broadly include following situations:

◆ On account of final determination as above where excess amount

has been reversed [Rule ITC-7(2)(b)]

◆ On account of amount paid subsequent to reversal of ITC |

|

Amendment in respect of information in information submitted in earlier period in Table 11 can be made by furnishing revised information on selecting the relevant month in Table 11 |

|

12 |

Levy-wise addition or reduction in output tax for mismatch and other reasons to be furnished in this table

Output Tax to be increased for following reasons:

◆ ITC claimed on mismatched or duplication of Invoices/ Debit notes

◆ Tax liability on account of mismatched credit notes Output Tax to be reduced for following reasons:

◆ Reclaim on account of rectification of mismatched invoice/ debit

notes

◆ Reclaim on account of rectification of mismatched credit note

◆ Negative Tax liability from previous tax period

◆ Tax paid on advance in earlier tax period and adjusted with tax on supplies made in current tax period |

| 13 |

Reporting criteria for HSN shall be same as required in GSTR-1wise value of outward supplies made during the period. . |

FORM GSTR-1A: AUTO DRAFTED DETAILS

OF SUPPLIES TO SUPPLIER

Details of inward supplies as added, corrected or deleted

by the recipients shall be communicated to the supplier

in Form GSTR-1A [Section 38(3)/ (4) r/w Rule Ret-1(4)].

This implies that supplier shall be provided only details

of unmatched transactions in GSTR-1A.The source of

details appearing in GSTR-1A shall be counter party

GSTR 2, GSTR-4 or GSTR-6. The supplier is required to

accept or reject the details contained in GSTR-1A on or

after 15th but before the 17th of the month succeeding the

tax period. Consequently, details furnished in GSTR-1 by

such supplier shall be updated. If the supplier does not accept the change made by the recipient, it shall qualify

as an unmatched transaction in the hands of the recipient.

GSTR-1A shall contain details of mismatch in respect of:

Taxable supplies to RTP other than those attracting

RCM

Taxable supplies to RTP attracting RCM

Zero rated supplies made to SEZ units or developer

and deemed exports

Debit/ Credit notes including amendments there of

issued during the period.

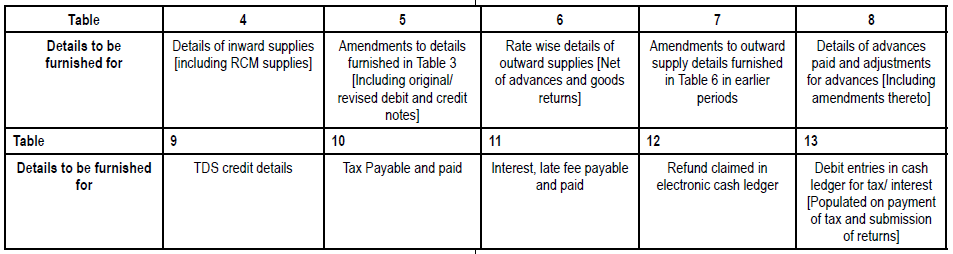

FORM GSTR-3: MONTHLY RETURN

Subsequent to filing GSTR-1 and 2, a monthly return in

Form GSTR-3 has to be furnished which can be filed only

after GSTR-1 and 2 are uploaded. It consists of two parts.

Part-A shall be auto generated based on details furnished

in GSTR-1 and 2. It comprises of details of turnover,

output taxes, RCM liability, ITC, reversal and reclaims

relating to ITC and reduction in output liability, TDS, TCS

and liability to pay interest and late fees. In Part-B, the tax

payer needs to furnish details of tax, interest and late fee

payments and details of refund claims.

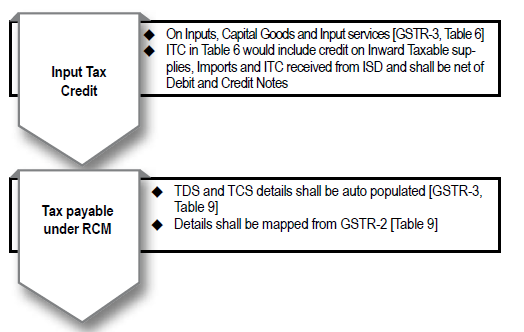

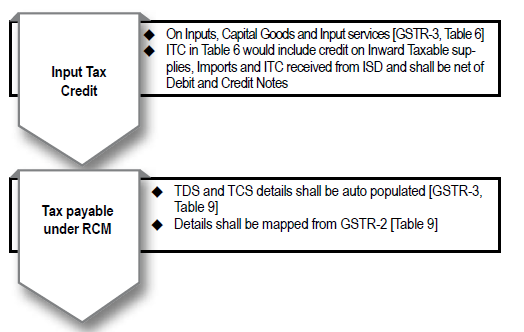

PART-A: Elements relating to ITC and other credits

Part-A would also provide details of various credits that

flow from the claims made in GSTR-2. The structure of

details relating to credits is explained with the help of a

diagram hereunder:

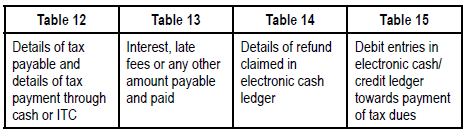

PART A: Details of Interest and Late Fees

Table 10 shall auto populate levy-wise details of interest

payable on account of various reasons. Extract of the

table is reproduced hereunder. Table 11 shall also furnish

details of late fees payable.

PART-A: Elements for computing total tax liability in Table 9

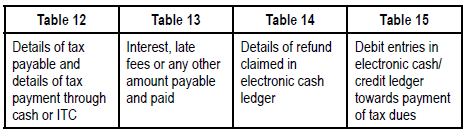

Part B of the return is to be filled by the tax payer. Various

tables in which details have to be furnished in Part B are

enumerated hereunder:

FORM GSTR-4: QUARTERLY RETURNS BY

COMPOSITION TAX PAYER

Section 10 of the CGST Act provides for composition

levy for small businesses.The threshold for opting for

composition levy has been capped at Rs. 75 Lakhs.

Under composition levy the RTP is not allowed to claim

ITC. However, he has to verify details of inward supplies

received in Form GSTR-4A and prepare details of inward supplies. GSTR-4 is a consolidated return which would

contain details of outward and inward supplies and

computation of tax and other dues and details of payment

thereof.

Where RTP opts for paying tax under composition at the

beginning of the financial year, the RTP shall continue to

furnish GSTR 1, 2 and 3, wherever required, relating to

supplies for the prior period. He shall continue doing so till

the due date for filing return for the month of September

in the succeeding financial year or date of furnishing of

annual return for the previous year, whichever is earlier.

However, in such cases he shall not be entitled to claim

any ITC in respect of invoices pertaining to period

prior to opting for composition levy [Rule Return-4(4)].

Conversely on the same lines where RTP opts to withdraw

from composition he shall continue filing GSTR-4, where

required up to the dates referred above [Rule Return-4(5)].

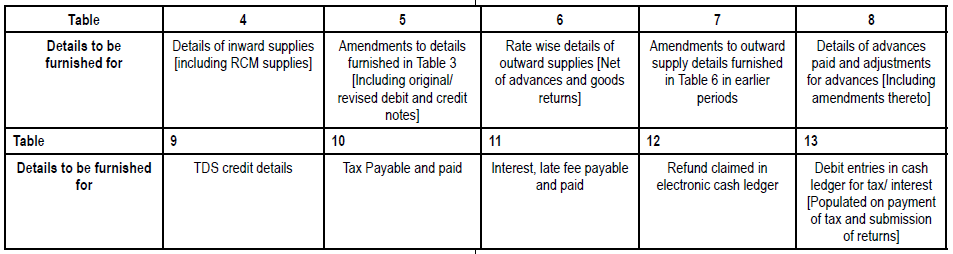

Broad contents of GSTR-4 are tabulated hereunder:

FORM GSTR-5: RETURN FOR NON-RESIDENT

TAXABLE PERSON

Non-Resident taxpayers are required to furnish details of

all taxable supplies in GSTR-5.Details to be furnished in

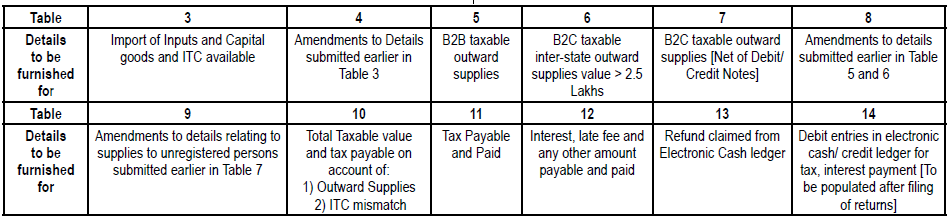

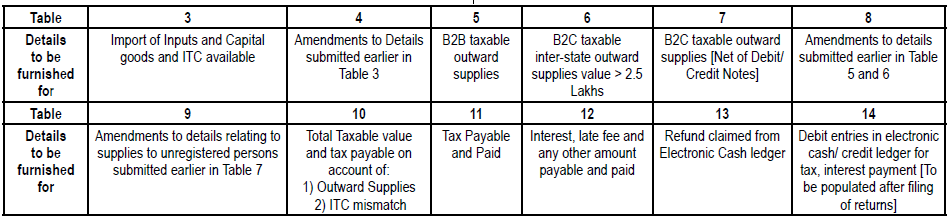

GSTR-5 are tabulated hereunder:

FORM GSTR-5A: DETAILS OF SUPPLIES OF

OIDAR SERVICES BY A PERSON LOCATED

OUTSIDE INDIA TO A NON-TAXABLE PERSON

IN INDIA

The above person shall be required to furnish return in

Form GSTR-5A. Details to be furnished in the return

broadly include the following:

1 State wise and rate wise details of supplies made to

consumers in India and IGST/ Cess thereon

Amendments to above details may be made in Table

5A

2 Interest, penalty or any other amount payable

3 Tax, Interest, late fee or any other amount payable

and paid.

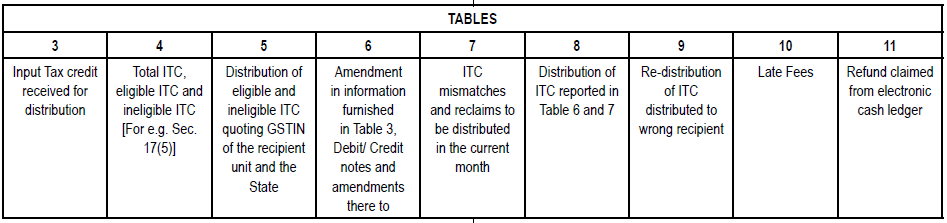

FORM GSTR-6: RETURN FOR INPUT SERVICE

DISTRIBUTOR [‘ISD’]

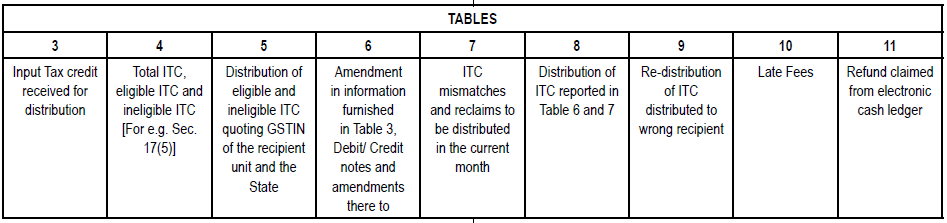

An ISD is shall furnish details of receipt ITC for distribution

and distribution of ITC in GSTR-6. The auto populated

details of inward supplies shall be made available to ISD

in GSTR-6A. The ISD shall verify, modify, accept or reject

the contents and prepare details in GSTR-6. Since, the

ISD only receives tax invoices it shall not be liable for any

payment under RCM. At its level it has to identify invoices

with respect to eligibility of ITC at invoice level in GSTR-6.

However, it shall distribute the eligible as well as ineligible

ITC [Table-5]. Further, Tax effect of amendments, credit

and debit notes as well as mismatches of ITC shall also

be distributed amongst the units by issuing credit note

[Table-8]. Any excess or short distribution amongst units

shall be re-distributed [Table-9]

FORM GSTR-7: RETURN FOR TAX DEDUCTION

AT SOURCE [‘TDS’]

Under the GST regime, certain persons are required to

deduct tax at source on specified inward supplies. Details

to be furnished in GSTR-7 include the following:

Deductee-wise details of amount paid and TDS

deductee quoting the GSTIN of the deductee.

Amendments to above details furnished can be made

in Table 4.

Amount of TDS and amount paid.

Interest, late fees payable and paid.

Refund claimed from Electronic cash ledger

Details of entries in Electronic cash ledger for payment

of TDS/ Interest shall be populated after payment of

tax and submission of returns

Certificate of TDS is to be issued in GSTR-7A

FORM GSTR-8: STATEMENT OF TAX

COLLECTION AT SOURCE [‘TCS’]

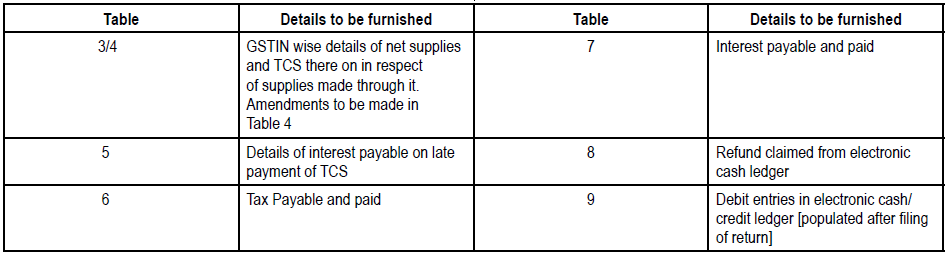

An E-Comm is required to collect tax at source from net

value of taxable supplies made through it. It has to furnish

details of supplies made through it and the TCS in GSTR-

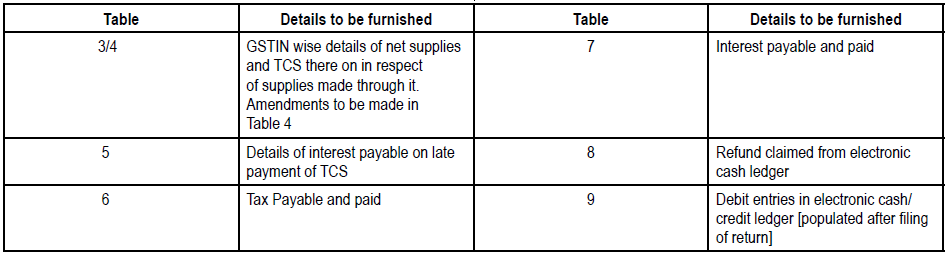

8. Broad details furnished in GSTR-8 are as under:

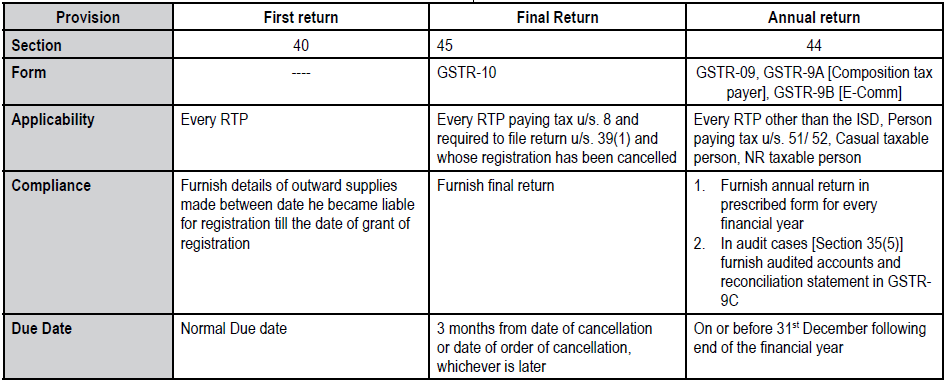

MISCELLANEOUS RETURN COMPLIANCES

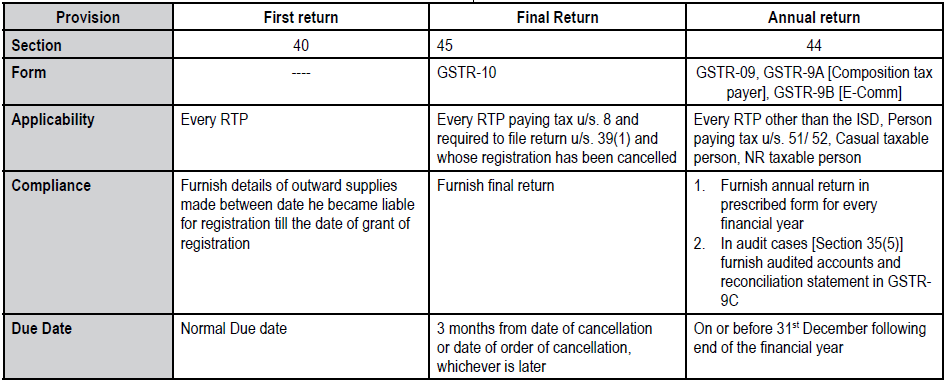

Every RTP [Other than ISD, NR Taxable person, casual

taxable person and persons liable for TDS/ TCS] shall file

an annual return for every financial year on or before 31st

December of following the end of the said financial year:

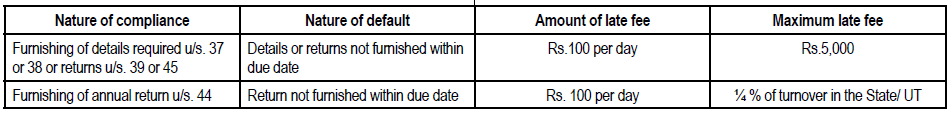

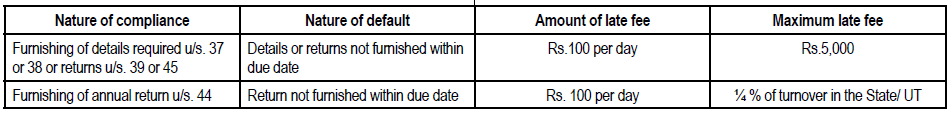

LATE FEE [SECTION 47]

Section 47 provides for levy of late fee for default in

furnishing of returns on or before the due date. The same

are tabulated hereunder:

MATCHING CONCEPT

The GST regime has introduced the concept of matching

claims of ITC and claims relating to reduction of output

taxes by a RTP. This concept forms an important basis for

claiming of ITC under GST regime. Currently, many states

in India match input set-off claimed with corresponding

sales disclosed by suppliers. However, this is not a

practice followed under Central Excise and Service Tax.

Under GST regime the matching is envisaged on two

broad fronts:

Matching of ITC claims

Matching of claims relating to reduction in output tax

[e.g. Credit notes].

MATCHING, REVERSAL AND RECLAIM OF

ITC [SECTION 42]

Section 41 states that a RTP shall be allowed to self-claim

ITC in respect of his inward supplies on provisional basis

for 2 month [As per the FAQ released by the CBEC on

31-03-2017]. This provisional acceptance shall be subject

to the matching of claims in terms of section 42. In terms

of section 42, all claims of ITC by a RTP being a recipient

of supply shall be matched by the GSTN portal after the

due date of filing GSTR-3. The claims shall be matched –

With corresponding details of outward supply

furnished by the concerned supplier in the same or

earlier month. Following details shall be matched:

• GSTIN of Supplier

• GSTIN of the Recipient

• Invoice or Debit note no.

• Invoice or Debit note date

• Tax Amount

With the IGST paid on Import of goods by him

For duplications of claims of ITC

Claims shall be accepted in following cases

In respect of invoices and debit notes that were

accepted by the recipient without amendments on the

basis of GSTR-2A shall be accepted subject to the

supplier filing a valid return;

Where the amount of ITC claimed by the recipient is

equal to or less than the amount of output tax paid by

the supplier on such invoice or debit note.

Explanation 1 & 2 to Rule ITC-10]

Details of claims that have matched shall be communicated

to the recipient in Form MIS-1 [Rule ITC-11]

Discrepancy in ITC Claim

The matching process may lead to discrepancy on

following broad grounds:

Recipient has claimed ITC in excess of the tax

declared by the supplier

There is no matching declaration by the supplier

Duplication of claim of ITC by recipient.

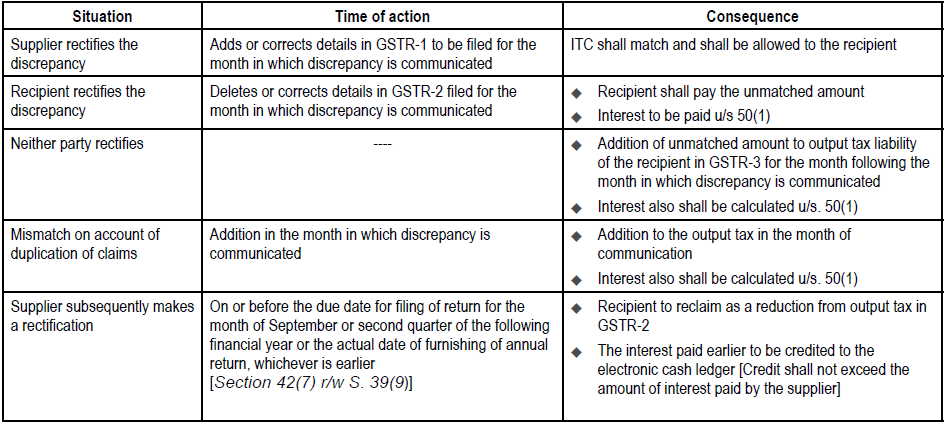

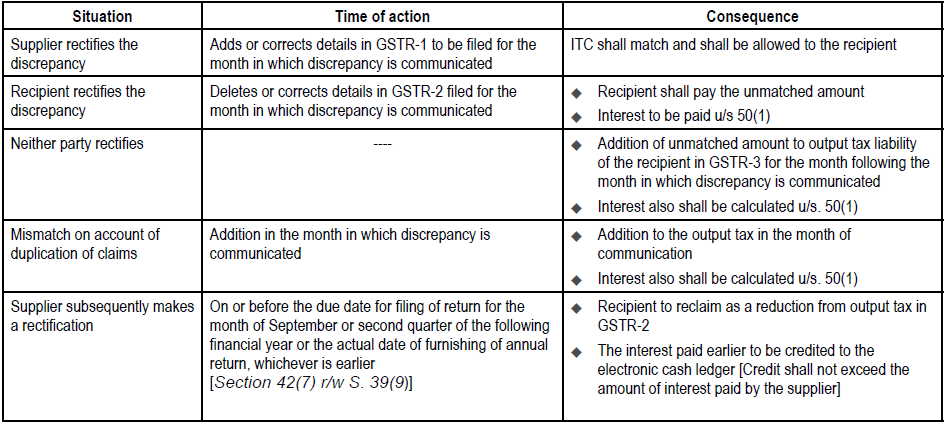

Consequences in Case of Discrepency

The discrepancy in ITC claim shall be communicated on

GSTN portal to the recipient in [Form MIS-1] and supplier

[Form MIS-2] on or before the end of the month in which

matching is done. This process may lead to the following

situations:

MATCHING, REVERSAL AND RECLAIM OF

REDUCTION IN OUTPUT TAX [SECTION 43]

The matching process envisaged by section 43 is in respect

of credit notes issued by a RTP. Any reduction in output

tax on account of credit note requires a corresponding

reversal of ITC claim by the recipient. Section 43 states

that the details of every credit note issued by a supplier

shall be matched –

With the corresponding reduction in claim of ITC by

the recipient, in the same or subsequent month, and;

For duplication in claim of reduction of output tax

The matching of reduction in output tax shall be done in

respect of following details:

GSTIN of the supplier and the recipient

Credit note no. and date

Tax amount

The other procedure relating to matching, reversal and

reclaim of reduction in output tax contained are similar to

provisions relating to matching, reversal and reclaim of

ITC discussed above.

CONCLUSION

It is evident that compliance under GST is going to be a

month-long activity and not a monthly activity. Accuracy

of data punching would be of utmost importance. Further,

the technology driven matching concept would surely

make GST a self-monitoring system. However, in times

to come small businesses would face great challenge in

coping up with high compliance requirements coupled

with increased cost of compliances.

GLOSSARY/NOTE

E-Comm: Electronic Commerce Operator

RTP: Registered Taxable person

ITC – Input Tax Credit

All references to section should be read as reference

to CGST Act.